How to Set Stop Loss Orders in BTCUSD Trading

Traders using a bitcoin system must have math formulas showing where they should place the order.

One can also set a stop loss bitcoin order in accordance to the technical indicators used to set these orders. Certain indicators use mathematical equations to calculate where the stop loss cryptocurrency order should be set so as to provide an optimal and ideal market exit point. These indicators can be used as basis for setting these orders.

Alternatively, other market participants structure these orders based on an established risk-to-reward ratio. This determination method relies on specific mathematical calculations. For instance, a trader might accept a stop-loss of 50 pips if the trade offers a potential profit of 100 pips, establishing a 2:1 risk-to-reward scenario.

Others just use a predetermined percent of their total equity balance.

Best Ways to Place a Stop Loss Order Include These Methods

1. Percentage of Bitcoin account equity balance

This is determined by the percentage of the account balance that the online trader is prepared to risk.

If you risk 2% of your account, set the stop order based on your trade size in buys or sells.

Example:

If a trader has a $100,000 account and risks 2%, the size of their Bitcoin trade comes straight from that 2% stop loss level.

2. Setting a Bitcoin Stop Loss Utilizing Support and Resistance Zones

An alternative methodology for establishing stop loss parameters for btcusd involves referencing support and resistance zones marked on the charts.

Because stop loss btcusd crypto orders tend to gather at certain points, when the bitcoin price tests one of those areas, the other orders are triggered, one after another. Stoploss orders tend to gather just above or below the areas of resistance/support.

Resistance or support levels work like walls for how Bitcoin's price moves. These levels are important for setting stop-loss orders. If one of these walls breaks, Bitcoin's price might move the opposite way of the original trade. But if the levels hold, the price will probably keep moving as expected.

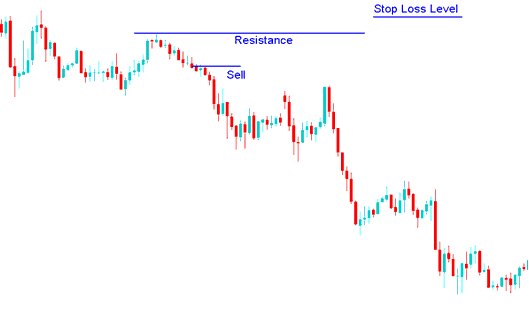

Stop Loss Bitcoin Order level using a resistance level

Placing order above the resistance

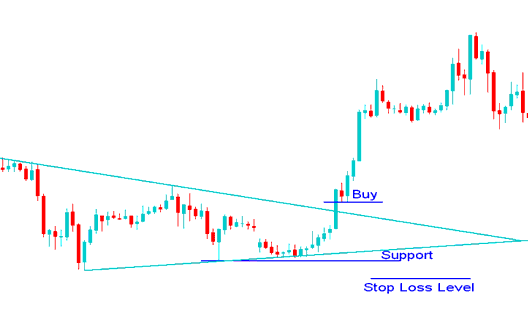

Stop Loss Bitcoin Order level using a support Level

Placing order below the Support Line

3. BTCUSD Trend-lines

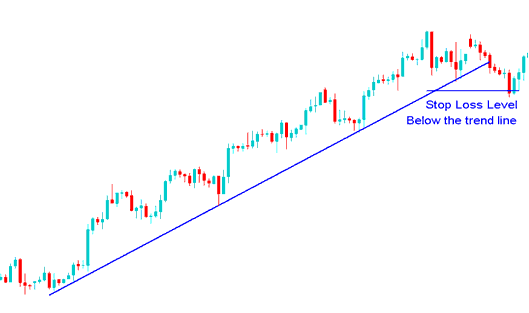

Use a Bitcoin trend line to place stop loss orders right below the line. As long as the trend line holds, traders keep earning profits. The order locks in gains if the line breaks.

Placing order below the bitcoin trend line

Examples of where to set this order using bitcoin trendlines.

Learn More Courses:

- How Do I Activate a Bitcoin Trade EA in MT4 Platform Software?

- BTC USD Fundamental Analysis Strategies

- How Do You Add a Trading Order on Place a Trade Order on Trade?

- MT5 Bitcoin Trading Software Install Procedure

- How Do I Analyze BTCUSD Support Resistance Levels in BTC USD Trade?

- BTC USD Trade Brokers BTCUSD Accounts

- BTC USD Equity Management and BTCUSD Equity Management Methods

- How to Develop One Page BTC USD Trade Plan Doc

- Integrating Stochastic Oscillator Readings with Other BTCUSD Indicators

- MA Whipsaw Signals in BTC USD Trade Range Markets BTC USD Strategies