Divergence BTCUSD Setups

Divergence Trading Setup is one way Bitcoin traders make trades. It involves looking at a crypto chart and another indicator. We will use the MACD indicator in our examples.

To find this setup, look for two spots on the chart where the bitcoin price makes a new high or low, but the MACD indicator doesn't, which means the price and momentum are moving in different directions.

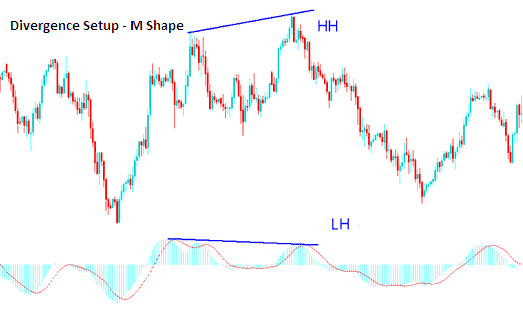

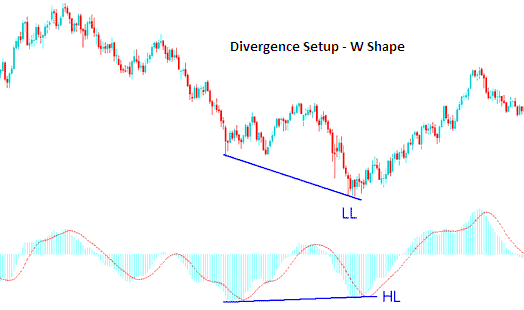

Searching for divergence involves identifying two highs forming an M-shape or two lows forming a W-shape on a crypto chart. Then, locate similar patterns on the Bitcoin indicator you use for trading.

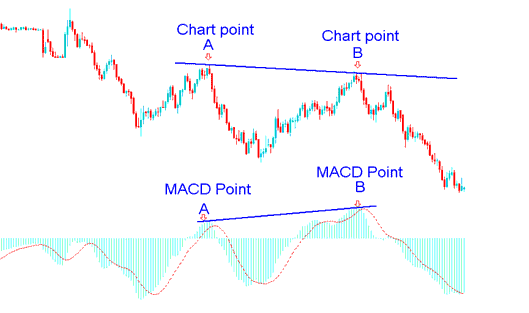

Example of a Divergence Trading Setup:

On the cryptocurrency chart here, we can see 2 chart points, point A and point B (swing highs). These 2 points make an M shape on the bitcoin chart.

Subsequently, by utilizing the MACD indicator, we examine the peaks formed by the indicator: these peaks are located directly beneath points A and B on the chart.

We then plot one line on the Crypto chart and another line on the MACD indicator.

Drawing Divergence BTCUSD Lines

The chart presented above illustrates one of four recognized divergence types: this specific example is known as hidden bearish divergence, considered one of the most advantageous types for trading. The subsequent lesson will elaborate on divergence types.

How to spot divergence

In order to spot & identify divergence signal we check for the following:

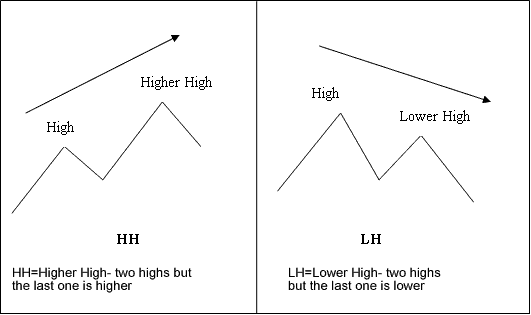

- HH=Higher High- 2 highs but the last one is higher

- LH = Lower High : two highs but last is lower

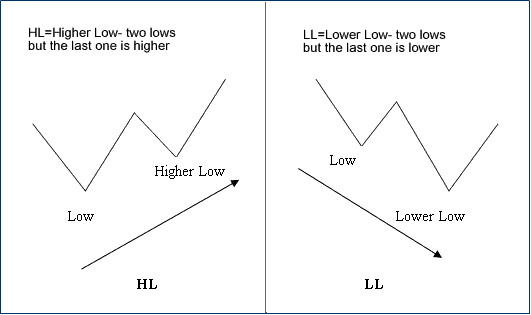

- HL = Higher Low - 2 lows but last is higher

- LL = Lower Low - two lows but the last is lower

First let us look at the exemplifications of these trading terms:

M-shapes dealing with BTCUSD Crypto price Highs

W-Shapes dealing with BTCUSD price lows

Explanation of M-Shapes

Examples of W Shapes

Now that you have grasped the divergence terminology used to describe setups, let us examine the two types of divergences and how to trade these chart setups.

There two types are:

- Classic Bitcoin Trade Divergence

- Hidden BTC USD Trading Divergence

These 2 setups are explained on the following tutorials below

Learn More Courses & Tutorials:

- Utilizing the MT5 MACD Indicator for BTC/USD Trading on MT5

- Instructions for Personalizing the Toolbar Menu for Bitcoin Trading within the MT4 Environment

- Types of Strategies for Trading Bitcoin

- Method for Setting the Linear Regression Indicator on a Trading Chart

- BTCUSD MT4 App for Android

- A beginner's guide to trading BTC/USD.

- How Can You Use BTCUSD MetaTrader 4 Platform Market-Watch Window?

- How do you trade Fibonacci pullback levels with trading indicators?

- Spotting Consolidation Patterns and Symmetrical Triangles for BTC USD trading.

- How can you look at and understand BTC USD price changes in Bitcoin swing trading?