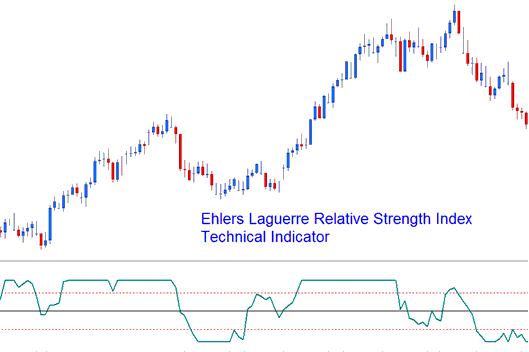

Ehler Laguerre RSI Bitcoin Analysis & Ehlers RSI Signals

Developed and Created by John Ehler.

Originally used to trade shares and commodities.

Ehler RSI technical indicator uses a 4-Element Laguerre filter to provide a "time distort" such the low frequency components/ bitcoin price spikes are delayed much more than the higher frequency components/constituents. This btcusd indicator enables more smoother filters to be created using short amounts of data.

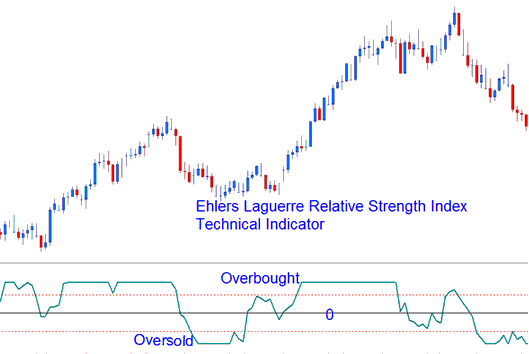

The Ehlers RSI operates on a scale from 0 to 100: the central line is employed to generate trade signals for cryptocurrency, and the boundaries at 80 and 20 signify overbought and oversold conditions, respectively.

The damping gamma factor, typically ranging between 0.5 and 0.85, can be optimized to suit specific trading strategies.

Ehler Laguerre RSI

Bitcoin Analysis and How to Generate Trading Signals

This implementation of the Laguerre RSI uses scale of 0-100.

Bitcoin Crossover Signals

Buy Signal - A buy signal for cryptocurrency is made & produced when the Ehlers RSI goes over the 50 mark level.

Sell Signal: A sell cryptocurrency signal happens when the Ehlers RSI goes under the 50 level line.

Overbought/Oversold Levels on Bitcoin Indicator

Overbought/Over-sold Levels in Indicator

A typical use of the Laguerre RSI is to buy after it crosses back above the 20 % level & sell after it crosses back below the 80 % level.

Study More Topics and Tutorials:

- Utilizing Sell Stop Orders for BTC/USD in MT4 Software

- The Top BTC/USD Brokers Ranked and Reviewed

- A Direct and Practical Tutorial Resource for Bitcoin Training

- Set Stop Loss Right: Analyze and Calculate Placement

- Leveraging Indicator Signals for BTC USD Trading Success

- Exploring the Application of Fibonacci Extension Levels in Bitcoin Chart Analysis

- Strategies for Trading Using Fibonacci Pullbacks