Bitcoin Reversal Patterns: Head and Shoulders or Inverse

Head and shoulders Bitcoin Setup

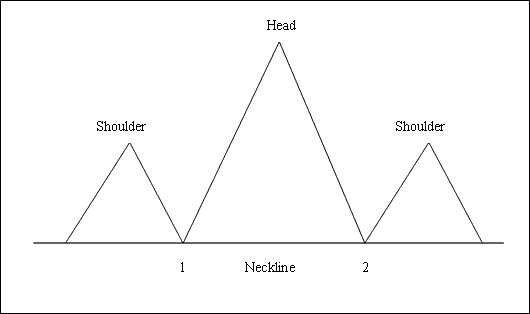

This configuration manifests after a protracted upward trajectory in the BTCUSD cryptocurrency market and signifies a reversal pattern. It is composed of three successive peaks: the left shoulder, the head, and the right shoulder, separated by two relatively slight troughs forming the structure.

This bitcoin setup is done when the bitcoin price goes below the neck-line, which is made by connecting the two low points between the shoulders pattern formation.

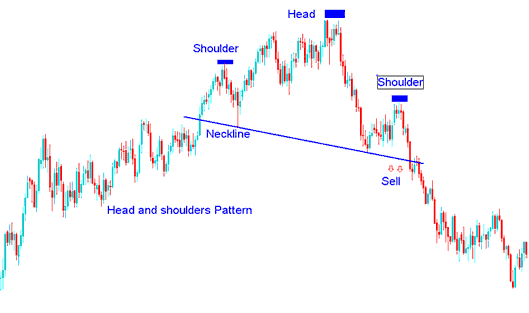

To initiate a short 'sell' position, Bitcoin traders place their sell stop orders strategically beneath the identified neckline.

Summary:

- This Bitcoin pattern forms after an extended move upward

- This formation shows that there will be a reversal in btcusd cryptocurrency trading market

- This setup looks like head with shoulders thus its name.

- To draw the neckline we use chart point 1 & point 2 such as displayed and shown below. We also extend the line in both directions.

- We sell when bitcoin price breaks out below neck-line: see the chart below for explanation.

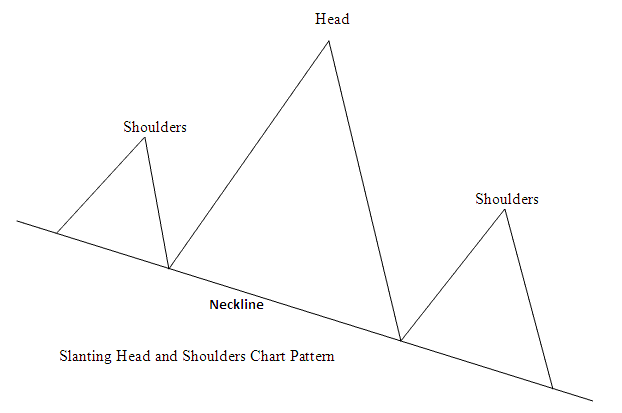

Alternatively, the head and shoulders pattern can also develop with a descending neckline, as exemplified by the cryptocurrency image shown underneath:

Example of Head and Shoulder Pattern Setup on Chart

Head and Shoulders Chart Pattern

This crypto pattern can form on a slanted neckline too. The neckline does not need to be flat.

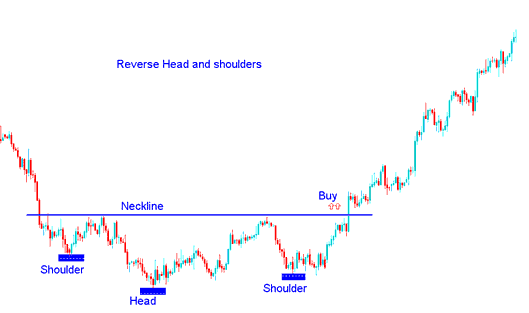

Reverse Head and Shoulders BTCUSD Setup

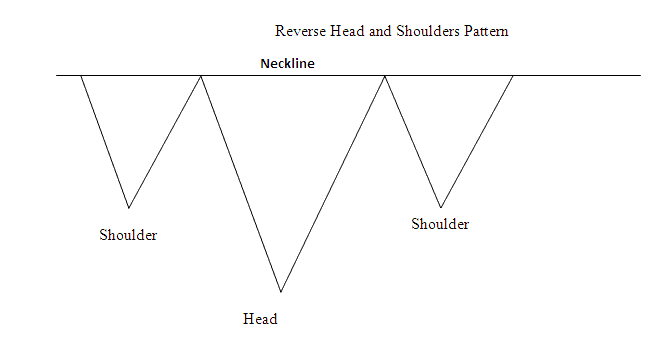

This is a head and shoulders reversal pattern that forms after a long Bitcoin downtrend. It looks like an upside-down head and shoulders.

This Bitcoin setup is finished once price breaks above the neckline, which you draw by connecting the two peaks between the reversed shoulders.

To go long buyers place their buy stop bitcoin orders just above the neck line.

Summary:

- This Bitcoin pattern forms after an extended move downwards

- This setup shows that there will be a reversal in btcusd cryptocurrency trading market

- This formation looks like up-side-down, thus the name Reverse.

- We buy when bitcoin price breaks out above the neck-line: see the chart below for explanation.

Example of Reverse Head Shoulder Pattern on a Bitcoin Chart

Example of Reverse Head Shoulders Pattern

Study More Tutorials & Lessons:

- What Are the Different Ways of Trading BTCUSD?

- Bitcoin Trading Using the MetaTrader 5 BTCUSD iPhone Trading App Guide for New Traders

- Method for Setting a Buy Limit Order Within the MT5 Software

- A Detailed Description of the BTCUSD Trend Following Trade System

- Retail Traders for BTC to USD

- How to Manage Open Orders in Trading Software

- Want to add the DeMarker indicator to your BTC/USD chart in MT5? Here's how to do it.

- How Can You Save a MetaTrader 5 Trade BTCUSD Chart Template on MT5 Software/Platform?

- Guide to Reading and Understanding BTC USD Trendlines as Displayed on MetaTrader 4 Bitcoin Charts

- How do you put in place a sell limit order within MT5 Software?