Placing a Bitcoin Entry Order and Setting a Limit Order in Bitcoin

Limit order meaning - Entry limit is an order to buy or sell a Bitcoin at a certain bitcoin price which is a retracement zone where bitcoin price is predicted to pull back to before resuming the original Bitcoin trend. Bitcoin traders use them to buy or sell at better market bitcoin price. These types of trading orders are available in most online platforms, for our example we will be using the MT4 btcusd crypto software.

This type of entry is often utilized to purchase below the BTC/USD market level during a bullish trend retracement or to sell above the BTC/USD market level during a bearish trend retracement.

A buy limit order triggers when Bitcoin prices drop to your set level. It opens your buy as prices pull back down.

A sell limit order works like this: you set it, and if the bitcoin market climbs to your price, your order gets executed. So, when price retraces up, your sell kicks in.

Entry orders are set by bitcoin traders when they expect bitcoin price to bounce back after reaching this area.

- Entry Buy Limit Bitcoin Crypto Currency Orderbuy at a level below the prevailing market level.

- Entry Sell Limit Bitcoin Ordersell at a price point above the prevailing market level.

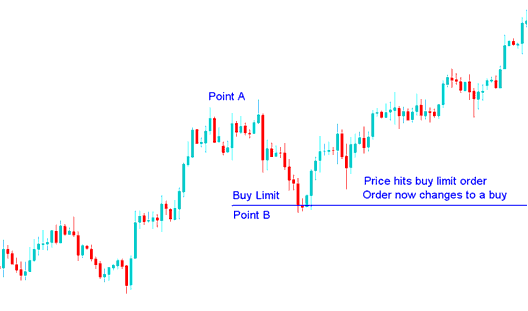

Buy Entry Limit Example

In the example below, a buy limit order for BTC/USD was set below the current market price. Point B marks the exact level for the order.

Limit Buy Order Opens Below Current Bitcoin Market Price

Bitcoin's price pulled back and fell to reach the buy entry limit. Then it resumed climbing toward the main upward trend. The limit buy order turned into a real buy once the price touched it.

Bitcoin Crypto Currency Price touches buy limit, order now changes to a buy

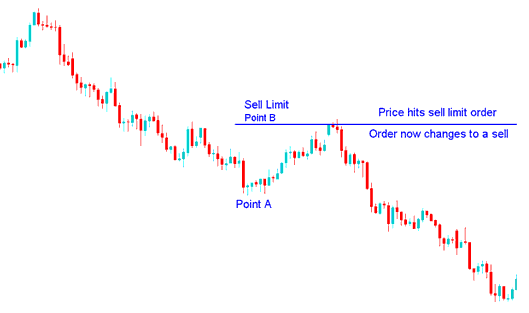

Sell Entry Limit Bitcoin Order

In the example provided below, the sell entry limit was established to initiate a sell when the bitcoin price exceeds the current market price. This represents the level for the bitcoin price retracement.

A sell limit order is established to open a short position at a price exceeding the current market Bitcoin price.

The price of bitcoin then surged, reaching the sell entry limit, and subsequently, the bitcoin price continued to decline in alignment with the ongoing downward trend of the cryptocurrency.

Bitcoin Price hits the sell limit, order now changes to a sell

When the bitcoin price hits your set level, the order turns to sell. This lets you enter at a better price after a pullback.

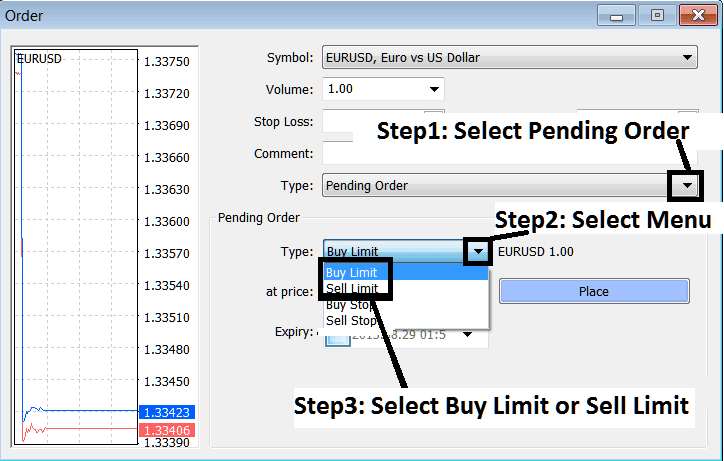

How to Set Buy and Sell Limit Orders for BTCUSD in MT4

To place these orders on the MT4 platform, right-click the Bitcoin chart. Pick "Trading." Then select "New." In the pop-up window that appears (shown below), choose "pending" under the "Type" label, not "market execution." For the pending crypto order type, pick "Buy Limit BTC/USD CryptoCurrency Order" or "Sell Limit BTC/USD Crypto Order." This depends on if you want a buy or sell pending order.

Placing Buy & Sell Limit Crypto Orders on MT4 Software

Placing your entry point can feel tough. Set it too far, and the limit order might miss. The Fibonacci retracement tool helps best. Aim for the 38.2% level. Many Bitcoin traders eye that spot. Orders pile up there. Your best shot at a trade comes from that 38.2% Fib level.

Fibo Retracement Guide and Tutorial

Tip: in Bitcoin online trading, If you as a trader want to set a good takeprofit level (not retracement level, take profit order level) for your trades you can use the Fib expansion 100% level for the best take profit area. To Read more on BTCUSD Fib Retracement and Fib expansion use the right navigating menu section Technical Analysis.

A Tutorial on the Fibonacci Expansion Tool - A Lesson Regarding the Fibonacci Expansion Tool

Find More Learning Content, Guides, and Instructions:

- How Do I Analyze MT4 Fibo Extension in MT4 Platform

- How Do You Add a Stop Loss BTC USD Order on MT5 Platform?

- Set TP BTC/USD Trade Order on MetaTrader 4 Trade Platform

- Accessing and Logging Into Your MT4 Platform Account

- How Do You Trade BTC USD in MT5 Platform?

- Add Demarker Indicator to Bitcoin Charts on MT4

- BTC USD Price Action Day Strategies Using BTC/USD Trade Charts

- BTC USD MT4 Opening a MT4 BTCUSD Trade Chart Guide Lesson

- Which is the Best BTC USD Micro BTC USD Trade Account Broker?

- BTC Pivot Points Trading Indicator