Bitcoin Trend-line Break

Bitcoin price trends in a channel for a while. Then it hits a limit and breaks out. This ends the BTCUSD trend line.

Since the line is point of support/resistance then we expect the btcusd market to go toward the in the opposite market trend direction. When this happens traders will close out the orders that they had bought or sold. This is known as booking profit.

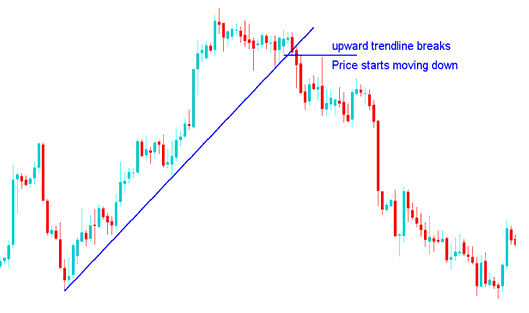

Up Bitcoin trend Reversal

When the upward trend line (support) for Bitcoin is decisively broken, the BTCUSD market is set to transition downward.

This signal is seen as finished when a lower high or lower low is made. It also lets you go short after the price breaks past it.

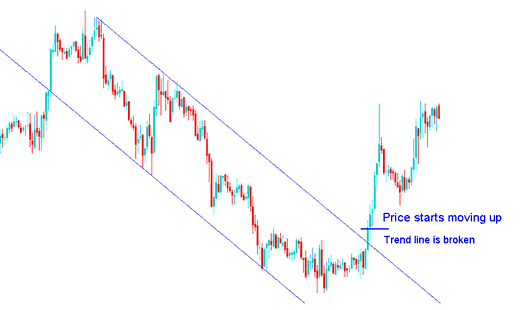

Down Bitcoin trend Reversal

Should the bitcoin price breach a downward trajectory line (acting as resistance), the btcusd market is then positioned for an upward move.

Down-ward Channel break

This specific signal is deemed finalized upon the formation of either a higher low or a higher high. This scenario also presents an opening to enter a long position once the level is breached.

Note that bitcoin breaks can lead to consolidation first. Then it shifts direction. Always take profits on reversals in BTCUSD.

To trade this setup, once a trader opens a new trade in the direction of the bitcoin crypto trend reversal, the bitcoin price should quickly move in that direction, like a bitcoin cryptocurrency price break out. This means the btcusd market should quickly move in that direction without much resistance.

Conversely, if the Bitcoin market fails to move immediately in the direction indicated by the Bitcoin price breakout, it is prudent to exit the trade, as this suggests the existing Bitcoin trend remains intact.

Another recommendation is to wait for the bitcoin trend line to be breached and for the BTC/USD market to close either above or below it, thereby confirming this bitcoin trade signal.

Often, traders make trades hoping for a change even before the bitcoin trend breaks, but the bitcoin price only touches this line, and the current market trend keeps going, and bitcoin continues in the same direction.

When you trade this setup, it's better to wait until the breakout is confirmed - meaning the bitcoin price actually closes above or below the trend line, depending on which way things are moving.

- Upward Market Direction Reversal - this signal is confirmed once the btcusd market closes below this upward line, this should be the right time to open/execute a sell short trade position, so as to avoid a bitcoin trade whipsaw.

- Down-ward Market Direction Reversal - this signal is confirmed once the btcusd market closes above the downward line, this should be the right time to open a buy long trade position, so as to avoid a btcusd crypto currency trade fake out.

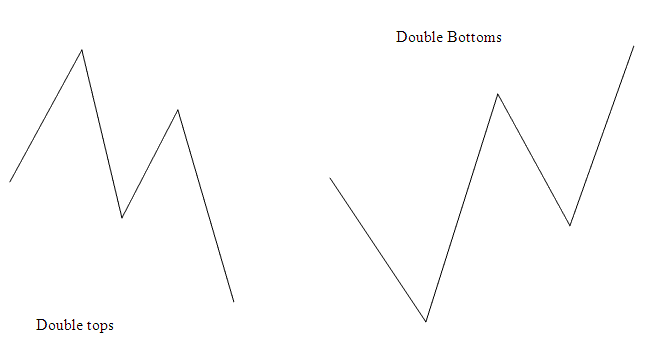

Combining with Double Top or Double Bottoms Bitcoin Patterns

Double tops and double bottoms are great patterns to use in your trading setup. If you want to know more, read the Double Top and Double Bottoms Chart Patterns Tutorial.

You want this setup to be ready before you get a bitcoin trend break signal. Double tops and double bottoms are reversal patterns, so when you combine both, you stand a better chance of dodging a bitcoin whipsaw.

The bitcoin setups illustrated in the above chart screenshots can be verified to have formed prior to the emergence of the reversal bitcoin signal.

First Explanation of Going Up Then Down - the Double tops pattern had already shown up before the setup for the bitcoin trend to change direction appeared on the bitcoin chart.

Second Explanation Examples of Reversal to Go Down - the Double bottoms bitcoin shape was there before the bitcoin trend break reversal setup showed up on the btcusd chart.

Double Top or Double Bottoms Combined with other Reversal Signals

Review Further Subject Areas and Programs: