How to Use Support & Resistance to Trade Bitcoin

In past trade examples, we saw support and resistance that held firm. They stayed strong and did not break.

However, sometimes support & resistances levels are not strong enough to stop movement of the bitcoin price moving in a certain direction. When bitcoin price moves past these support & resistance levels we say that these technical levels have been broken. That is why we always use a stoploss order when trading these technical levels, just in case they don't hold.

However, if these regions are breached, for instance, if these levels move from one to another, what occurs?

- When a support level is broken it becomes a resistance

- When a resistance level is broken it becomes a support

Charts below show what happens when these levels break, with examples.

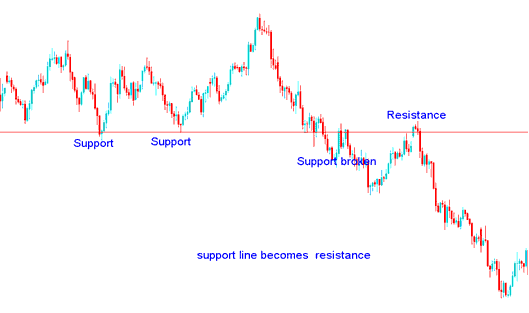

Support level is broken it becomes a resistance

In the cryptocurrency scenario illustrated beneath, the support level, which had been tested twice previously, failed to maintain its integrity upon the third attempt: sellers managed to drive the Bitcoin price below this established technical threshold.

But, the bitcoin price went back up, but this time it couldn't get past a certain line. After that, sellers quickly pushed the bitcoin price back down. This happened because the line that used to be support had now become resistance.

In Bitcoin trading, when a support level is breached, stop-loss orders placed below it are triggered. This reduces buyer momentum (bulls) and opens opportunities for sellers to short-sell Bitcoin, placing stop-loss orders above this newly formed resistance level.

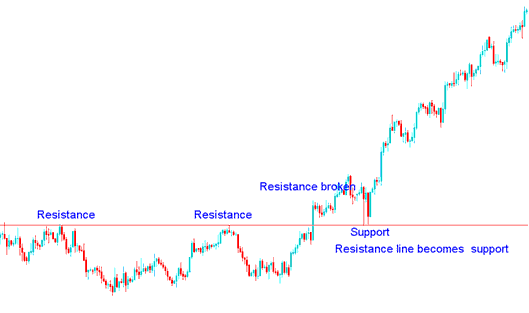

Resistance level is broken it turns into a support

In the crypto chart example below, resistance held for two tests. On the third, bulls broke through. Bitcoin prices surged past that level.

When the price of Bitcoin attempted to decline again, it was unable to fall below a specific technical level. After hitting this level, buyers quickly pushed the price upward. This is due to the fact that a previous resistance line has now converted into a support level. In Bitcoin trading, once a resistance level is breached, it frequently transitions into support.

Traders who have closed their short cryptocurrency positions will now likely initiate long trades, positioning their stop losses just underneath this technical threshold.

Major and Minor Resistance Zones

On charts, the areas where the price struggles to go higher or lower are either strong or weak resistance or support areas.

Major Resistance/Support levels

In Major Resistance/Support levels bitcoin price will stay at this level for some time, either the bitcoin price will consolidate at this point or form a rectangle cryptocurrency chart pattern when bitcoin price gets to this point. This price level will be tested several times before it is either broken or it holds and bitcoin price doesn't get to go past this support/resistance area.

These examples show key support and resistance zones.

Minor Resistance/Support levels

At minor resistance and support levels, BTCUSD often forms these points pretty quickly, then moves past them just as fast.

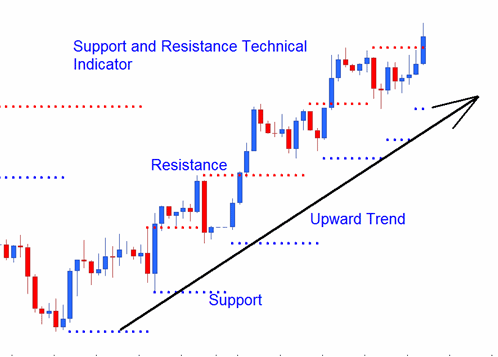

Upward crypto trends reflect a setup of minor resistance and support points, designed to form a series of upward directional areas.

Upward Bitcoin Trend Series of Support & Resistance

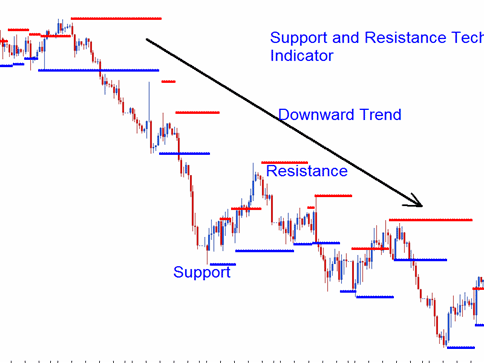

Downward Bitcoin Trend: Small support and resistance spots create a pattern that trends lower overall.

Down-ward Bitcoin Trend Series of Support & Resistance

Study More Lessons:

- Bollinger Band BTC/USD Trend Reversal BTC/USD Strategies

- How to Interpret and Analyze BTC USD Upward Trend Channels in BTC USD Trade

- How Do I Download Bitcoin Trade MetaTrader 5 on iPad?

- BTC USD Trade Reversal Strategy

- Avoiding MACD Whipsaw Fake-outs Signals BTC USD Trade Strategies

- MetaTrader 4 Platform Tutorial Course Explained

- BTC USD Trade Cent Account BTCUSD Crypto

- How Can I Differentiate Double Bottoms Pattern from a Double Tops Pattern?

- Instructions for Adding the Volumes Indicator to an XAU/USD Chart

- Buy Entry Limit BTC USD Order & Sell Entry Limit BTC USD Order