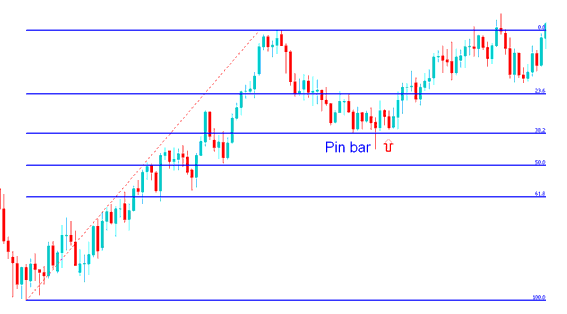

Pin bar bitcoin price action method

A pin bar represents a reversal signal in cryptocurrency on a chart, indicating a clear shift in sentiment during that timeframe.

This bar has got a long tail with closing bitcoin price near the open.

This specific candle shape resembles a pin, hence its designation as a Pin-Bar, and it typically manifests after a sustained price advance or decline.

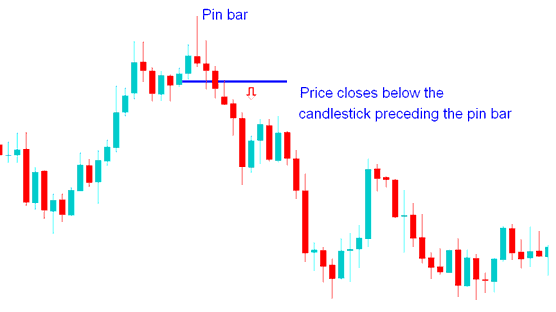

This reversal gets confirmed when the market drops below the prior candle after close. For BTCUSD, it confirms below the blue candle before it.

Combining Together with line studies:

This particular signal can be effectively integrated with other graphical tools like Support and Resistance levels, Fibonacci retracement markings, and Bitcoin trendlines to generate robust buy or sell signals in the cryptocurrency market.

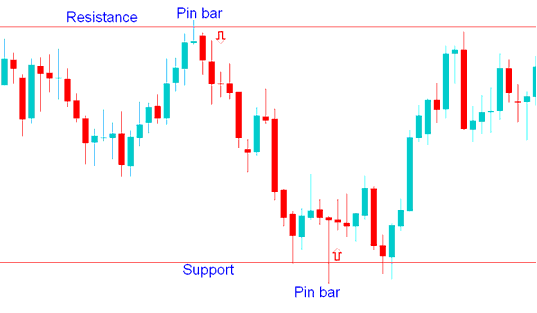

Support & resistance

A pin bar that appears after the price of bitcoin reaches an important area of support or resistance can signal when to enter the btcusd market. When this happens, trades should be made in the opposite direction of the tail.

If the BTCUSD market rises and forms a pin bar with a long upper shadow, the signal is to short.

If the BTCUSD market drops and shapes a pin bar with a long lower shadow, the trade signal calls for going long.

Combining Together with Support & Resistance

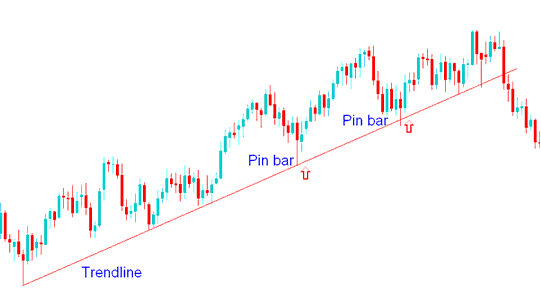

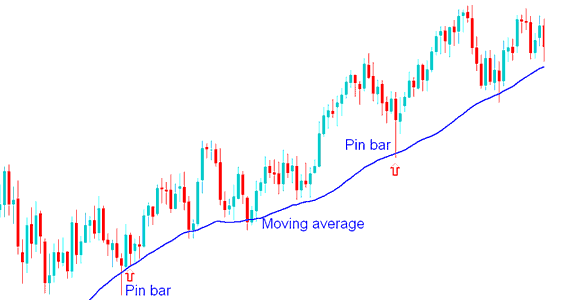

Bitcoin Trendlines and moving averages

You can use pin bars that appear after the bitcoin price touches a line showing the bitcoin trend or a moving average as signals to trade btcusd.

Combining with Bitcoin Trend Lines

Combining with Moving Averages(MAs)

Bitcoin Trading Fibo Retracement Areas

Pin bars that appear after the bitcoin price touches or tests a Fib retracement can also be used as signals to get into the btcusd market.

Combining Together with Bitcoin Fib Retracement Zones

These trading shapes usually show up close to big market changes, and they often occur after fake breakouts. That's why this shape is used to make trades that go against where the tail points in the market.

Study More Tutorials & Topics:

- Method for Creating BTCUSD Trendlines for Intraday BTC USD Movements within BTCUSD Visualizations?

- How does a Bitcoin chart trading system really work?

- BTC USD Strategies for Short-term and Long-term Moving Averages

- What is the Process to Trade Bitcoin and Place a Pending BTCUSD Order in the MetaTrader 5 iPhone Trading App?

- How to Trade Descending Triangle Patterns Analysis

- Tutorial Outlining the Method for MT5 BTC USD Trading

- Accessing the BTCUSD Trading History Log Located in the MetaTrader 4 Tools Menu

- Description of the Bitcoin Trading Line Chart Display in MT5

- How to Start a Real MT5 BTC USD Account in MetaTrader 5 Described

- How to Trade Bitcoin Within a Consolidation Pattern (BTCUSD)