Forex Indicators List and Their Technical Analysis - Best Technical Indicators Day Trading Forex

To learn Forex trading technical analysis the first thing that a trader should do is to know about all the different technical analysis indicators and then try to find out the ones that they can use - the list of All Forex Indicators Explained is shown below.

All Forex Indicators List - All Forex Indicators Explained

A

- Acceleration/Deceleration: AC

- Alligator

- Aroon

- Aroon Oscillator

- Awesome Oscillator

- Accumulation/Distribution

- ADX

- Average True Range (ATR)

B

- Bollinger Bands: Fibonacci Ratios

- Bears Power

- Bollinger Bands

- Bollinger Bandwidth

- Bulls Power

- Balance of Power

- Bollinger Percent B or %b

C

- Chaos Fractals

- Chande Q-Stick

- Choppiness Index

- Chande Trend Score

- Coppock Curve

- Chaikin Money Flow

- Chande Dynamic Momentum Index

- Chande Momentum Oscillator

- Commodity Channel Index (CCI)

D

E

G

H

I

K

L

M

P

R

S

T

- T3 Average

- Trailing Stop loss Levels

- Trend Trigger Factor

- Triple Exponential Average (TRIX)

- Triple Exponential MA (TEMA)

- True Strength Index (TSI)

U

W

You can navigate these tutorials from the right navigation menu or using the above links.

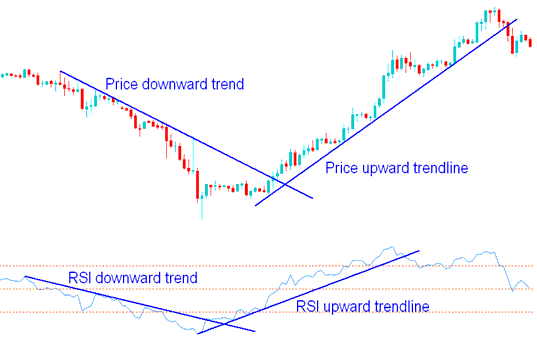

RSI Indicator - Forex Technical Analysis

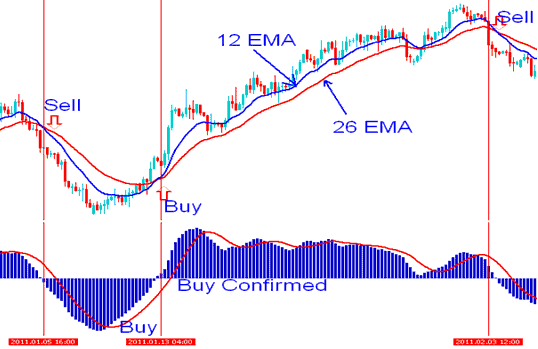

MACD Indicator - Forex Technical Analysis

Indicators Forex Technical Analysis

Most indicators are displayed separately from the chart usually below it. This is because the technical indicators oftenly use a different scale than that of the price chart.

Other Forex technical analysis indicators are shown on the chart itself, such as Moving Averages indicator and Bollinger Bands indicator these are referred to as price overlays.

Some of the popular when it comes to Forex analysis ones are:

Moving Average (MA) - Using a variety of Forex trading analysis studies, various types of trading signals can be generated from the currency charts using the moving averages. The MA indicates buy signals when currency prices rise above the moving average lines. Sell signals occur when the price falls below the moving average lines. Another method to trade with moving averages is using the MA crossover signals.

MACD technical indicator is one of the trend following indicators, MACD indicator has a signal line that is used to generate a buy signal (above the MACD indicator center line) or a sell signal (below the MACD indicator center line).

Volume based forex market analysis indicators are used to determine the momentum of market trends. High volume, especially near the bottom of the market can indicate the beginning of a new trend while low volume may indicate ranging markets or sideways market movements.

Bollinger Bands show potential points where the market movements are likely to change. Technical analysis Forex setups of this indicator that show sharp moves in price action tend to occur when the bands tighten (the Bollinger band squeeze). While prices that touch one of the outer band tends to go all the way to the other band. Bollinger Bands move in a particular direction up or down when there is a market trend.

These indicators are some of the most commonly used indicators when it comes to daily Forex technical analysis. To learn more about how to combine these forex technical analysis indicators to form a trading strategy you can go to the Forex trading strategies section and learn how to come up with an indicator based Forex trading system.

All Forex Indicators List - All Forex Indicators Explained - Combination of Indicators for Forex Trading List