CAC40 Stock Index

The CAC40 Index, representing the French market, tracks the performance of the top 40 largest companies listed on the Euronext Paris Stock Exchange. It monitors the market capitalization of these key shares.

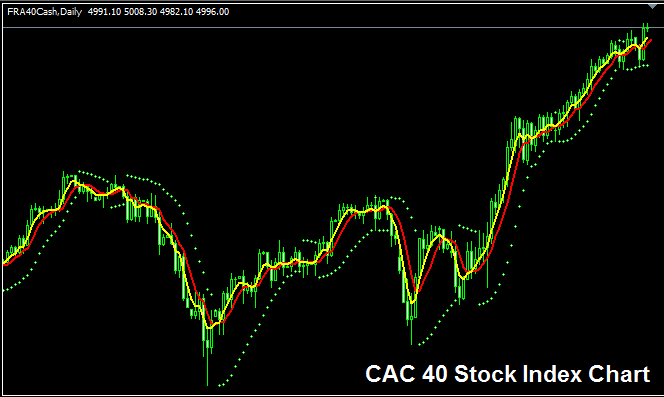

The CAC40 Index Chart

The CAC40 Stock Index chart is displayed & shown above. On above example this Stock Index is named FRA 40CASH. You want to look for & find a broker that offers CAC40 Stock Index chart so that you can begin to tradeit. Example displayed and illustrated above is of CAC40 Indices on MT4 FX Platform Software.

Other Details about CAC40 Index

Official Stock Index Symbol - CAC:IND

The 40 stocks that make up the CAC40 Stock Index are chosen from the best companies in France, and the selection is checked every three months.

Strategy for Trading CAC40 Stock Index

The CAC40 Index follows the market value of France's top 40 companies. This stock index tends to rise over time. That matches the strong growth in the French economy.

Study More Topics & Courses:

- Interpreting and Analyzing Trading Charts by Utilizing Trends

- The Role of Economic and Forex News Reports in Moving Markets

- Steps to Add Dow Jones Index in MetaTrader 5 Mobile App

- Forex Demo Account for Trading MetaTrader 4 Download

- Learn About Trading Tools in XAU/USD Market

- How Can I Trade Divergence and How to Trade Divergence Patterns in Trade?

- Forex Leverage Tips

- Example of SWI 20 Trade Strategy

- Setting Up Nas100 in MetaTrader 5 for PC

- How Can I Add GER30 in MT5 Platform?