DeMark Analysis for Bitcoin Trading and Signals from the Range Extension Index Indicator

Made by Tom DeMark.

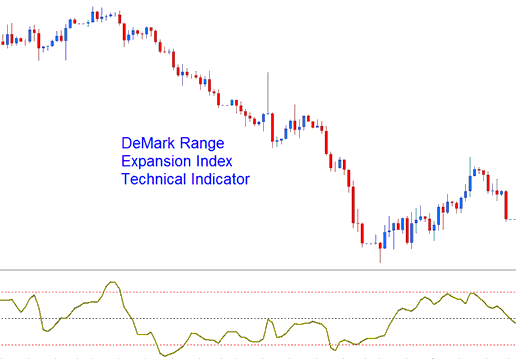

DeMark made use of the Range Expansion Index tool for trading options, as part of how he planned his trades. This btcusd tool acts as an oscillator.

DeMark Range Extension Index

This specific Oscillator is employed for precise market timing, designed to mitigate deficiencies found in exponentially calculated technical indicators, which, because of their arithmetic calculation basis, often trail the actual BTCUSD market action.

BTCUSD Analysis & Generating Signals

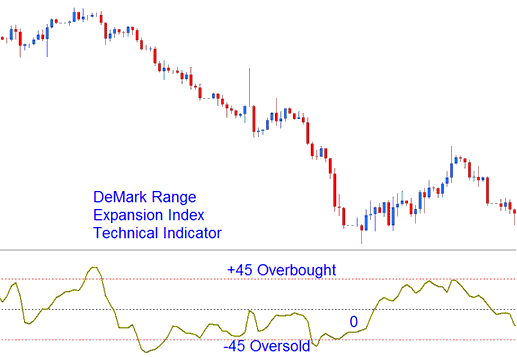

This Oscillator Technical typically oscillates between values of -100 to +100.

Overbought Levels - Readings of +45 or above signify overbought conditions.

Oversold Levels - Readings of -45 or lower indicates over-sold conditions.

Overbought & Over-sold Levels in Indicator

DeMarks warns against trades in heavy overbought zones. For buys, exit six bars after BTCUSD hits +45.

Exit signals come from deep oversold. Six or more bars below -45 mean close short trades.

Discover Extra Subjects & Educations:

- How to Trade with Candle BTCUSD Trade in MT4 Bitcoin Charts

- How to Set a Trailing SL Order on MetaTrader 5 Platform

- What's BTC USD Maximum BTCUSD Leverage?

- How to Interpret and Analyze BTC USD Divergence Trade Setup Using Indicators

- How Do I Interpret BTCUSD Trade System Signals?

- Download Free BTC USD Trade Robot That Works for MT4 Platform

- Installing BTC/USD on MetaTrader 4 Trading Platform