Trading Spinning Tops and Doji Candles on Crypto Charts

Spinning Tops Candle Patterns

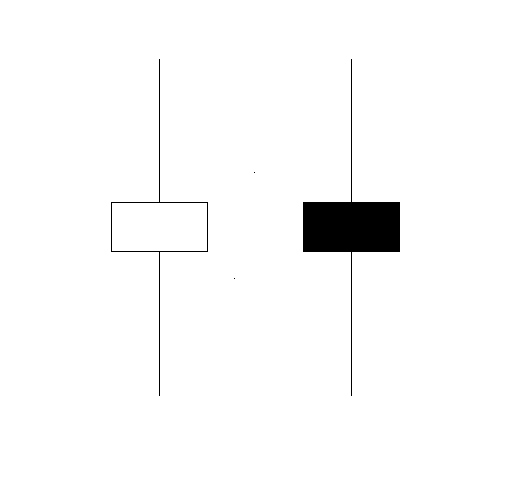

Spinning tops are candlestick patterns with small bodies and long wicks on both ends. They're called spinning tops because, well, they look a lot like those toys spinning on a stick.

The upper and lower lines of the spinning tops are more extended than the main part. The following example demonstrates how the spinning tops pattern looks. You can search for this pattern on the MT4 BTCUSD Platform charts you use. The example shown here is a screenshot to assist BTCUSD traders in learning about and understanding these patterns.

How to read candlestick charts - Spinning Tops

Color of spinning tops candle is not very important, this formation show the indecision between the buyers and sellers in the btcusd trading market. When these btcusd patterns appear at the top of a bitcoin trend or at the bottom of bitcoin trend it might signal that the bitcoin trend is coming to an end & it may soon reverse & start going the other direction. However, it's best to wait for confirmation signals that the direction of a bitcoin trend has reversed before trading the trading signal from this chart setup.

Candle Reversal Setups Formations on btcusd Charts

At the peak of a rising bitcoin trend, a black or red spinning top signal indicates a greater likelihood of a reversal than if the candle is white or blue.

At the end of a Bitcoin downtrend, a white or blue spinning top signals a likely reversal. A black or red one does not.

A reversal signal in cryptocurrency is validated when the subsequent candlestick pattern forms after spinning tops closes beneath the neckline, indicating a downward trend reversal in Bitcoin, while a close above the neckline signifies a reversal in a downward trend.

The neck line is:

- For an Upwards Bitcoin Trend - The open of the previous candlestick that was drawn just before the spinning top.

- For a Downward Bitcoin Trend - The open of the previous candlestick that was drawn and formed just before the spinning top candlestick

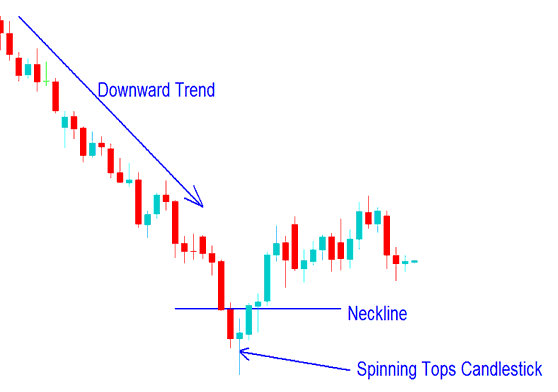

Below is an example of the Japanese charting technique, showing how the pattern forms and its application in trading. In the chart provided, the spinning top candle's reversal signal was validated when the BTCUSD price rose above the neckline, indicating a favorable time to exit a short position in Bitcoin.

Spinning Top Pattern on Chart

The spinning top is blue, so reversal odds rise. Red would make it less likely.

Doji Candles Pattern

This setup has matching open and close prices for Bitcoin. Doji candles come in various forms on charts.

The following example show various patterns of the doji candle:

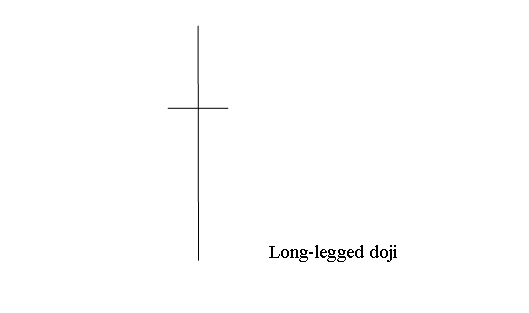

A long-legged doji candle has tall shadows top and bottom. The open and close prices sit in the middle. On a bitcoin chart, it points to doubt among buyers and sellers.

Shown Below is an example screen-shot screenshot image of the Long Legged

- Doji cryptocurrency chart pattern

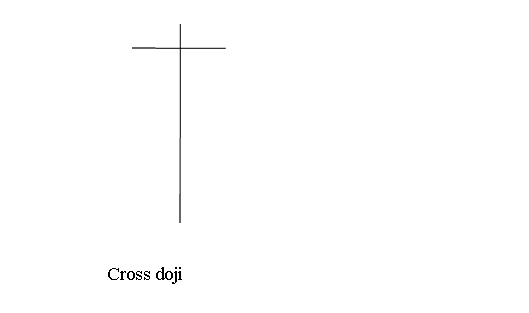

Cross Doji BTCUSD Candlestick

A Cross doji has a long tail pointing down and a short tail pointing up, and the price when the day starts and ends is the same.

This Bitcoin pattern forms at key market shifts. It signals a likely trend reversal in Bitcoin prices. The chart below shows this setup.

- Cross Doji Candle Pattern

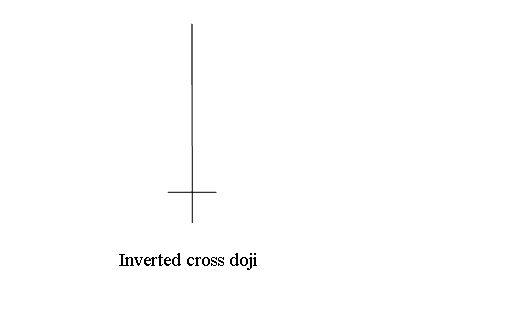

Inverted Cross Doji Bitcoin Candle Pattern

Inverted cross doji shows a long top shadow. It has a short bottom one. Open and close match.

This reversal bitcoin pattern appears at market turning points and warns of a possible bitcoin trend reversal in the Bitcoin. Below is an example illustration

- Inverted Cross doji

In BTCUSD crypto trading, doji candlestick patterns show indecision in the market. At the top, bulls had control; at the bottom, sellers took over. But in the end, neither side really won, and the market closed at the same price where it opened. This doji pattern illustrates that the overall bitcoin price movement for that given particular day(candlestick trading period) was 0 pips or a minimum range of 1 - 3 pips. Reading these charts patterns require very small pip movement between the opening bitcoin price & closing bitcoin price.

Study More Lessons and Tutorials and Courses: