Examination of Bullish and Bearish Pattern Formations in Cryptocurrency Candlesticks

Hanging Man Bearish CryptoCurrency Candle Setups

Reversal candlestick patterns follow a long trend. For a Bitcoin reversal, a clear prior trend must exist.

The reversal candle patterns are:

- Hammer Bitcoin Candle Pattern and Hanging Man Crypto Currency Candle Pattern

- Inverted Hammer Bitcoin Candle Pattern and Shooting Star Candle Pattern

- Piercing Line BTCUSD Candle Pattern and Dark Cloud Candle Pattern

- Morning Star Candles and Evening Star Candles

- Engulfing BTCUSD Candles Patterns

Analysis of the Hammer and Hanging Man Candle Patterns in Bitcoin Trading.

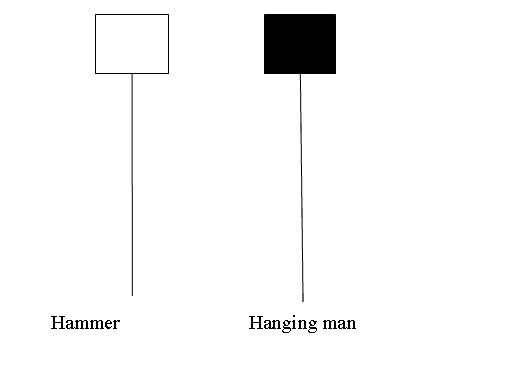

Hammer Bitcoin Candle Pattern and Hanging Man Bitcoin Crypto Currency Candle Pattern candles look similar but hammer is a bullish reversal bitcoin pattern and hanging man is a bearish reversal bitcoin crypto pattern.

Hammer Bitcoin Candle Pattern and Hanging Man Bitcoin Candle Pattern

Hammer Candle

A hammer forms in downtrends as a bullish sign. It looks like the market is pounding out a bottom in BTCUSD.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or three times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

Hammer Candle

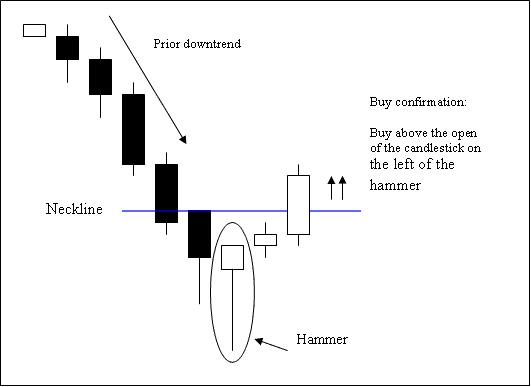

Analysis of the Hammer BTCUSD Candles Pattern

The buy signal confirms when a candle closes above the open of the candle before the hammer.

Stop orders ought to be positioned a small distance in pips below the lowest point established by the hammer candlestick pattern.

Hanging Man Candle

This bitcoin pattern signals a possible bearish turn in crypto. It forms in an uptrend and looks like a hanging man.

A hanging man candlestick has:

- A small body

- The body is at the top

- The lower shadow is two or three times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

Hanging Man Candle

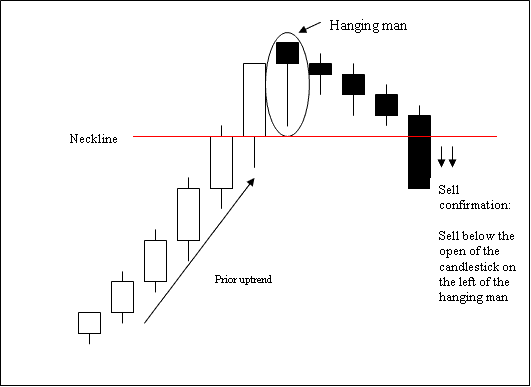

Analysis of Hanging Man BTCUSD Candles

The sell signal for cryptocurrency is confirmed when a red candlestick ends lower than where the candle to the left of the hanging man candle started.

Stop orders should be positioned a few pips just above the high of the hanging man candle.

Study More Tutorials & Topics:

- Instructional Lesson Detailing the MetaTrader 4 Moving Average (MA) Indicator for BTC/USD?

- Bitcoin Account Login for MetaTrader 4

- Risk Management Strategies for BTC/USD Trading

- McGinley Dynamic BTC/USD Technical Indicator

- Swing Trading with the 4-Hour BTC/USD Chart

- Trading BTC USD on the MT5 Platform Using Mobile Devices

- How Do You Study/Understand BTCUSD on MetaTrader 4 Program?

- Instructions for Drawing an Upward Trend Line Directly onto MetaTrader 4 Charts

- Explanation of the Terminology: What is Straight Through Processing (STP) for a Bitcoin Account?