Types of BTCUSD CryptoCurrency Analysis

Types of BTCUSD Crypto Strategies

Learn About Different Kinds of Analysis - Learn About Analysis Types - Learn About Market Analysis - Learn About Bitcoin Analysis

Open a Bitcoin demo account and start learning with these Bitcoin trading analysis tutorials.

Learn BTC USD Technical Analysis

- Technical Analysis Training

- Technical Analysis Basics

- BTC/USD Crypto Price Action 1 2 3 Method

- Pin Bar BTC USD CryptoCurrency Price Action

- Elliott Wave Theory

- Types of BTCUSD Crypto Charts

- Types of BTCUSD Orders

- Setting a Limit CryptoCurrency Order

- Setting a Stop Bitcoin Order

- Pivot Points Crypto Indicator

- Day Trade Pivot Point

- Japanese Candlesticks Charts

- Marubozu & Doji BTCUSD Candles Setup

- Spinning Tops Candles

- Reversal Candlesticks Setup

- A Comparison of the Inverted Hammer Candle Pattern and the Shooting Star Candlestick Pattern

- Recognizing the Piercing Line Candle Pattern and Dark Cloud Candles

- Morning Star and Evening Star Patterns in BTCUSD Cryptocurrency Candlestick Charts

- Support Resistance Levels

- Drawing Support and Resistance

- What is Trend-Line

- Drawing an Upward Trendline for BTC/USD Cryptocurrency

- Drawing a Downward Bitcoin Trendline

- BTC/USD Crypto Trend-Line Break

- Momentum Bitcoin Trends

- Bitcoin Crypto Currency Patterns

- Continuation BTCUSD CryptoCurrency Patterns

- Consolidation BTC USD Crypto Patterns

- Double Tops and Double Bottoms Bitcoin Patterns

- Patterns of Head & Shoulders in BTCUSD Cryptocurrency

- BTCUSD Cryptocurrency Fibonacci Retracement Levels

- Drawing Fibonacci Retracement Levels

- Bitcoin Crypto Currency Fibonacci Expansion Levels

- Drawing Fibonacci Expansion

- Fib Expansion and Retracement Exercises

- BTC/USD: Divergence Crypto Trade Setups

- Trade Classic Divergence Setup

- Trade Hidden Divergence Trading Setup

- Divergence BTCUSD Crypto Trading Summary

BTC/USD Crypto Analysis

Bitcoin technical analysis tutorials encompass a broad spectrum of strategies, including bitcoin price action strategies, the drawing of bitcoin trendlines and channels, analysis of bitcoin charts, candlestick bitcoin charts, cryptocurrency chart patterns, and bitcoin divergence trading setups utilized by numerous BTCUSD traders to analyze and interpret bitcoin price trends.

BTCUSD Strategies:

When you as a trader want to learn how to create your strategy, you need to use bitcoin trading analysis. BTCUSD analysis is a very wide topic where a beginner btcusd trader is required to study many bitcoin analysis topics. This learn website btcusd strategies section shows examples of simple bitcoin trading strategies that can also be combined together to form strategies that traders can use when trading the bitcoin trading market.

The section dedicated to learning bitcoin strategies details the most favored methods for trading bitcoin, such as those based on the RSI indicator, Stochastic oscillator, Moving Average crossovers, MACD, and Bollinger Bands - strategies fundamentally reliant on technical indicators. These bitcoin trading methodologies explain numerous underlying principles, offering traders a solid foundation from which to adapt these examples and formulate their unique strategies. Aspiring traders often struggle to devise their own bitcoin trading systems if they lack basic knowledge about what bitcoin trading entails, or even the roles of a Bitcoin broker or a bitcoin trading platform. Therefore, it is critical to begin by gathering comprehensive data on bitcoin trading to proactively avoid the typical errors made by newcomers.

The bitcoin trade strategies section of this web site found either on the website homepage or on main side navigation bar.

Each Bitcoin trading strategy comes with multiple examples, such as the case below, designed to enhance your understanding of BTCUSD market analysis.

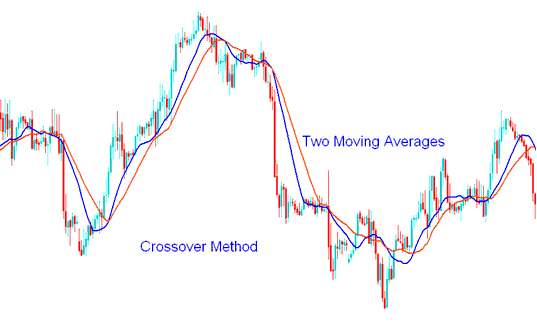

An Example of Moving Average Cross-over Strategy

Example of MA Cross-over Strategy

If you want to create your own strategies that works, you need to form a basic and simple bitcoin strategy then keep develop it over time - learning and improving is the key to everything in learning bitcoin trading. Most beginner traders start with simple bitcoin strategies & then develop them over time.

Crypto Indicators:

Traders utilize these indicators to develop their bitcoin strategy: each bitcoin indicator is distinct from the others. There are approximately 100 bitcoin indicators discussed in the indicators section, which can be accessed through the main side navigation menu of this learn bitcoin trading website. This learn indicator section will address and elucidate each bitcoin indicator individually and present the btcusd analysis that is employed to generate buy or sell trading signals.

Bitcoin signals come from bitcoin indicators. Learn all these indicators to choose the best BTCUSD technical one for your trading style. The top bitcoin indicators are:

- Moving Average Indicator

- RSI Crypto Indicator

- Stochastic Oscillator Indicator

- ADX CryptoCurrency Indicator

- Bollinger Bands Indicator

- MACD Crypto Indicator

Learn About Different Kinds of Analysis - Learn About Analysis Types - Learn About Market Analysis - Learn About Bitcoin Analysis

Check Out Extra Subjects and Lessons: