Bitcoin Accounts Types Explained

Standard vs. Micro Bitcoin Trading Accounts: What's the Difference?

Recently, more regular people are trading bitcoin, and there's a bigger need for different types of accounts. There are many different crypto account types for traders who want to invest online - Account Explanation.

The market involves high btcusd crypto leverage to guess at btcusd crypto price moves and values. Traders can buy lots of bitcoin trading units using leverage - Bitcoin Trade Leverage is why many online bitcoin traders like bitcoin trading - using bitcoin trading leverage lets someone make greater gains or losses because they risk less money of their own and borrow the rest.

Various account types are available to assist investors in effectively managing their account capital and bitcoin transactions.

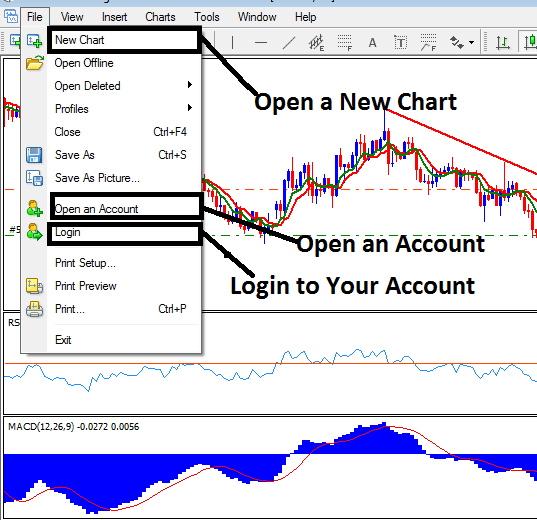

How a Real Bitcoin Account Looks Like

Bitcoin traders should think about their goals first. Then pick the right account type to match.

Here is a comparison of the two kinds of trading accounts people often use to trade bitcoin. The review of the trading account types below tells about the different features of each kind of bitcoin trading account.

1. Standard Bitcoin Accounts Examples Explained

Bitcoin Account Definition - Standard Account. A Standard BTC/USD Crypto Account is denominated in United States Dollars, and bitcoin trade transactions are initiated using standard lots or contracts. Remember, one lot equals one contract. The minimum initial equity required is at least $10,000.

A single contract signifies the minimum size for one Bitcoin transaction. This particular Bitcoin account type is best suited for crypto investors possessing substantial capital reserves. This option mandates an initial deposit between $10,000 and $50,000. With this standard cryptocurrency trading account, the trader avoids being undercapitalized. By adhering to sound BTCUSD equity and money management guidelines, this standard Bitcoin account setup offers the greatest potential for profit because it is adequately funded. Insufficient capitalization is the main reason most Bitcoin traders fail to become profitable.

Avoid opening a standard Bitcoin account below $10,000 balance. Wait until you reach $50,000.

Institutional capital managers generally suggest a minimum deposit of $50,000 to open a standard trading account, adhering to a strict policy of risking no more than 2% of total account equity per trade transaction. Despite this, a majority of contemporary online cryptocurrency brokerages will permit the activation of such a standard account with an initial funding exceeding $10,000.

With a leverage ratio of 100:1 for bitcoin, you are borrowing from your crypto broker (a 100:1 leverage option means your broker furnishes $100 for every $1 you hold in your account). Consequently, if your balance is $1,000, the broker extends $100 in leverage for each dollar you possess, resulting in a total of $1,000 * 100 = $100,000, which you, as a bitcoin trader, can then deploy for bitcoin trades.

2. Micro Bitcoin Trading Account Explained with Example

Bitcoin Account Meaning - Micro Bitcoin Trade Account. These accounts handle lot sizes that equal just one-hundredth of a standard bitcoin lot. Micro crypto accounts fit bitcoin traders with little BTCUSD cash. Some start with as little as a five-dollar balance.

This trading account type, focused on micro lots for Bitcoin, permits the trader to initiate trade positions in very small volumes. One micro lot/contract for Bitcoin trading equals one-tenth of a mini lot for Bitcoin trading, and one-hundredth of a standard lot for Bitcoin trading.

Micro bitcoin accounts work best for $1,000 to $5,000 balances.

When trading btcusd in crypto, one bitcoin standard lot is the smallest amount you can trade in the btcusd market. However, many crypto brokers let you trade smaller amounts, so more individual traders can use the btcusd market. Letting people trade btcusd in smaller amounts means that new cryptocurrency traders and bitcoin traders who do not have much money can start trading and understand the btcusd market without having to spend a lot of money.

There are online tutorials available for learning bitcoin trading that a trader can explore prior to establishing a real cryptocurrency trading account. As an additional practice opportunity, a beginner in bitcoin trading should consider opening a demo account with a cryptocurrency broker to gain experience with placing trades before committing real funds to an actual trading account.

When you're training with a bitcoin demo account, you'll pick up the essentials - things like trading education, btcusd money management, a clear trading plan, and solid crypto trade systems.

The types of bitcoin trading strategies used and the skills required for any of these 2 cryptocurrency trading accounts are essentially the same - those bitcoin trading skills and bitcoin trading strategies required for the Standard bitcoin account or Micro bitcoin account are the same the only difference to be adjusted are the btcusd funds management guidelines for each trading account type.

Find Even More Help and Subjects: