How Do I Analyze Trailing Stop Loss Order?

Bitcoin Trade a Trailing StopLoss

A trailing stop loss is a stop loss levels that keeps adjusting itself automatically by a set number of pips once the btcusd trading market heads in the direction of the trader's open trade by a number of pips.

For instance, the trailing stop can be established at 30 pips and configured to automatically reset to a 30-pip distance once the financial instrument advances by 5 or 10 pips. This implies that this specific trailing stop loss crypto instruction will continuously follow the movement of Bitcoin's price, provided the price keeps moving in the direction anticipated by the online trader for their open transaction.

This stoploss that follows the price will end the order when the btcusd price goes down to where the stop loss was most recently put.

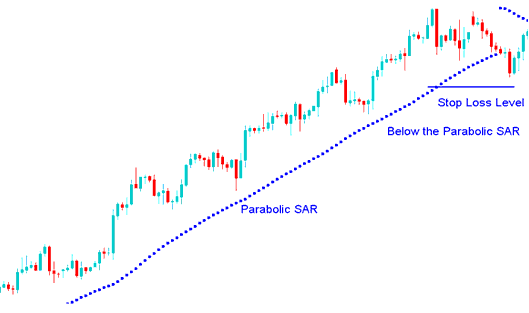

A good indicator used to set trailing stop loss levels is the Parabolic SAR indicator:

Parabolic SAR Indicator

Online traders utilize the Parabolic SAR indicator as a means to establish trailing stop-loss levels for Bitcoin prices.

The Parabolic SAR is effective at indicating appropriate exit points, perpetually tracking the price movement of bitcoin.

In an upwards btcusd trend, you should close long positions when the bitcoin price drops below the parabolic SAR

In a downward bitcoin crypto trend, you should close short positions when the btcusd crypto price rises above the parabolic SAR Indicator.

If you are trading long, the price will be above the Parabolic SAR, which will rise daily, irrespective of the direction in which the Bitcoin cryptocurrency price is moving. The extent to which the Parabolic SAR technical indicator ascends is contingent upon the movement of Bitcoin prices. Once the Bitcoin price falls below the Parabolic SAR, as illustrated in the example below, traders should close open buy trades at the trailing stop level indicated by the Parabolic SAR.

Parabolic SAR - A Technical Indicator Utilized for Establishing Trailing Stop Loss Levels on Bitcoin Orders

Analyze Bitcoin Trailing StopLoss Bitcoin Order

Explore Further Instructions and Manuals:

- How Do You Add MT5 BTCUSD William % R Technical Indicator on MetaTrader 5 Platform Charts?

- BTC USD Calculator Excel Risk Calculator

- Going Long or Going Short in Crypto Trade

- Adding RVI Relative Vigor Index to MT5 BTCUSD Charts

- Changing Chart Options and Settings for BTCUSD on MetaTrader 5

- What's BTC USD Maximum BTCUSD Leverage?

- Best Time of Day to Trade BTC USD Cryptocurrency