Meta Trader 4 Template System

A System is a group of trading rules you follow to handle all your trades. These written rules say when you should start a trade and when you should end it. A trading strategy is made by putting together two or more technical indicators.

For instance, the Stochastic indicator can be used alongside other indicators to form a system. In this case, the stochastic oscillator can be integrated with the indicators listed below to develop a cohesive system.

- RSI indicator

- MACD indicator

- MAs technical indicators

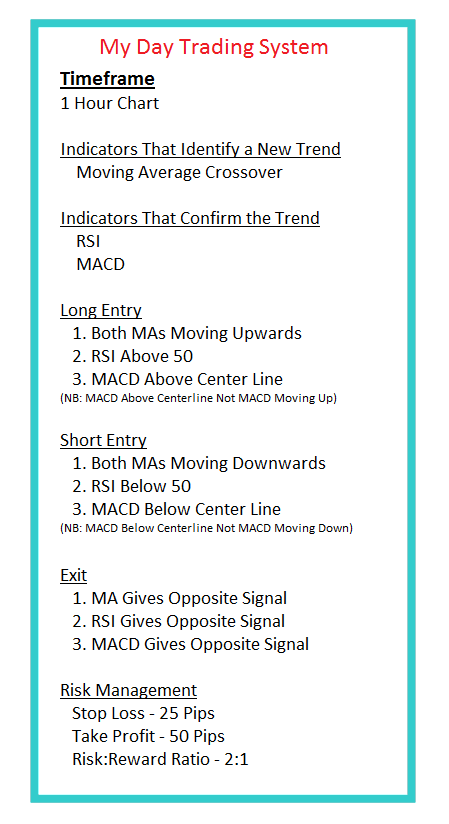

Example - MT4 Template System Example

Making a System - Strategy Example

The question arises: how can effective trading systems similar to the example provided be developed, and how are its XAUUSD rules formulated? To create such rules, follow the outlined steps below.

Seven steps to creating a trading indicator based system

To create these set of trade rules we will use the following seven guidelines.

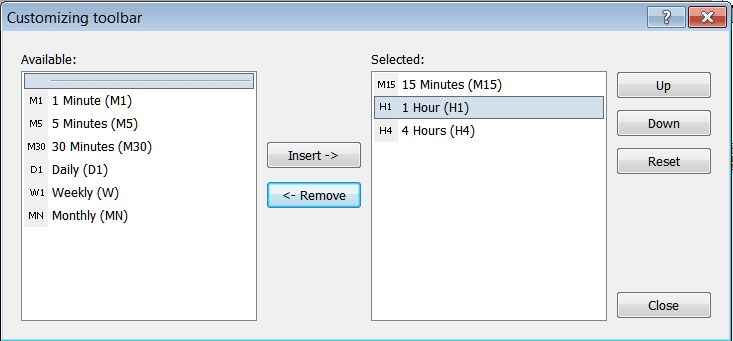

1. Choose and Select your Time-Frame

The first step depends on the number of hours you want to set a side to xauusd. Whether you prefer sitting in front of the computer constantly for several hours analyzing short chart timeframes OR you prefer setting up your charts using bigger and larger chart timeframes once or twice a day. Choosing/Selecting a timeframe will mainly depend on what type of trader you're.

Time Frames on MT4 Platform

While testing your new system you may want to find out about its performance on different time frames and then select the most accurate and profitable timeframe for you.

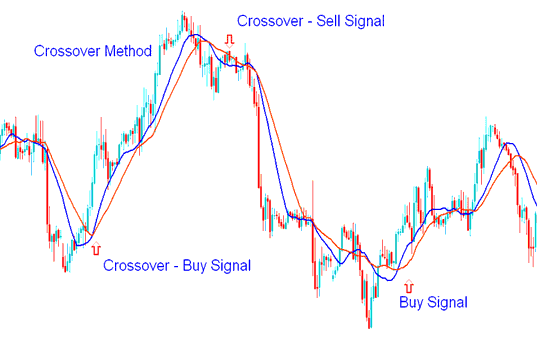

2. Choose & Select indicators to spot & identify a new trend

A trader's objective is to enter positions at the earliest opportunity to capture the maximum potential benefit from gold price movements.

Using MAs Indicator is one of the most popular methods for identifying a new trend as quickly as possible. The easiest approach is to employ a moving average crossover trading strategy that will pinpoint a fresh trading opportunity at the earliest possible point.

Moving Average Cross-over Strategy

Generation of Sell and Buy Signals via the Moving Average Crossover Method for XAU/USD Pairs

3. Choose and Select additional indicators to confirm the trend

Once we find a new market trend we need to use additional indicators that will confirm the entry signals and give either a green light for action or save a trader from fake outs/whipsaws.

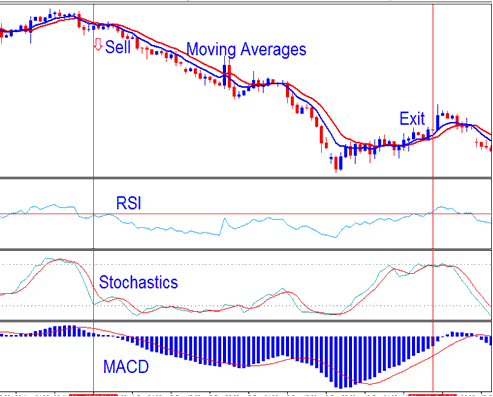

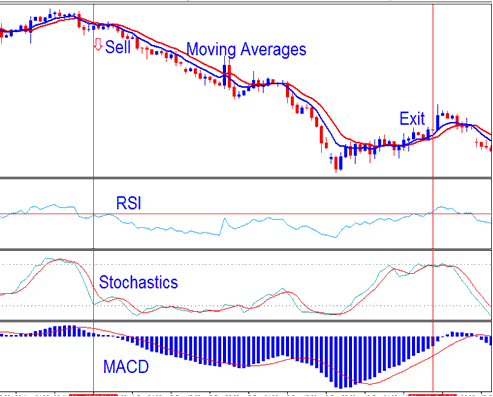

To confirm the trade signals we use RSI indicator & Stochastic Oscillator.

RSI and Stochastic Indicator System

4. Finding entry and exit points

After picking signs that work together, where one sign gives the starting signal and the other confirms it, then it's time to trade gold.

One should initiate a trade promptly once a trading signal has materialized and been conclusively verified following a completed candlestick closure.

Aggressive traders enter trades right away without waiting for the current gold price bar to close.

Alternatively, some traders elect to wait until the current gold price bar has concluded its formation before entering the trade, provided the initial setup criteria remain unchanged and the trade signal retains its validity. This approach is more prudent and serves to mitigate false entries and premature whipsaws.

Generating Signals - how to Generate Signals.

Generating Signals

Traders can aim for a fixed profit target per trade. Or use tools like Fibonacci expansion for take-profit levels. Add a stop loss based on current market swings. Another option is to exit on a signal that points to the opposite trend.

When opening a new trade transaction it's always important to calculate in advance how much you're willing to lose if the trade goes against you. Although the objective is to come up with the best strategy in the world, losses are inevitable & hence being ready to tell where you'll give up & cut your losses before beginning a trade is very important.

5. Calculate risks in each trading setup

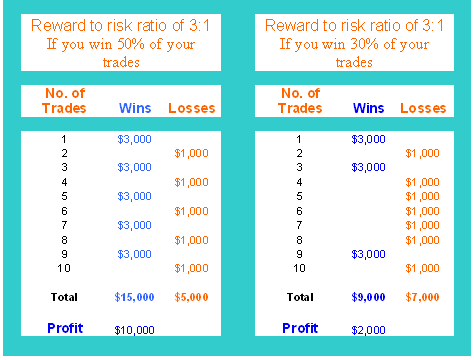

In XAU/USD, you as a trader must calculate your risk for each transaction. Serious traders will only enter and look to open/execute an order if the risk : reward ratio is 2:1 or more.

When you use a high risk-to-reward ratio, like 2:1, you really boost your chances of making a profit over time.

The Risk : Reward Chart below indicates to you how:

Gold Money Management Risk:Reward Chart - Sample Template Trading Strategy

In the first examples of Risk to Reward Ratio, you can see that even if your xauusd system only won 50% of your positions, you'd still make profit of $10,000. Read more on this money management xauusd topic: Here Gold Money Management Rules - MetaTrader 4 Template System and Gold Capital Management Methods and Strategies - Template System Example.

Before opening a new trade, a gold trader should define the point at which they will close the trade if it turns out to be a losing trade. Some traders use Fibonacci retracement levels tool and support and resistance areas. Other traders just use a pre-determined stop loss order to set stop losses once they have opened a trade.

6. Write down the systems xauusd rules and follow them

A strategy constitutes a comprehensive set of trading guidelines designed to manage positions.

It all comes down to this: you need a set of trading rules. If you aren't following any rules, you don't really have a strategy.

The subsequent lesson in this system sequence will present an example illustrating how to apply the preceding steps to construct your proprietary XAUUSD online system:

Next lesson: Sample rules for trading systems.

7. Practice on a Practice Account

You need enough trades to see your strategy's real profits.

Once you as a trader have your xauusd system rules written, it is time to test and improve your trade system by using it on a practice account.

Open a free practice trading account to test your trading strategy and see how effectively it will perform.

Before beginning to trade, it is highly advised to create a practice account and spend at least one or two months learning and gaining practical experience.

After you start making consistent profits on your demo account, you can try opening a real account and begin trading with actual money.

Study More Lessons and Topics:

- XAUUSD Psychology and Risk Management

- Placing the Force Index XAU/USD Indicator on MT4 Charts: Implementation Overview

- Learn XAUUSD Key Concepts in Gold Online

- Technique of Calculating Where to Set & Place Stop Loss XAUUSD Orders Using Trend lines

- Choppiness Index Indicator

- MetaTrader Platform for Nasdaq Index Nas100 MT5 Forex

- How to Add Rate of Change Indicator on MT4 Charts

- A Guide to Downloading Gold MT4 Platform