BTCUSD Divergence Bitcoin Trade SETUPS SUMMARY

Regular Bearish - Higher high bitcoin price, lower high indicator - Shows that a bitcoin trend is getting weaker - This is a sign that the bitcoin trend may change from going up to going down.

Regular Bullish - Lower low bitcoin price, higher low indicator - Shows that a bitcoin trend is getting weaker - This is a sign that the bitcoin trend may change from going down to going up.

Hidden Bearish - Lower bitcoin price, Higher indicator - Shows hidden strength in a bitcoin trend - Usually happens when prices temporarily rise in a cryptocurrency downtrend.

Hidden Bullish - HL bitcoin price, LL indicator - Shows the strength of a bitcoin trend - Happens mostly when there are small drops in a cryptocurrency trend that's going up.

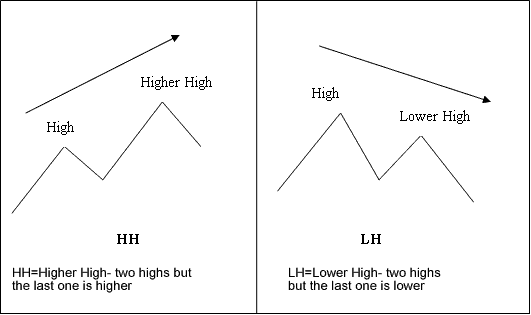

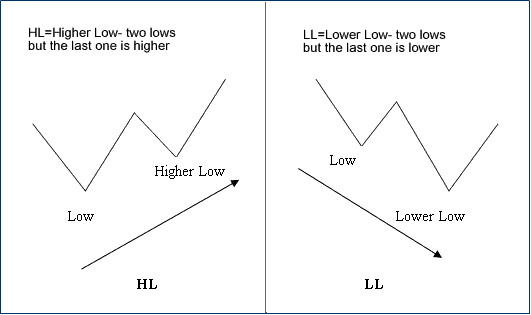

Example illustrations of the divergence terms:

M shapes dealing with Bitcoin price highs

M-shapes

W-shapes dealing with Bitcoin price lows

W shapes

These are shapes to look for when using these bitcoin trading setups.

A superior indicator for this cryptocurrency trading configuration is the MACD: specifically, a MACD divergence setup serves as a signal for entering a trade within the cryptocurrency sphere. However, like any signal, certain cautionary steps must be taken for this cryptocurrency signal to evolve into a viable setup. Immediately entering a trade position the moment a trader observes this cryptocurrency pattern is generally not the optimal approach. This configuration ought to be utilized alongside another indicator to corroborate the prevalent direction of the cryptocurrency trend. A robust strategy to integrate with is the MA cross-over method.

Note that this crypto setup on a short time frame lacks much weight. A divergence on a 15 min chart may not matter much. Compare it to the 4 H chart on the MetaTrader 4 platform.

When observing on a 60-minute, 4-hour, or daily chart, begin to identify additional factors and elements that indicate potential price reactions in Bitcoin related to the divergence.

This leads to an important idea for using this crypto signal to start a trade. On a higher time frame, MACD divergence often signals a solid shift in Bitcoin's price direction. But the main issue remains: when exactly? Jumping into a trade right after spotting this crypto pattern does not always make for the smartest plan.

Many investors get caught out by entering the btcusd trading market too soon when they see MACD divergence. In many cases, bitcoin price still has got a bit of momentum to continue in the ruling direction. The investor who has jumped in too soon can only stare at the screen in dismay as bitcoin price moves through his stop loss order taking him out.

Solely focusing on this cryptocurrency setup without incorporating supplementary analysis will not optimize your trading prospects. To significantly enhance your probability of a successful trade, a Bitcoin trader must examine other market variables and facets, particularly other confirming indicators.

What Further Elements and Considerations Should Be Taken Into Account When Employing This BTCUSD Trading Configuration?

Support, Resistance, and Fibonacci Levels on High BTCUSD Time Frames

Another smart way to boost your chances of a winning trade is to check higher timeframes before making a move based on lower ones.

If you examine the hourly, 4-hour, or daily Bitcoin chart and observe that it has reached a significant resistance, support, or Fibonacci level, the likelihood of executing a successful trade based on divergence in a lower time-frame at this juncture increases.

Principle 2: The Reward-to-Risk Ratio in Bitcoin Trade Capital Management

When looking for divergence, make sure you enter the BTCUSD trade right. This helps you get a solid risk/reward setup. Only take Bitcoin positions with higher profit chances than your risk. If you know how to enter trades well, you can check the risk/reward first. Then pick orders with a good ratio.

Finally, when it's used the right way with other clues to back up the bitcoin trade, divergence can lead to very big trading profits.

Get More Topics and Courses:

- Copy Trades with MT4 Software & Copy Trades with MT5 Software Program

- How to Trade When You See a Descending Triangle Pattern

- Guide on Registering a Practice Account within the MetaTrader 4 Software

- How can you tell a double bottom pattern apart from a double tops pattern?

- Using MetaEditor for the MT5 BTC/USD Platform