Use Bollinger Bands to Set Bitcoin Stop Loss Levels

How to Set Bitcoin Stop Loss with Bollinger Bands Indicator in Trading

Set Bitcoin Stop Loss with Bollinger Bands Indicator

Bollinger Bands Crypto Indicator

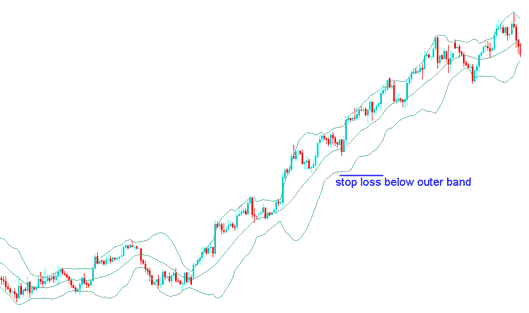

Bollinger Band bitcoin indicator use standard deviation as a measure of bitcoin market price volatility. Since standard deviation technical indicator is a measure of the market volatility, the Bollinger bands are self-adjusting meaning they widen during periods of higher bitcoin price volatility & contract during periods of lower bitcoin price volatility.

Bollinger Bands consist of Three Bollinger bands designed to encompass the majority of a instruments bitcoin price action. The mid band is the basis for the inter-mediate market trend, mostly it's a 20 day period simple moving average, which also serves as the base for calculating the upper band & lower band. The upper band's and the lower band's distance from the middle-band is determined by the price volatility.

Given that Bollinger Bands enclose the price action of bitcoin, they can be effectively utilized to place stop-loss orders for bitcoin just outside the outer perimeter of the Bollinger Bands.

Where Should I place a Stop Loss Bitcoin Order using Bollinger Bands Indicator

Trade Where to Place Stop Loss Bitcoin Order using Bollinger Bands Bitcoin Indicator?

Further Subject Areas & Resources:

- Continuation Patterns: Ascending vs Descending Triangles

- How Do You Find App Trade MT4 App?

- How Do I Use MT4 Mobile App for Android Phone?

- BTC USD Trade Strategy BTCUSD Signals

- How Do I Install MT4 Bitcoin Platform Software in a Computer PC Desktop?

- How to Draw Downwards BTCUSD Trend Lines & Downwards Bitcoin Channels on BTC USD Charts

- How to Interpret and Analyze MT4 Bitcoin Pending Orders in MT4 Platform Software

- Understanding Chart Tools and How to Trade BTC/USD with Them

- How Do I Download Bitcoin Trade MT5 on iPad?

- Step-by-Step Guide to Setting Up MetaTrader 4 Trading Applications