Bollinger Band Indicator and Price Volatility

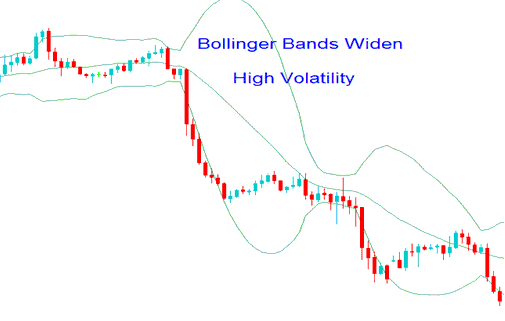

When price volatility is high: prices close far away from the moving average, the Index Bollinger Bands width increases to accommodate more possible price action movement that can fall within 95% of the mean.

Bollinger Bands expand when price swings grow wider. The bands swell around the current price. In stock indexes, wide bands signal a continuation pattern. The market keeps moving in the same direction. This acts as a continuation cue.

The schematic representation of the Bollinger trading indicator, shown beneath, clarifies and highlights the Bollinger band compression.

High Stock Price Volatility - Bollinger Bands Bulge

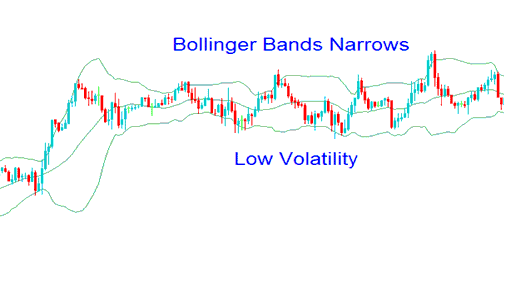

Under conditions of low price volatility, prices cluster nearer to the moving average, and the spread narrows, thereby minimizing the range of potential price fluctuations that might fall within 95% of the average price.

During periods of low volatility, prices typically consolidate before breaking out. When Bollinger Bands move sideways in stock indices, it's recommended to remain cautious and avoid entering trade transactions.

The example of the Bollinger Bands indicator is depicted below when the Index Bollinger Bands contracted.

Low Price Volatility - Bollinger Bands Squeeze

More Topics and Tutorials:

- What's the pip value for US TEC 100?

- How Can I Use MT5 Keltner Bands in MT5 Platform?

- Forex EUR DKK Pip Calculation Tool

- Starting Guide to Forex Pairs and Pair Symbols/Quotes

- EURRUB System EURRUB Strategy

- What's 1:400 XAUUSD Leverage in XAU USD?

- NETH25 Index Guide: Training for Effective NETH25 Index Trading

- Which forex brokers offer Dow Jones 30 trading?