Bullish Candle Setups and Bearish Candlestick Setups

Shooting Star Bearish Candle Setups

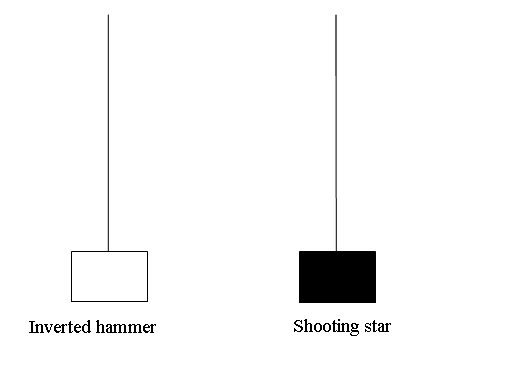

Inverted Hammer Bitcoin Candle Pattern and Shooting Star Bitcoin Candle Setup candlesticks look similar. These candles have a long upper shadow and a short body at the bottom. Their fill colour doesn't matter. What matters is the point at where they appear whether at the top of a market btcusd crypto trend (star) or the bottom of a market btcusd crypto trend (hammer).

The difference is that an inverted hammer is a bitcoin setup suggesting prices will go up, while a shooting star suggests prices will go down.

Upward BTC/USD Crypto Trend Reversal - Shooting Star Candlesticks

Downward BTC/USD CryptoCurrency Trend Reversal - Inverted Hammer Candles

Inverted Hammer Bitcoin Candle Pattern and Shooting Star Bitcoin Candle Setup Bitcoin Setup Setups

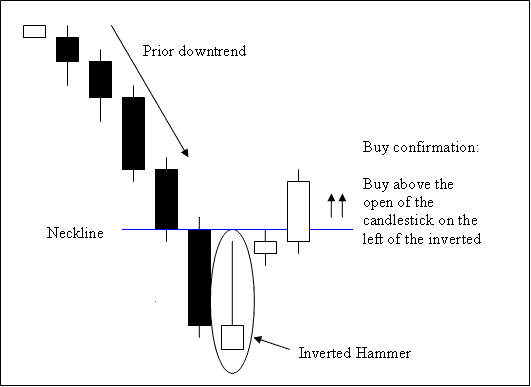

Inverted Hammer Bitcoin Candlestick

This formation signals a bullish reversal in the market trend, materializing at the trough of a Bitcoin price movement.

An inverted hammer appears at the bottom of a falling bitcoin trend and suggests the chance that the Bitcoin trend will change direction.

Inverted Hammer BTCUSD Trading Candle

Analysis of the Inverted Hammer BTCUSD CryptoCurrency Candle

A buy happens when a candle closes above the neckline, and this is the start of the candlestick on the left side of the pattern. In this case, the neckline acts as resistance.

Stop orders to purchase should be set a bit below the lowest bitcoin crypto price from the most recent low point.

The inverted hammer candlestick pattern derives its name from its visual representation, suggesting that the btcusd cryptocurrency market is actively forming a price bottom.

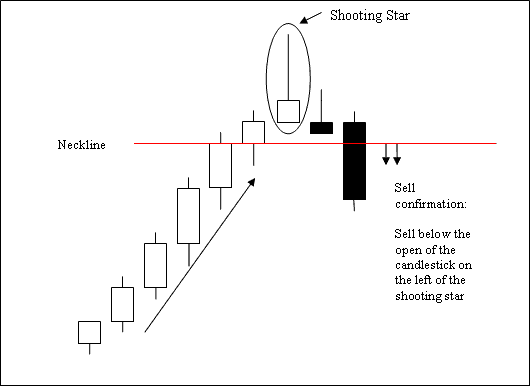

Shooting Star Candlestick

that is a bearish marketplace reversal candlestick pattern. It occurs on the pinnacle of a market fashion.

This pattern forms at the peak of a Bitcoin uptrend where the opening price matches the low. Bitcoin prices rally upward but are pushed back down, closing near the opening price.

Shooting star candlestick

Analysis of Shooting Star Candle-stick

A sell is done when a candle closes below the neckline, which is the opening of the candlestick on the left side of the pattern: in this case, the neckline is a zone of support.

Stop orders for sell trades should be set just a little bit above the highest bitcoin price from the recent high point.

The name "Shooting Star" candle comes from how this cryptocurrency candle pattern looks like a shooting star in the sky when it appears at the peak of an upward bitcoin market.

More Tutorials and Topics:

- Best Analysis BTC/USD Guide Lesson

- How Do I Login to a MT4 Bitcoin Account?

- How to Add Bitcoin Ehler Laguerre RSI on BTC USD Chart

- What Happens to BTC USD Price Action After a Double Bottoms Pattern?

- Establishing a Trading Schedule for Bitcoin Cryptocurrency

- A Tutorial on Reading MT4 Trend-lines and MT4 Channels within MetaTrader 4 Charts

- Types of BTC USD Strategies

- How to Interpret and Analyze Trading Indicators

- Accumulation Distribution Indicator

- Stochastic Oscillator Analysis BTC USD Strategies