BTCUSD Trend Indicators

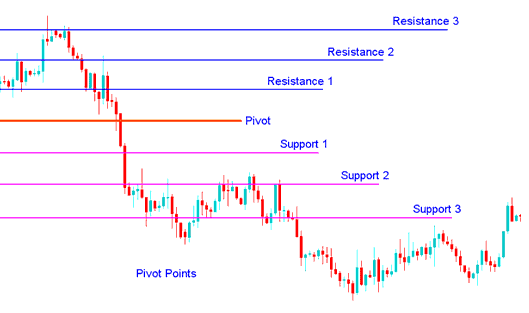

Cryptocurrency traders use Pivot Points to identify support and resistance areas based on the previous day's bitcoin price movements.

This BTCUSD tool projects support and resistance. It uses highs, lows, and closes from past bars.

This btcusd indicator gives you an idea of where important support and resistance areas might be. Put the pivot points on your crypto charts and the bitcoin price will likely move off these specific technical levels. Cryptocurrency traders use these levels to identify market peaks, bottoms, or potential shifts in the Bitcoin trend.

- Daily pivots points are calculated from previous trading day's high, low, close

This btcusd indicator is displayed and shown below

Analysis in BTC USD Trading

The center pivot point itself is the primary level, which is used to figure out the market trend

The additional support and resistance levels are also vital for calculating points that can lead to significant market movements.

This btcusd indicator can be used in 2 ways

The primary method for discerning the broader Bitcoin trend involves checking the pivot point: a break above it signals a bullish btcusd trading environment, whereas a break below indicates bearish sentiment. However, pivot levels are inherently short-term indicators for the bitcoin trend, becoming obsolete after a single day when recalculation is necessary.

The second way is to use these points to start and end trades in the btcusd market. This btcusd indicator is a helpful and useful tool for figuring out the areas that will likely cause the bitcoin price to move.

Use these points and levels with other tools like moving averages, MACD, and stochastic oscillator.

This btcusd indicator can be utilized in numerous ways. Below are a few of the most common methods for employing them.

Bitcoin Trend Direction: When used with other ways to look at trades, like those that show if something is too bought or sold, measures of how much prices change, the main spot can help to see where the price is going in general. Trades are only started going the same way as the Bitcoin trend. A buy signal happens when the bitcoin price is higher than the main point, and a sell signal happens when the bitcoin price is lower than that point.

Bitcoin Price Breakouts: A bullish signal occurs when the btcusd trading market breaks up through the center pivot point or one of the resistances (generally Resistance Area 1). A bearish signal occurs when the btcusd trading market breaks down through the center point or one of the supports (often Support Area 1).

Bitcoin Trend Reversals:

- A buy cryptocurrency signal occurs and happens when the bitcoin price moves towards a support zone, gets very near to this point, touches this point, or moves only slightly/a little through it, and then reverses and moves back in the opposite market direction.

- A sell cryptocurrency signal happens when the bitcoin price moves towards a resistance level, gets very near to this point, touches this point, or only moves slightly/a little through it, and then reverses and moves back in the opposite trend direction.

Stop-loss and take-profit levels based on market structure can help determine optimal trade exit points. For instance, if executing a long trade following a breakout above Resistance Level 1, placing a stop-loss below this resistance level can be a sound strategic decision to mitigate potential losses.

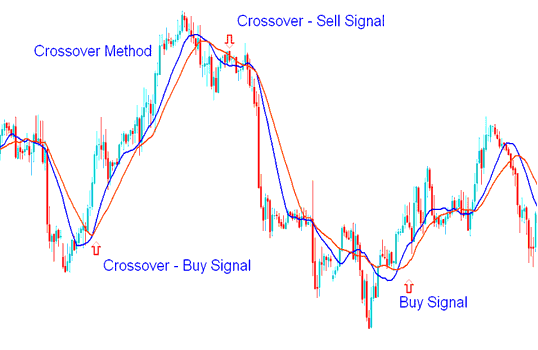

Combining Together with MA(Moving Average) Cross over System

A useful indicator to combine with reversal bitcoin trading signals is the moving average crossover, which can help confirm the direction of a bitcoin reversal signal.

A trader can place an order when these two indicators align and point in the same direction.

MA Cross over Strategy Method

The Moving Average (MA) crossover technique can be combined with this technical indicator to develop a trading strategy for producing buy and sell signals in Bitcoin.

To Download The Pivot Points Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

After you download the file, use MQ4 Language Editor to open it, then press the Compile Button to add it to your MT4.

Note: After you add it to MetaTrader 4, the indicator shows extra lines called MidPoints. To remove them, open the MQL4 Editor with F4 key. Then edit line 16 from:

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Then click Compile again, and it will display as shown on this website.

More Tutorials & Topics:

- Where to Find Methods for Trading BTCUSD Crypto

- Defining and trading Bitcoin trends in BTC/USD pairs.

- Applying Trendline Signals to Trade BTC USD within Bitcoin Trading

- Methods for Executing BTCUSD Trades on the MT5 Application for iPhone

- How to Configure the Trade Demarker Indicator on a Trading Chart

- How do you draw Fibonacci extensions on MetaTrader 5 BTCUSD charts?

- Opening a BTCUSD Demo Account on MetaTrader 4

- How to Add a Trailing Stop Loss Tool to a Chart

- Best Micro Bitcoin Brokers Rankings

- Instructions for Utilizing the Practice Software Demo Account within the MetaTrader 4 Platform