Draw-Down & Max Draw-down

To profit in business, traders must handle risks well. Learn equity management methods for BTCUSD from this Bitcoin tutorial site.

In trading, the risks to manage encompass possible trading losses. Adhering to money management guidelines not only safeguards your account but also enhances your profitability in the long term.

Draw-down

Foremost among risks for traders is what is known as draw-down - this quantifies the monetary reduction experienced in one's cryptocurrency account resulting from a single bitcoin trade loss.

If your trading capital totals $10,000 and a single trade position results in a $500 loss, your calculated draw-down amounts to $500 divided by $10,000, which equates to a 5 percent draw-down.

Maximum Draw-down

This quantifies the total monetary value lost within your cryptocurrency account prior to achieving a net positive performance. For example, if your starting capital is $10,000, and you experience five consecutive losing trades accumulating a total loss of $1,500, followed by ten winning trades generating a total profit of $4,000, the resulting maximum drawdown is calculated as $1,500 divided by the initial $10,000, yielding 15% drawdown.

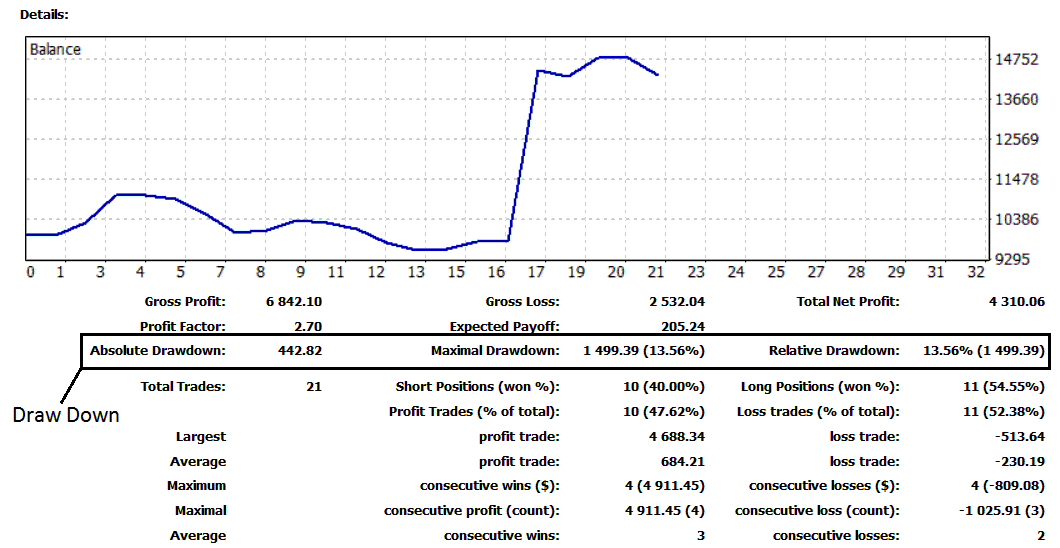

Draw-Down is $442.82 (4.40%)

Maximum Draw Down is $1,499.39 (13.56%)

To learn how to create and obtain the trading reports mentioned above using the MetaTrader 4 platform, please refer to the lesson guide on generating reports on MT4.

Bitcoin Trade Equity Management

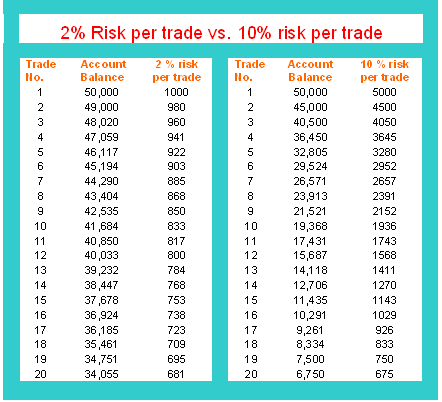

The example below shows how it's different to risk a small part of your trading money compared to risking a larger part. Good investing means you shouldn't risk more than 2% of all your money.

% Risk Technique

2 percent & 10 percent Risk Rule

Risking two percent of your equity differs a lot from risking ten percent on one trade.

If you had a bad run and lost 20 trades in a row, and you risked 10% on each trade, your starting balance of $50,000 would drop to just $6,750 left in your account. That means you would have lost more than 87.50% of your money.

However, if you risked only 2 % you would have still had $34,055 which is only a 32% loss of your total equity. This is why it's best to use the 2 % risk management strategy

The difference between risking 2% and 10% lies in outcomes after consecutive losses. Risking 2% would leave you with $34,055 following 20 unsuccessful trades.

However, if you risked 10 % you would only have $32,805 after only 5 losing trade positions that's less than what you'd have if you risked only 2 % of your account and lost all 20 trade positions.

The key thing is that you, as someone who trades, should create your rules so that even if you experience a period of losses, you still have enough money available to trade in the future.

Should you lose 87.50% of your funds, you would have to gain 640 % to get back to the point where you started even.

Losing 32% of your trading capital requires earning a profit of 47% just to break even. Compared to needing an extraordinary recovery like 640%, achieving 47% is significantly more manageable under such circumstances.

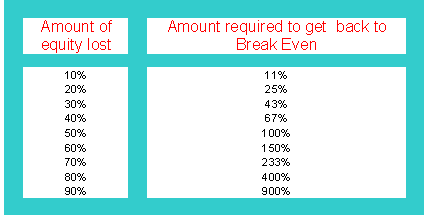

The chart below shows what percentage you'd need to earn to get back to even if you were to lose some percentage of your money.

Concept of Break-Even

Account Equity & Break Even

If you lose 50% of your money, you need to make 100% of what's left – very few traders can do this – to just get back to where you started with the amount they had initially.

At an 80% drawdown, traders need to quadruple their equity just to recover their starting balance. This recovery point is known as "breaking even," where your account returns to its original deposited amount.

The larger the percentage loss sustained, the more challenging it becomes to recover that deficit and return your trading account to its original capital level.

This is the rationale behind why, as a BTC/USD trader, it is imperative to take all necessary measures to safeguard your equity. You should not permit yourself to incur a loss exceeding 2 percent of your equity on any single trade position.

Bitcoin risk management means risking just a small part of your funds per trade. This way, you handle losing runs without big account drops.

BTCUSD cryptocurrency traders use stop-loss orders to manage risks by minimizing losses. Setting an order involves placing the stop-loss immediately after finalizing the trade order.

Effective Risk Management

To manage risks effectively, one must keep all risks under control. It is essential to establish a clear bitcoin trading money management system and a solid trading plan. Engaging in Bitcoin or any business requires making choices that come with inherent risks. Every aspect should be evaluated to minimize risk, utilizing the recommendations provided in this guide.

Learn More Courses and Topics:

- How to Perform Analysis and Interpretation of the BTC/USD Symbol Data in the MetaTrader 4 System?

- How to Perform Analysis and Interpretation of the BTC/USD Symbol Data in the MetaTrader 4 System?

- 3 Stochastic Oscillator Strategies for BTC/USD

- MetaTrader 4 Tool Bar Display for BTCUSD Platform

- Tutorial Lesson Describing Key Indicators for BTC USD Analysis

- BTC USD Trendline Break Analysis Methods

- Can You Trade With MT4 Platform?

- Stochastic Divergence Setups for Bitcoin Trading

- How to Use Fibonacci Pullback Levels for Day Trading BTCUSD

- Trading Using Bar Charts