How to Trade Bitcoin with Bullish and Bearish Divergence Analysis

In bitcoin trading, classic divergence is used as a possible signal for a bitcoin trend reversal and is used by bitcoin traders when looking for an area where bitcoin price could reverse & start going in the opposite trend direction. For this reason this setup is used as a low risk entry method & also as an accurate way of exit out of a btcusd trade.

This strategy is a low risk method to open sell near the top or buy near the bottom, this makes the risk in your trades are very small compared to potential reward. However, this is one method with very many whipsaws and most traders do not recommend using it.

Divergences in trading are useful indicators for pinpointing optimal exit levels for profitable trades. If a trade setup involving Bitcoin shows divergence, this could signal an ideal profit-taking level.

There are 2 types, based on the direction of the Bitcoin trend:

- Classic Bullish divergence setup

- Classic Bearish divergence

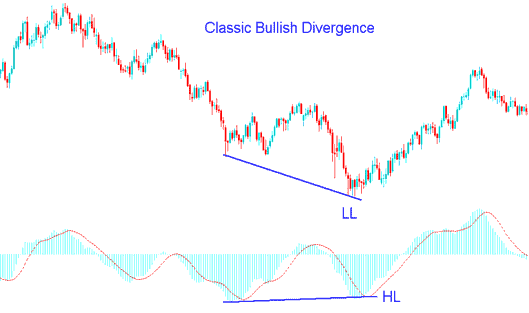

BTCUSD Classic Bullish Divergence Trading Setup

A classic bullish divergence happens when btcusd crypto price makes lower lows (LL), but the oscillator makes higher lows (HL). The picture shown below gives an example of this bitcoin cryptocurrency trade setup.

Crypto Classic Bullish Divergence Trading Setup

This examples uses MACD as a Bitcoin divergence indicator.

From the above exemplification the bitcoin price made a lower low(LL) but the indicator made a higher low(HL), this highlights there a divergence setup between the bitcoin price & technical indicator. The signal warns of a possible bitcoin crypto trend reversal.

Classic bullish diverging signal warns of a possible change in btcusd crypto trend from downward to upward. This is because even though the bitcoin market price went lower the volume of the sellers who pushed the bitcoin price lower was less as highlighted by MACD. This shows under-lying weakness of the down-ward BTC/USD CryptoCurrency trend.

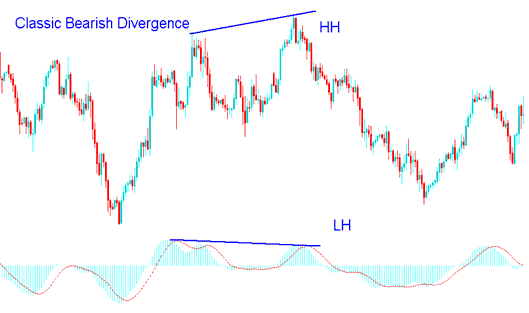

Classic bearish BTC/USD Divergence Trading Setup

The classic bearish divergence pattern manifests when the price of btcusd registers a higher high (HH), yet the accompanying oscillator indication shows a lower high (LH). The example screenshot underneath offers a clear illustration of this pattern.

BTCUSD Trading Classic Bearish Divergence Trade Setup

This examples also uses MACD indicator

From the above example the btcusd crypto price made a higher high(HH) but the indicator made a Lower High(LH), this highlights there is a divergence setup between the btcusd price & technical indicator. The signal warns of a possible bitcoin crypto trend reversal.

A classic bearish divergence signal indicates a potential reversal in the Bitcoin cryptocurrency trend from upward to downward. Despite an increase in the Bitcoin market price, the buying volume that supported this rise was lower, as shown by the MACD analysis. This indicates a fundamental weakness in the upward momentum of Bitcoin.

Examining the preceding examples, if a trader had employed a divergence trading setup for trade execution, they would likely have received favorable signals for entering or exiting transactions at opportune moments. Nevertheless, divergence configurations, much like any other trading indicator, remain susceptible to false signals or 'whipsaws.' Hence, it is invariably best practice to validate divergence signals using complementary indicators such as the RSI, Moving Averages, and the Stochastic Indicator.

A helpful tool for combining standard diverging setups involves the stochastic oscillator and waiting for the stochastic indicator lines to head toward the divergence trade setup, confirming the signal.

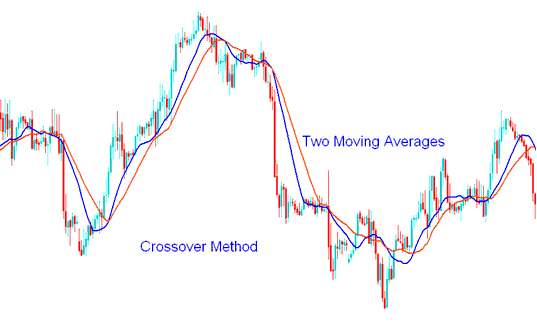

Another good indicator to combine with is the Moving Average indicator, in this trading indicator a bitcoin trader should use the MA Cross-over System

Example of MA Moving Average Crossover Technique Method

After the divergence setup forms, a trader waits for the moving average crossover to signal in the same direction. For a classic bullish setup, wait for an upward crossover. For a bearish classic divergence, wait for a downward crossover from the moving average strategy.

By mixing regular divergence signals with other indicators like this, a trader can avoid getting tricked when trading these signals. This way, the trader can wait for the BTC/USD market to really change direction and move that way, stopping them from trying to guess when the market will reach its highest or lowest point.

Discover More Manuals & Training:

- How to Study Fibo Pullback Levels as a Trading Indicator

- Metaquotes Platform Software/Platform MetaTrader 5 Opening BTC/USD MT5 Open BTC/USD Charts

- How to Calculate BTC USD Trade Pips in BTC/USD Charts

- How to Open BTC USD Demo Account in MT5 Platform

- How to Use BTC USD MetaTrader 4 App for Beginner Traders

- How to Draw Upward Trendlines in MT4 Platform

- BTC USD Trend Indicator MetaTrader 4 Platform Software

- How Do I Analyze a New BTC USD Order on MT4 Android App?

- BTC USD Add a Downloaded MT4 Bitcoin Trade EA in MT4 Platform

- Best Hours to Trade BTC USD