Reversal Setups

These shapes happen after the market has gone up or down for a long time, and the price gets to a strong point where it can't go any further.

Price hits a spot and starts a pattern. These shapes appear often, so spotting them gets easy with practice. Four main types exist.

- Double Top

- Double Bottoms

- Head and shoulders

- Reverse Head and shoulders

This XAUUSD course covers double tops and bottoms only. For head & shoulders patterns and reverse head & shoulders, check out the other guide.

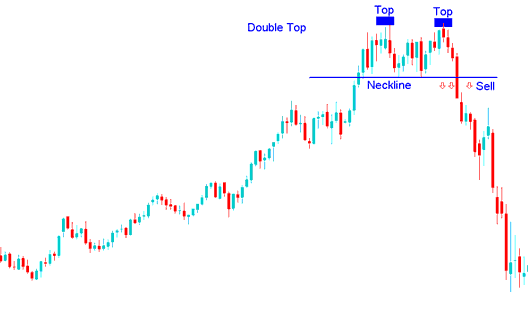

Double Top

This gold reversal setup comes after a long uptrend. It has two peaks about the same height, with a small dip between.

This pattern is seen as complete when the price makes a second high point and then goes past the lowest spot between the high points, called the neckline. The signal to sell comes when the market breaks below the neckline.

In XAU USD, this pattern acts as an early sign that an uptrend might change direction soon. But, it's only official when the support level is broken and prices go below that level. The support level is just another way of saying the lowest price area on the chart.

Summary:

- Forms after an extended move upward

- This formation reflects that there'll be a reversal in market

- We sell when price breaks-out below neck line point: see below for an explanation.

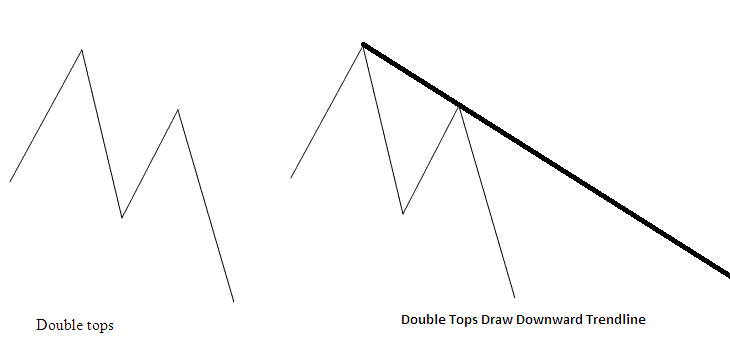

A double top forms an M shape. The strongest reversal happens when the second top sits lower than the first, as shown below. Confirm it with a downward trend line like the one drawn. For gold, place a sell stop loss just above that line.

M Shaped

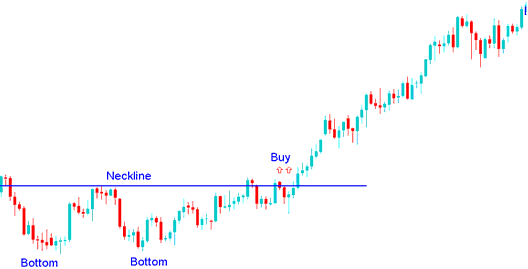

Double Bottoms

This is a gold pattern that changes direction, and it happens after a long drop. It has 2 low points in a row that are close in value, with a small high point between them.

This is done when the price makes a second low point and then goes above the highest point between the lows, which is the neck-line. The signal to buy from this bottoming pattern happens when the market goes past the neckline upwards.

In XAU USD, this pattern serves as an initial signal that the downtrend is likely going to change direction. It's not regarded as fully formed or verified until the neckline is broken. In this pattern, the resistance zone for the price is the neck-line. The market will go upward as soon as this resistance zone is passed and broken.

Summary:

- Forms after an extended move downwards

- This formation reflects that there'll be a reversal in market

- We buy when the price breaks out above the neck-line level as shown in the explanation below.

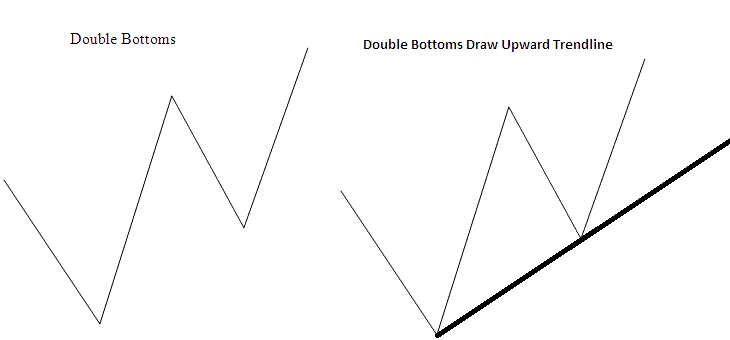

The double bottoms pattern look like a W Shape, the best reversal trading signal is where the second market bottom is higher than the first one such as displayed below, this means that the reversal signal can be confirmed by drawing an upwards trend-line just as is shown below. If a gold trader opens a buy trade signal the stop loss order will be placed just below this upwards trend-line.

W Shaped

Examine More Topics & Lessons: