Trading strategies for beginner traders step by step

Beginner Tips for Index Trading Strategies Online

Set Simple Rules for Indices Trading - Follow Market Trends

The more straightforward the technique/strategy, the better. It will be quite challenging and difficult to adhere to the rules of the Index Trading Strategy if it is excessively complicated. Additionally, complex trading methods might be perplexing. The trade regulations are easy to understand thanks to a straightforward approach.

2. Eradicate Exposure to Risk Swiftly and Permit Gains to Grow

Minimizing risk is significantly more paramount than maximizing profit. Our primary objective in Stock Indices trading is to systematically reduce trade exposure. We accomplish this by engaging only in high-probability setup entries, implementing stop losses, rapidly exiting losing trades, and strictly avoiding averaging down. Profitable trades are allowed to run long enough to amplify earnings, but not excessively so. Profitable Indices positions are sustained *only* as long as the strategy confirms the trend remains intact: these Index trades must be closed immediately once the strategy generates and provides the designated exit trading signal criteria.

3. Select and Choose the Right Stock Indices

With your stock strategy ready, test it on a demo account. Indices each have unique traits unlike other assets. An index trading plan yields varied outcomes per index.

- EUROSTOXX 50 Index

- DAX30 Stock Index

- Information on the Dow Jones Industry Average 30 Index

- FTSE 100 Stock Index

- Nikkei225 Index

- S&P ASX200 Index

- FTSE MIB 40 Stock Index

- S & P 500 Index

- NASDAQ 100 Index

- CAC 40 Index

- SMI20 Stock Index

- AEX25 Index

- HangSeng50 Index

- IBEX 35 Index

To get the most from your trading, learn when the Indices market is busiest for your Stock Indices and only trade during that time.

4. Use Funds Management Guidelines

Never risk more than 2% per trade. Once you start compounding profits, you'll be amazed at how quickly your account can grow with a solid strategy.

5. Keep a Journal

Maintaining a record of all your trading positions will assist you in becoming a more proficient trader and will enable you to adhere to the trading rules of your Index Trading Strategy. A trading journal will also allow you to track your profitable index trades and losses, facilitating analysis and interpretation of why certain trade setups were successful or unsuccessful.

6. Place take Profit Targets

Set daily, weekly, and monthly profit goals for index trading. Once you reach a goal, stop and step away from the market. This avoids overtrading and losing back your gains. Aim for a 3:1 risk-reward ratio. Only enter trades where you can win three times your risk.

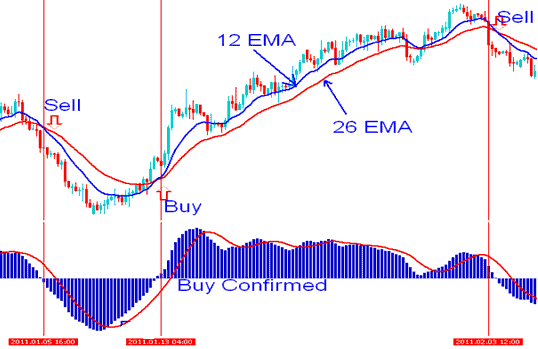

Example illustration of signals generated by our Index Strategy

Example 1: Buy and Sell Signals from Stock Indices Strategy

A buy signal is formulated and produced utilizing a methodology based on technical indicator analysis: subsequently, an appropriate exit signal is formulated and generated just before a confirming reverse sell signal appears on that specific trade chart.

Example 2: Buy Signals from Stock Index Strategy

Two buy Index signals are generated during the upwards trending market

Case Study 3: Identifying an Exit Trigger via a Stock Indices Trading System

Example of Signals Derived and Generated by a Trading Strategy

Examine More Explanations & Subjects: