Support & Resistance Areas

Support and resistance form a core idea in crypto charts. They act as barriers that block bitcoin prices from crossing certain points in one direction.

Support

This point stops the bitcoin price of something from being pushed down: it's seen as the floor because it keeps the btcusd market from falling past a certain level.

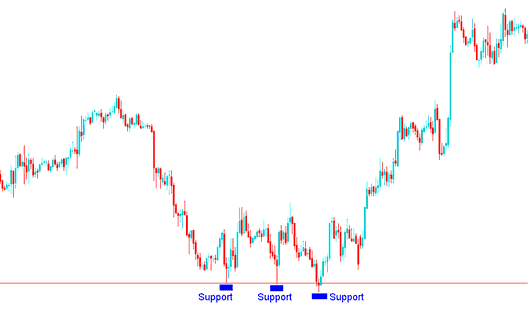

Example:

Observing the trading illustration below, one can see that the Bitcoin price declined until it encountered a support level.

Upon reaching this price point, the bitcoin price experienced a minor upward rebound before continuing its descent until it encountered the support level once more.

The process of hitting a level & bouncing back is termed as testing the support.

A support level grows tougher with each test and bounce. The chart below shows three holds without a break. At last, the BTCUSD trend flipped and climbed the other way.

Once this level has been determined traders use it to place their orders to buy bitcoin at the same time putting a stop loss a few pips below it.

In this BTCUSD setup, price stayed above that zone. It marks a spot where Bitcoin can't drop lower.

These areas are good spots where the bitcoin price in a downward trend will likely change direction, find support, and begin to move back upwards.

The desire to buy bitcoin at this time will be greater, so it is a good time to start a trade to buy bitcoin, while setting stop loss orders a few pips just below.

This particular level of support is also utilized by traders executing short bitcoin positions as a target point for setting their take-profit orders on those said short sales.

This observation provides another justification for the likelihood of the Bitcoin trend either neutralizing or reversing at this precise juncture. The reason is that once the selling participants (bears) exit their short positions, the driving force behind the preceding downward Bitcoin trend diminishes, leading to a period of consolidation, after which the market direction is poised to potentially reverse.

Resistance

Resistance levels block bitcoin prices from rising. They act like a ceiling, stopping the BTCUSD market from going up.

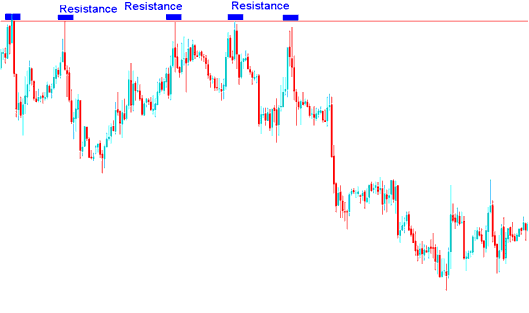

Example:

In the trading scenario illustrated below, one can observe that Bitcoin's price ascended until it encountered a resistance level.

Upon reaching this specific level, the bitcoin price slightly pulled back before continuing its upward trajectory until it encountered resistance once more.

The resistance holds & is tested 5 times without breaking.

More times a resistance area is tested the stronger the it is.

Once this critical level has been established, traders place their sell orders precisely at this level while simultaneously setting a protective stop loss a small distance above it.

In the aforementioned example, the btcusd market did not surpass this level. This zone represents a point where the bitcoin price struggles to break through.

These levels make good spots where bitcoin's price, after climbing for a while, is likely to run into resistance and then start heading back down.

This shows strong sell demand at that level. It makes a solid spot to enter a bitcoin sell trade. Set stop loss a few pips above this key level.

The people buying(bulls) also use this resistance level as a place to set and put their take-profit orders for when they are betting prices will rise.

This shows why bitcoin's trend might pause or turn here. As buyers exit positions, the upward force fades. A halt comes, and prices often drop after.

Study More Topics & Courses:

- Explaining Bitcoin Leverage and Margin Trading with Practical Examples

- How Can You Trade BTCUSD & Place Stop Loss BTC USD Order & Take-Profit BTC USD Order in MT5 Platform?

- Identifying Support and Resistance Levels in Bitcoin Charts (BTC/USD)

- How Can You Put in an Unfilled Trade Order on BTCUSD Platform?

- How to install BTC USD Trading MT4 Platform for MAC

- How Do You Study/Understand BTC USD Trading on MetaTrader 4?

- How to Save Open Charts as a Profile on MetaTrader 4 Trading Platform

- Interpretation of BTCUSD Trading Activity as Observed on the MT4 Platform

- Reversal Shape: Double Tops Shapes and Double Bottom Shapes

- How Can You Set DeMarks Range Expansion Index Technical Indicator on Trading Chart?