Japanese Bitcoin Candlesticks Patterns Analysis

Japanese Candle PatternsBrief History

Candlesticks go way back to the 18th century, invented by the rice trader Homma Munehisa. They give you a quick look at the open, high, low, and close of the BTCUSD crypto market over any time period.

A famous rice trader used these methods to forecast bitcoin prices. He ruled the rice markets, then hit Tokyo exchanges. There, he built a fortune with over 100 wins in a row.

Types of Bitcoin charts

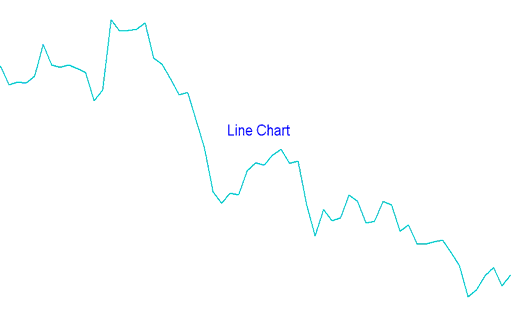

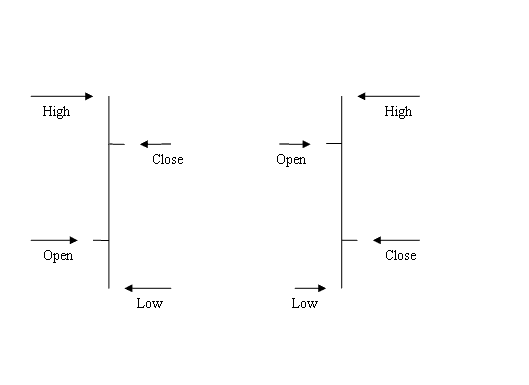

Three types of charts exist used in Bitcoin: Line, bar and candlesticks.

A line is plotted to create a continuous representation connecting closing Bitcoin prices.

Bars- shown as a line of OHCL bars. OHCL means OPEN HIGH LOW and CLOSE. The bitcoin dollar price when trading starts is shown as a line on the left and the bitcoin digital money price when trading stops is shown as a line on the right.

The main drawback of bar charts is their lack of visual clarity, which is why many traders avoid them.

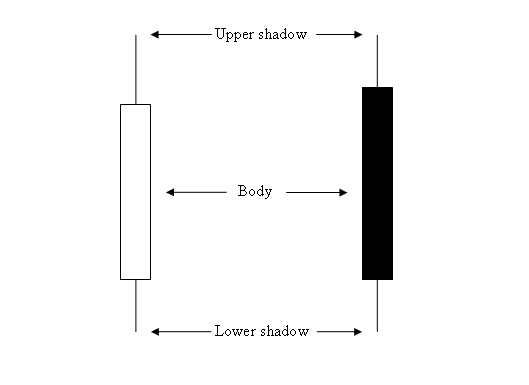

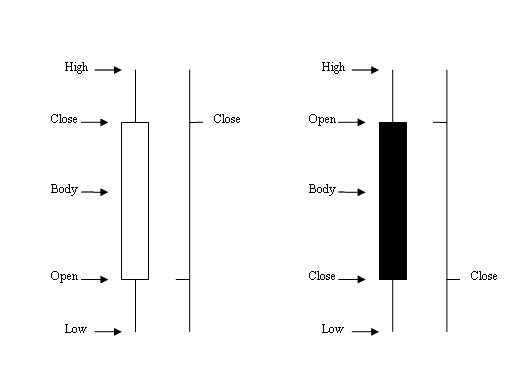

Candlesticks use the same bitcoin price information as bar crypto charts (open, high, low, and close). But, they are shown in a way that's easier to see and more appealing, looking like a candle with wicks on both ends.

How to Interpret and Analyze

Rectangle section is called the body.

The high and low are illustrated as shadows & drawn as poking lines.

The color may be either blue or red

- (Blue or Green Colour) - Crypto Prices moved up

- (Red Color) - Bitcoin Prices went down

Most trading platforms, such as MT4, use color to show direction. The colors are blue/green for when btcusd crypto price goes up, and red for when it goes down.

Candles Vs. Bar BTC USD Crypto Chart

If you use candles, it's simple to tell if the bitcoin price went higher or lower, unlike when bar charts are what you use.

The ways of doing things in Japan also have many different arrangements that are used when trading in the BTCUSD CryptoCurrency market. These arrangements have different ways of figuring out trades, and the ones that happen most often are:

These patterns make Japanese candlesticks a favorite for traders. They help analyze the bitcoin market often. The method for bitcoin matches stock trading analysis.

Drawing These Charts on the MT4

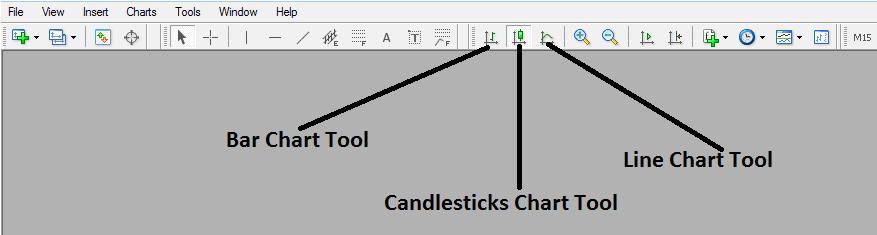

Use MT4 drawing tools from the toolbar to add these lines on charts, as shown.

To view this toolbar on MT4 navigate to the 'View' Next to file on the top-left corner of MetaTrader 4 Software, Click 'View', Then Click 'Tool Bars', Then tick the 'Charts' Button. Above toolbar will appear.

Once the visual toolbar appears, you are free to select your desired chart representation. For a bar chart view, activate the "Bar" tool button. To switch to a continuous line format, click the "Line" tool button. For the Japanese candlestick display, select the "Candlesticks" tool button, as demonstrated above.

Explore additional lessons and subjects:

- How I Analyze Continuation Setups

- How to Analyze 38.2% Fib Pullback Level on BTC USD Charts

- Rainbow Charts BTCUSD Technical Indicator Analysis Trade

- How Do I Analyze Bullish Bull Flag Patterns Analysis?

- BTC USD Hanging Man Candlestick Pattern Lesson

- How to Learn BTCUSD for Free Tutorial Guide Training Website

- How to Read and Study BTC USD Charts

- Where to Learn Techniques/Methods of Trade BTC USD Crypto

- How to Install and Open the MT5 Bitcoin Smart Phone BTC USD Trade App

- BTCUSD Analysis Tools Used in Day Trading Bitcoin Analysis