How Do I Analyze Fibo Retracement Levels Crypto Indicator?

Bitcoin Trade Fibonacci Retracement Levels Crypto Indicator

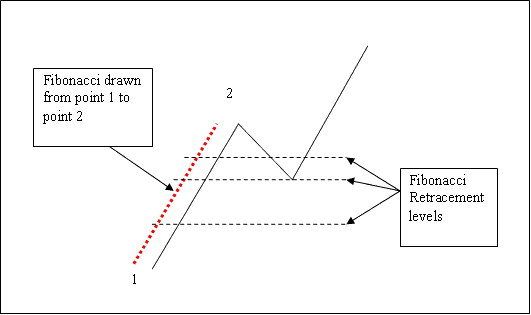

Fib Retracement is an bitcoin indicator used in bitcoin trading to calculate bitcoin price retracement levels in an upward or a downwards trend. These pull-back zones are then used by traders to open trades and open trades at a better bitcoin price after bitcoin price has retraced and resumes heading in the original bitcoin trend direction.

What's the Explanation Fib Retracement Levels?

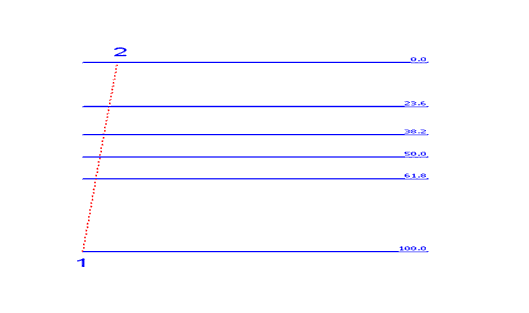

- 23.6 % BTCUSD Fibonacci Retracement

- 38.2% BTCUSD Fibonacci Retracement

- 50.0 % BTCUSD Fibonacci Retracement

- 61.8% Fibo Retracement

How Do I Interpret BTCUSD Fibonacci Retracement Levels?

38.2% and 50.0% Fibonacci Retracement Areas are the most used and most times this is where the bitcoin price retracement will get to. With 38.2% Fibo Retracement Level being the most popular/liked & most widely used retracement level in bitcoin trade.

People also often use the 61.8% Fibonacci Retracement Level to set stop loss crypto orders for trades that use this strategy to track bitcoin price changes.

Fib Retracement Levels btcusd crypto tool is drawn in direction of the btcusd crypto trend as shown in the two bitcoin trading illustrations put on display below.

What's the Explanation of Fibo Retracement Areas?

How Do I Analyze Fibonacci Retracement Levels Crypto Indicator?

Clarifying the Meaning of Fibonacci Retracement Levels - A Description of the Fibo Retracement Tool

Crypto Trade Fibonacci Retracement Levels Crypto Indicator?

How Do I Read Fibonacci Retracement Levels Technical Indicator

Dive into more topics and guides

- Getting Started in Learn Bitcoin Trade Website for BTCUSD Course Guides

- How to Interpret and Analyze Double Tops Chart Setup

- BTC USD Buy Long Trades & BTCUSD Sell Short Trades on BTC USD Charts

- How to Analyze MT4 Charts Described

- What's BTC USD Trade Market Psychology?

- Where Can a Beginner Learn BTCUSD Trade Analysis?

- BTC USD Gann Trend Oscillator Trading Strategy Lesson

- BTC USD Trade Strategies List

- Technical Analysis of BTC/USD Indicators to Use in BTC/USD Trade

- How to Choose Automated Crypto Trade Robots