Moving Average Cross-over Strategy Method

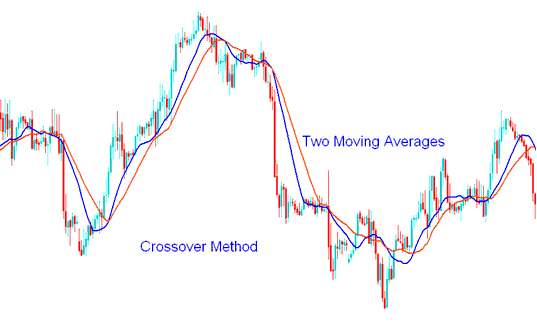

The Moving Average crossover method uses two MAs to trigger trades. The first is a short-period bitcoin Moving Average, and the second is a longer-period one.

MA Cross-over Technique/Method - Moving Average Cross-over Crypto Trading

This specific approach utilizing the crossover of moving averages in bitcoin trading is termed the crossover method because buy or sell prompts materialize when the two average lines intersect one another.

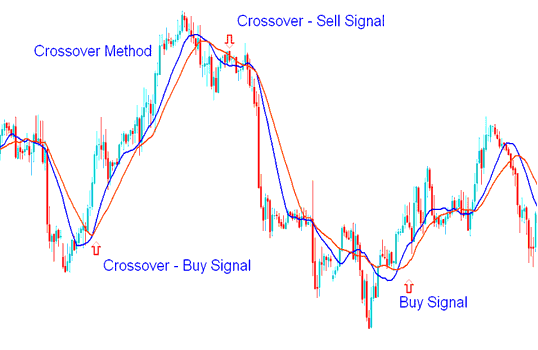

Buy Signal

A buy bitcoin trade is generated when the shorter moving average crosses above the longer moving average.

A Buy signal happens when the Shorter Moving Average goes above the Longer Moving Average - Crypto MA (Moving Average) Crossover Method here

Sell Trading Signal

A sell signal for bitcoin trading forms when the short moving average crosses under the long moving average.

A sell is created when the shorter Moving Average(MA) goes below the longer Moving Average - Crypto MA Moving Average Cross-over Method.

This moving average Bitcoin cross-over strategy is the simplest one. Bitcoin traders use it often.

More Tutorials and Topics:

- Combining Relative Vigor Index with BTC/USD Indicators Effectively

- BTC USD Save a MT4 Bitcoin Trade Profile in MT4 Platform Software

- Fundamental Principles Guiding BTC USD Trading Analysis

- Automated BTCUSD Trade Platforms & Bitcoin EAs Expert Advisors Platform Software Platform Setup

- MACD Bitcoin Trading Indicator Analysis MACD Bitcoin Trading Indicator

- BTC USD Trading Indicators Buy Sell Bitcoin Signals

- How to Add Bitcoin Ehler Laguerre RSI on BTC USD Chart

- How Do I Interpret a BTCUSD Trade Lesson Guide Guide Guide Tutorial?

- BTC USD Candlestick Meanings

- How to Interpret and Analyze BTC USD Trend-Lines in MT4 Bitcoin Charts