Techniques of Setting Stop-Loss in Gold

Traders employing a XAUUSD system are required to possess precise mathematical calculations that dictate the exact placement of their trade orders.

Traders set stop losses based on indicators. Some indicators run math to find the best spot for an exit. These tools help place orders for ideal results.

Some traders set orders based on a fixed risk-reward ratio. For example, you might use a 50-pip stop loss if the trade could bring in 100 pips profit. That's a 2:1 risk-reward ratio - risking 50 to gain 100.

Others just use a pre determined % of their total equity balance.

To set a stoploss order order it is best to use one of the following methods:

1. Percent of XAUUSD equity balance

This is determined by the proportion of the trading account balance that the online trader is prepared to risk.

If someone wants to risk 2% of their account balance, they choose how far to set the order based on the size of the trade they have bought or sold.

Example:

If someone has $100,000 in their account and wants to risk 2%, then the amount of money they use for each trade will depend on that 2% stoploss order level.

2. Setting Stop Loss using Support & Resistance Areas

An alternative methodology for establishing protective stop-loss placements involves utilizing established support and resistance boundaries visible on the trading charts.

Because stop losses tend to cluster at certain levels, when the price hits one of those spots, it triggers the others, like a chain reaction. Stop loss orders often build up just above or below where resistance or support is found.

A zone of support or resistance is meant to work like a wall, stopping price from going certain ways. That's why people use these spots to decide where to put their stop-losses. If the wall breaks, the price might start going the opposite way from what you thought with your xauusd gold trade. But, if these zones of support and resistance stay strong, the price will likely keep going the way you expected.

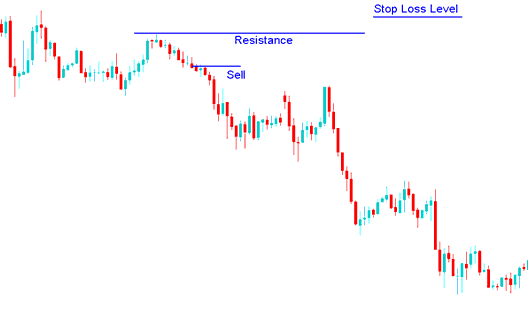

Stop Loss Order level using a resistance zone

Putting order above the resistance

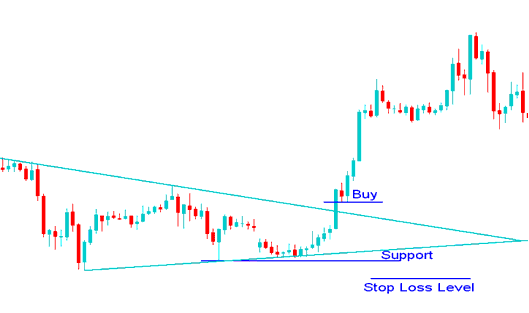

Stop Loss level using a support Level

Putting order below the Support Line

3. Trendlines

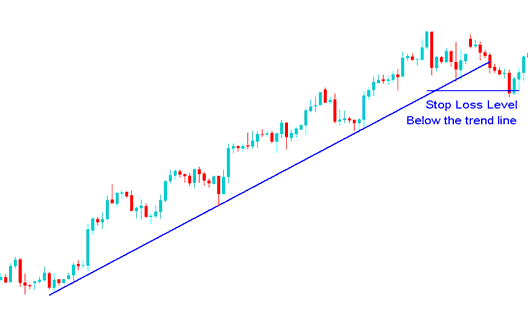

A trend line can aid in determining stop-loss orders by placing the order just below the trend line. As long as the trend line remains intact, online traders can continue to profit and secure their positions, ensuring that profits are locked in once the trend line is breached.

Putting order below the trend line

Examples of where to set this order using trendlines.

More Courses: