Double Tops in Bitcoin Trading: What Does This Pattern Mean?

In crypto trading, how do you spot a double tops pattern in Bitcoin?

How to Identify & Trade Double Tops Bitcoin Pattern

Bitcoin Patterns Examples Explained

This tutorial focusing on Double Tops chart patterns explains how to identify cryptocurrency chart formations. Recognizing such cryptocurrency patterns is the initial and necessary step before one can learn to conduct Bitcoin trading using the Double Tops cryptocurrency chart pattern within the context of Bitcoin.

Double Tops are notable price patterns in Bitcoin trading charts, and this tutorial explains how to analyze and trade using these Double Tops patterns.

Double Top Bitcoin Pattern

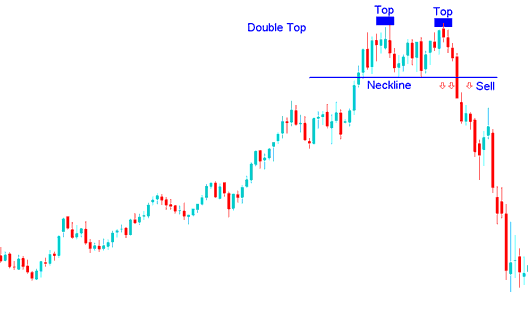

Double tops cryptocurrency chart pattern is a reversal bitcoin pattern that forms after an extended upwards cryptocurrency trend. As its name implies, this double top cryptocurrency pattern setup formation is made up of 2 consecutive peaks which are roughly equal, with a moderate trough between.

The double tops cryptocurrency pattern is deemed complete once the bitcoin price reaches a second peak and then breaches the lowest point between the peaks, known as the neckline. A sell signal from this pattern emerges when the BTC/USD market breaks below this neckline.

In BTCUSD, this double tops crypto setup setup is used as an early signal that a bullish Bitcoin Crypto Currency trend is about to turn and reverse. However, double top cryptocurrency pattern formation is only confirmed once the neck line is broken & the btcusd market goes below neckline. Neckline is just another name for the last support zone formed on chart.

Summary:

- Double tops btcusd setup forms after an extended move upward

- This double tops cryptocurrency pattern formation demonstrates that there'll be a reversal in btcusd market

- We sell when bitcoin price breaks-out below neck-line: see below for the explanation.

Double Tops in Bitcoin Trading: What Does This Pattern Mean?

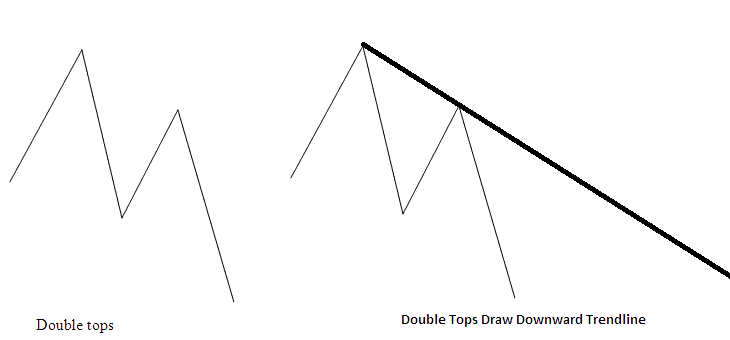

The double tops cryptocurrency chart sample look like an M-form, the satisfactory reversal cryptocurrency signal is where the second pinnacle is decrease and lesser than the first one as depicted beneath, which means the reversal crypto sign may be confirmed through drawing a downwards bitcoin btcusd trend line like is shown below. If a trader opens a sell cryptocurrency sign the forestall loss can be located just above this downward bitcoin trend line.

M Shaped Double Tops Bitcoin Pattern Setup - What are Double Tops CryptoCurrency Patterns when Trading Bitcoin?

Get More Topics and Tutorials:

- Rainbow Charts – BTC/USD Indicator Analysis for Traders

- Calculating Stop Loss Placement for Accurate Trade Management

- Free System for Bitcoin Candle Charts and Trades

- How to trade trend buy and sell signals

- MT4 MACD BTC/USD Indicator for BTC USD Trading

- What is a Demo Account for BTC/USD?

- How Do You Spot a Double Tops Pattern when Trading Bitcoin?

- Bear Power: Technical BTC/USD Indicator

- How Can You Set BTC/USD New Orders on Bitcoin Trading Charts?

- What is a BTC/USD Demo Practice Account?