What does linear regression analysis tell you, and how do you use its signals to trade?

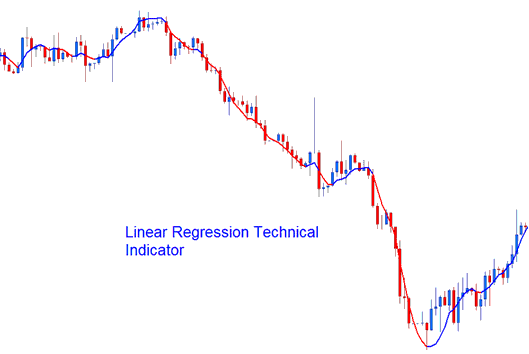

Another term for a regression line is a line of the best fit/best fit line. This technical indicator draws the market trend of the currency price over a specified duration of time. The market trend is determined by calculating a Linear Regression Trend-Line using the "least square fit" method. This technique helps to minimize distance between price data points and the line of best fit.

Unlike the straightforward Regression Trendline indicator, this tool plots the end values of multiple Linear Regression trendlines. Each data point along the Linear Regression corresponds to the endpoint of a Regression Trendline, but the resulting graph resembles a moving average.

But unlike the Moving Average, this indicator reacts more quickly because it draws a line using data points instead of finding an average.

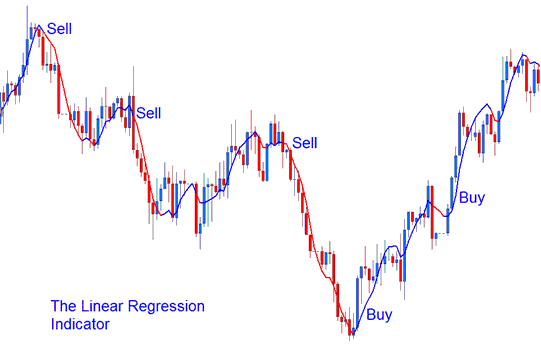

The Linear Regression estimates what tomorrow's price will be, based on today's data, one day in advance. When market prices consistently go above or below what's expected, then a forex trader might think they will quickly go back to more normal predicted levels.

Put another way, this technical analysis tool forecasts the statistically probable trading range for prices, suggesting that any significant departure from the regression line is unlikely to persist for an extended period.

Forex Analysis and Generating Signals

This tool lets you pick the price, change the number of periods, and smooth the price data before doing the math, and also choose the type of smoothing.

This indicator looks like a Moving Average, but it shows in two different colours.

- Bullish Signal (Blue color) - A rising line (higher than its previous value one previous bar before) is displayed & shown in the uptrend blue colour, while

- Bearish Signal (Red colour) - a falling line (lesser than its previous value one previous bar before) is shown & displayed in the downtrend red colour.

Analysis in FX Trading

Courses and Courses to Learn More:

- How to Find and Get Dow Jones 30 in MetaTrader 4 PC

- XAUUSD Chart Periods and Timeframes on MT4

- The How to Setup Guide for MT5 Forex Software/Platform

- What's FX Market Trading?

- How to Learn XAUUSD Successfully

- MA Stock Index Signal

- Avoiding MACD Fake-outs Signals XAU/USD Strategies

- Gold Chart Technical Indicators Lesson Guide

- What's the Value of 100 Pips when Trading Forex Cent Lots in Forex?

- RSI Classic Bullish Divergence & RSI Classic Bearish Divergence Trade Setup