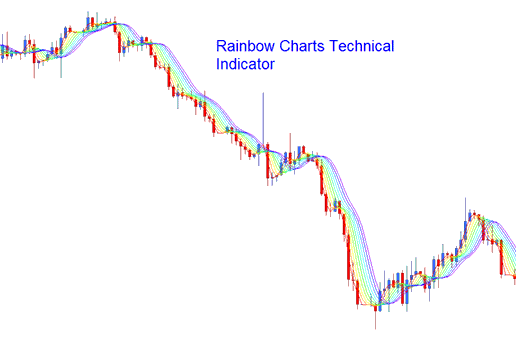

Rainbow Charts Technical Analysis and Rainbow Charts Signals

Developed & Created by Mel Widner

This indicator follows price trends, much like moving averages. It starts with a two-period simple MA. That gets smoothed into ten MAs total. Each new one builds on the last. This creates a rainbow-like pattern for the market trend. Colors differ for each line to mimic a rainbow.

FX Analysis and How to Generate Trading Signals

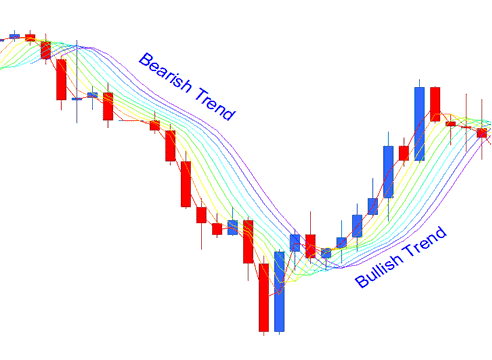

Bullish Trend/ Upward Trend

During an upward or bullish market trend, the rainbow indicator lines will be directed higher: the least smoothed line, which is the red line, will occupy the top position of the technical indicator, while the most significantly smoothed line - Violet - will be situated at the lower end of the indicator, appearing as the violet line.

Bearish Market/Downwards Trend

In a bearish downtrend, rainbow chart lines slope downward. The violet line, which is most smoothed, sits at the bottom. The red line, least smoothed, stays at the top.

Trend Continuation Signal

As the trend continues in one direction upwards or downward, the rainbow charts follow the price closely. The more the price moves away from the rainbow chart the more the trend is likely to continue, this is considered as a trend continuation trading signal. The indicator lines also will continue to expand its width: this is also another trend continuation trade signal.

Trend Reversal Signal

When the price begins to move in the direction of the rainbow charts, this indicates that the market trend may be changing. Also, the width of the trading indicator lines gets smaller, which suggests the market trend is changing. The signal that the trend has changed is confirmed when the price goes past all the rainbow charts, and the direction of the rainbow charts also changes in the same direction.

More Tutorials & Courses:

- How to Use MetaTrader 4 T3 Moving Average MA Technical Indicator on MetaTrader 4 Software Platform

- Gann Swing Oscillator MetaTrader 5 Technical Analysis in Forex

- How to Create a USD TRY Strategy

- How Can I Add WallStreet 30 Index in MetaTrader 5 Platform?

- What are Linear Regression Buy and Sell Forex Signals?

- Instructions on Incorporating the MACD Indicator into a Forex Chart using MetaTrader 4

- Gann HiLo Activator Automated FX Trading Strategy