Money Management Approaches and Techniques for Bitcoin (BTCUSD) Trading

A good way for someone to get better at managing their money in Bitcoin trading is to make sure they don't lose more money than they gain. This is called risk:reward ratio.

Bitcoin Account Management Techniques

This strategy is designed to enhance the profitability of an investment approach by executing trades only when the potential return exceeds three times the amount being risked.

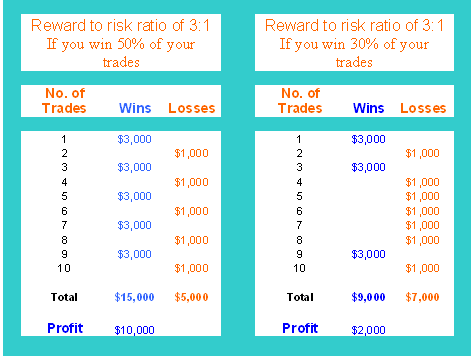

If you invest using a high risk reward ratio of 3:1 or more, you significantly increase your chances of becoming profitable in the long-term. The BTCUSD Chart below displays to you how:

In the early Bitcoin examples, winning half your trades would still yield a $10,000 profit in your crypto account.

Even with a win rate dropping to around 30%, you could still make money - Bitcoin Account Management Principle - Bitcoin Trading Equity Management.

Just know that if you have a good risk-to-reward ratio, you're more likely to make money as a trader, even if your bitcoin plan wins less often.

Never use a risk to reward ratio where you might lose more bitcoin pips on one trade than what you expect to gain. It is not smart to risk $1,000 only to possibly gain just $100 instead.

Because you need to win 10 different times to earn the $1,000 back. If you as a btcusd trader lose your money just one time, you have to return all bitcoin profits.

Adopting this category of investment strategy lacks long-term viability, and consistent losses are the probable long-run outcome.

Bitcoin Crypto Currency Account Management Techniques

The % risk technique is a way to risk the same percentage of your total money on each trade - Account Management Methods.

The percent risk method means a certain part of your bitcoin trading money is at risk for each trade. To figure out the % risk for each bitcoin trade, find out the percentage you're willing to risk and the amount of a cryptocurrency order to know where to set the stop loss order. Now that you know the %, use it to figure out the size of the bitcoin trade you'll make: this is known as position size.

Example

If a trader maintains a $50,000 balance in their crypto trading account and the risk percentage is set at 2%.

Then 2 % is the same as $1,000

Other factors to consider include:

Maximum Number of Open BTC USD Crypto Trade Positions

Another thing to think about is the most bitcoin trades you want open at once. This is another thing to decide when managing your money in cryptocurrency trading.

For example, if you pick 2%, you might also choose to have a maximum of 5 bitcoin trades happening at any one time. If you start 4 trades and all 4 of them result in losses on the same day, your account balance will drop by 8% that day.

Invest Sufficient Capital

One of the biggest errors that those who invest can make when trading btcusd is trying to trade bitcoin without enough money in their account.

A BTCUSD trader with small capital often feels anxious. They try to cut losses more than needed in real trades. Yet, they get stopped out of Bitcoin positions before their plan can work.

- Exercise Discipline

Discipline matters most for Bitcoin traders. It helps you turn a profit. Discipline means planning your trades and sticking to the plan.

It means you can let a bitcoin trade grow without quickly taking yourself out of the btcusd market just because you are worried about risk. Having discipline also means you can keep following your btcusd plan even after you have lost money. Try your best to build up the level of discipline you need to make money.

Managing Trade Account Capital Basics

Bitcoin trading risk control forms the base of any BTCUSD setup. It boosts your odds of profits in the Bitcoin market. This matters most in leveraged crypto trades. That space counts as one of the most fluid yet risky financial spots.

If you hope to invest successfully in the btcusd trading market, you should know that it's very important to have a good plan for managing your bitcoin money because you'll use bitcoin trading leverage when you open your orders - Bitcoin Account Management Basics.

The difference between how much you typically gain and lose should be carefully figured out: when trading, the average profit should be more than the average loss, or trading btcusd crypto won't make any money. In this case, a trader needs to make up their own rules for handling their bitcoin account: each trader's success depends on their own qualities. As a result, every trader makes their own plan and figures out their own bitcoin money management rules based on what's mentioned above.

When you make your trade orders, put your stop loss cryptocurrency orders in the right place to keep from losing too much money. Stop loss orders can also protect your profits.

Think of your chance to make money versus your chance to lose money as 3:1: it is best if this risk to reward ratio is more on the profit side.

Use these bitcoin rules to boost your strategy's profits. Build your own approach. It could lead to solid gains in trades.

Explore More Lessons, Tutorials, and Courses:

- How to Calculate BTC USD Trade Margin Formula

- How to Draw BTC USD Channels in MT4 Platform

- Awesome Oscillator Technical BTC USD Indicator

- How Do You Put a BTCUSD Trend Line on MT4 Bitcoin Charts?

- How Do You Trade BTC USD & Set Take Profit BTC USD Orders in MT5 BTCUSD Charts?

- Differences between Fibo pullback and Fibo extension in BTC/USD.

- ECN BTC/USD Broker, STP BTC/USD Broker, NDD BTC/USD Broker, DD BTC/USD Broker, Market Makers

- How to Draw Upward Trend-lines & Upwards Bitcoin Channels on BTC USD Price Charts

- What are the Differences between MT4 & MT5 Bitcoin Platforms?

- How Can I Open Live BTC USD Trade Account with $10?