Trading Chart Reversal Patterns & Chart Continuation Set Up Configurations

Gold Patterns - Gold Analysis Patterns XAU USD StrategiesGold chart patterns represent recognizable sequences of recurring price action formations commonly analyzed within the precious metals market.

Gold Patterns aid trading studies. They help spot repeating shapes in price action.

These chart formations are vital in trading because when the market lacks a clear directional thrust, it is actively forming a pattern. Familiarity with these Chart patterns is essential for forecasting the market's subsequent movement.

When you plot price movements, you'll notice certain chart patterns repeat themselves over and over. Technical traders use these patterns to get a read on where prices might head next.

Traders frequently scrutinize these Chart patterns to gauge the underlying forces of supply and demand that fundamentally drive price volatility.

These Gold Setup Patterns are classified in to 3 different categories:

1. Reversal Patterns

- Double tops Gold Setup Patterns

- Double bottom Gold Patterns

- Head & shoulders Gold Setup Patterns

- Reverse head & shoulders Gold Patterns

2. Continuation Chart Setups Patterns

- Rising triangle Gold Setup Patterns

- Falling triangle Gold Setup Patterns

- Bull flag/pennant Gold Patterns

- Bear flag/pennant Gold Setup Patterns

3. Bilateral

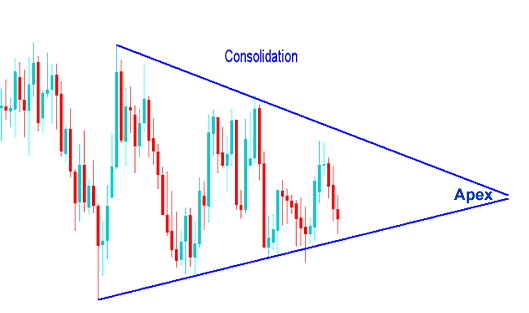

- Symmetric triangle - Consolidation Setups Patterns

- Rectangle - Range XAUUSD Patterns

Reversal patterns, such as Gold Setup Patterns, signal a market trend reversal once this chart setup is validated. These patterns emerge after prolonged upward or downward trends and suggest that the market is poised for a shift.

Gold Continuation Pattern Setups are formations that prime the market for a move continuing in the direction dictated by the prior market trend. These Continuation Patterns materialize when the market enters a period of consolidation before resuming its course along the preceding XAUUSD trend.

Gold Setup Consolidation Patterns - happen when the market stops for a bit to decide which way to go next. When these Consolidation Patterns take shape, the market is trying to decide which way it should trade.

Technical Chart Analysis of Setups

There exist two distinct forms of chart analysis employed in trading: while appearing similar, they are fundamentally different: these two are:

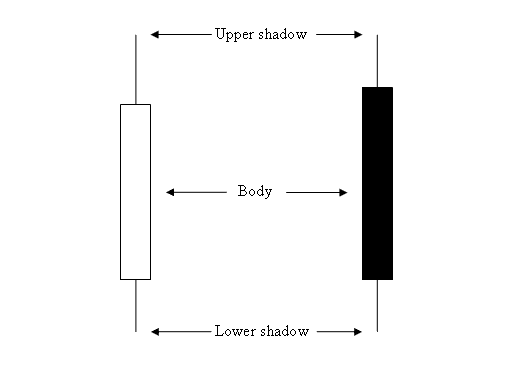

- Japanese Candlesticks - Study of a single candlestick - Understanding Japanese Candlestick Patterns

- Gold Patterns - Study of a series of candles formations

(This educational guide on XAUUSD focuses on the second stated category above: Gold Trading Setups and Patterns)

The different tutorials for these 2 types xauusd analysis are:

Japanese Gold Candles

Gold Setup Patterns Guides Courses

The examples shown here also highlight the differences in how these two ways of studying the market are set up.

Candles - Study of a single candle

Gold Chart Patterns - The systematic study of sequences of trading candlesticks.

More Courses and Guides:

- Bollinger Bands Bulge and Bollinger Bands Squeeze Stock Indices Strategy

- Forex Average True Range

- How to Use MetaTrader 5 T3 Moving Average(MA) Moving Average in MetaTrader 5 Platform

- What Are the Steps to Put NZDUSD Chart to MetaTrader 4?

- List of Best Indicators for XAUUSD

- Creating a CAD/CHF Trading Strategy

- William % R Indicator in MetaTrader 5

- CFDs vs Futures Trading vs FX

- Mastering S&P ASX200 Index Trading Strategies

- EURJPY Open and Close Times