RVI Bitcoin Analysis & Relative Vigor Index Signals

Created by John Ehler

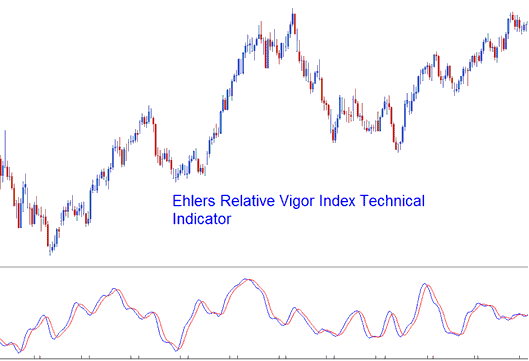

The Relative Vigor Index amalgamates traditional analytical concepts with contemporary digital trade signal processing theories and filters, resulting in a practical and valuable technical indicator.

The basic principle behind it's simple -

- Bitcoin Prices tend to close higher than they open in up-trending markets and

- Bitcoin Prices close lower than they open in down-trending markets.

The vigor or strength of the movement depends on where Bitcoin prices settle at the close of the candlestick. The Relative Vigor Index (RVI) plots two key lines: the RVI Line and the Signal Line.

The Relative Vigor Index (RVI) fundamentally measures the average difference between the closing and opening prices of Bitcoin, with this value subsequently averaged against the mean daily range and depicted graphically.

This characteristic renders the index a highly responsive oscillator, possessing rapid turning points that align synchronously with the cyclical fluctuations of bitcoin prices (btcusd market cycles).

BTCUSD Analysis and Generating Signals

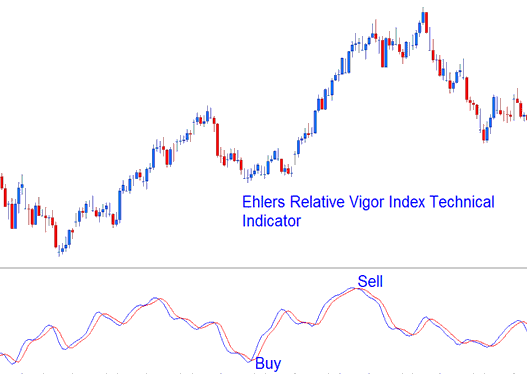

The Relative Vigor Index is an oscillator. The basic idea is to watch for crossovers between the RVI and its signal line. You get your trading signals when those two lines cross.

Buy signals in crypto happen when the RVI line crosses over the signal line.

Bearish Signals - A sell signal for cryptocurrency is generated the moment the RVI crosses beneath its corresponding Signal-line.

Buy & sell signals generated using the cross-over method

More Tutorials:

- How do I understand MT4 Bitcoin trade chart analysis?

- Best BTC/USD Indicator Combos: Using Bull Power in MetaTrader 4

- How to Identify BTCUSD Trends in BTC USD Trade Chart

- How Do I Draw Candlestick Charts on Trading Software?

- BTC USD Moving Averages SMA EMA and LWMA Indicators for Bitcoin Trades

- Reversal Patterns: Head and Shoulders and Inverse Head and Shoulders Setups

- Analyzing 1-Minute Candlestick Times for BTC USD Trading

- How Do I Analyze MT4 Bitcoin Pending Orders in MT4 Platform Software?

- Kurtosis BTC USD MT4 Indicator