Reversal BTC USD Patterns

These patterns form after the BTCUSD market moves far up or down. The bitcoin price then hits strong resistance or support.

When bitcoin price gets to such a point it starts and begins to form a pattern. Since these setups are frequently formed it's easy to identify them once you learn how & begin using them. There are 4 types:

- Double Tops

- Double Bottom

- Head & shoulders

- Reverse Head and shoulders

This bitcoin tutorial only covers double tops and double bottoms. If you want to learn about head and shoulders or reverse head and shoulders, check out the other article on those patterns.

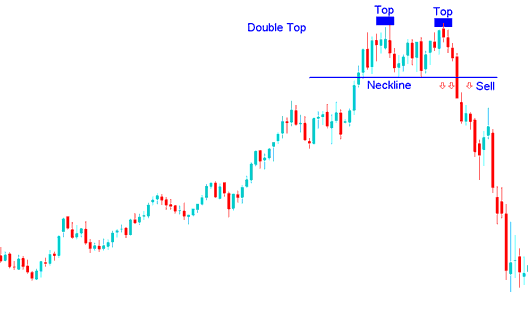

Double Top

This is a change in bitcoin pattern that happens after a long upward trend. As the name says, this pattern has two peaks that are about the same, with a small dip in the middle of them.

This pattern is seen as done when the bitcoin price makes a second high and then goes below the lowest spot between the highs, which is called the neck-line. The signal to sell cryptocurrency from this pattern happens when the bitcoin market goes below the neck line.

In the context of Bitcoin, this formation serves as an initial indication that the bullish trend may be reversing. Confirmation occurs only when the neckline is breached, causing the BTC/USD price to drop below this support level, often referred to as the neckline.

Summary:

- Forms after an extended move upward

- This formation shows that there will be a reversal in btcusd cryptocurrency market

- We sell when bitcoin cryptocurrency price breaks-out below the neckline point: see below for an explanation.

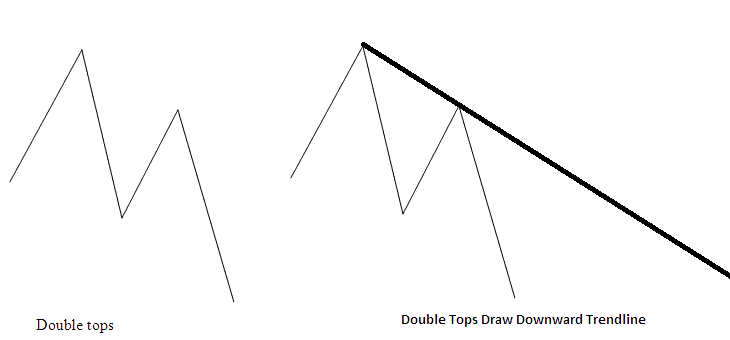

The double tops look like an M-Shape, the best reversal crypto currency signal is where the second top is lower than the first one such as illustrated below, this means that the reversal setup can be confirmed by drawing a downwards bitcoin crypto currency trend line like as shown below. If one opens a sell crypto signal the stop loss order will be placed just above this downward bitcoin trend-line.

M Shaped

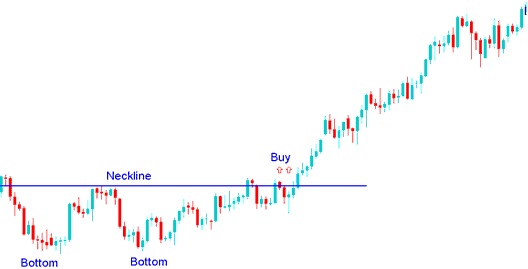

Double Bottoms

This is a bitcoin pattern that shows the price will go up after a long period of going down. It has 2 dips that are about the same, with a small peak in between.

This pattern is seen as done when the bitcoin price makes a second low and then goes above the highest point between the lows, called the neckline. The signal to buy comes when the btcusd cryptocurrency market goes past the neckline on the way up.

In BTCUSD Crypto, this formation is an early signal that the bearish bitcoin trend is about to turn and reverse. It's only considered complete/confirmed once the neckline is broken. In this formation the neck-line is the resistance level for the bitcoin crypto price. Once this resistance is broken the btcusd cryptocurrency market will move upward.

Summary:

- Forms after an extended move downwards

- This formation shows that there will be a reversal in btcusd cryptocurrency market

- We buy when bitcoin price breaks above the neckline point: see below for an explanation.

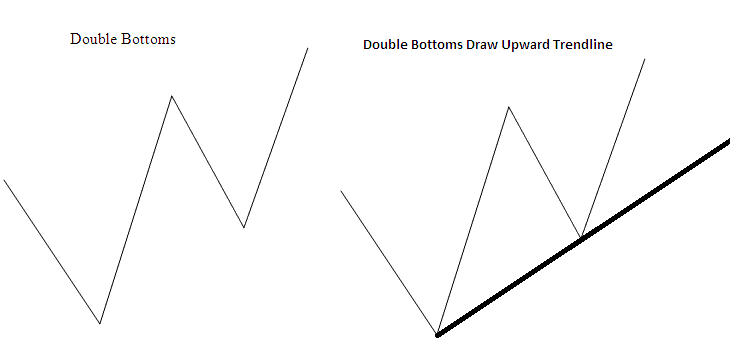

The double bottoms pattern forms a W shape. The strongest reversal signal in crypto comes when the second bottom sits higher than the first, as shown below. Confirm the reversal by drawing an upward trend line on bitcoin charts. For a buy signal, place the stop loss just below this trend line.

W Shaped

Explore More Tutorials:

- BTC/USD Trading: Add Custom MT4 BTCUSD Indicator to MetaTrader 4 Platform

- MetaTrader 5 BTCUSD Trade for Mobile

- How Do You Add a Bitcoin Trade Trend Line on BTC USD Charts?

- BTC USD Trade Tips: How to Improve Results of BTC USD Strategy

- MT4 BTC USD Trade Profit Target Indicator

- Understand Bitcoin chart pattern arrangements explained with examples.

- McGinley Dynamic BTCUSD Indicator

- Drawing Fibonacci Extension BTC USD Trade Levels in Upwards and on Downwards Bitcoin Chart Trend

- How to Trade Various & Different Types of Trade Candlestick Patterns

- BTC USD Leverage & Margin Trade Explanation and Examples