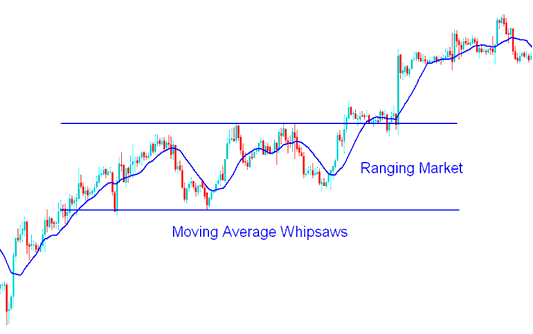

Moving average whipsaws and fake outs - what happens in sideways markets.

Range Markets Systems

The moving average is a helpful tool for trading when the price is generally going up or down. But, the moving average can give false signals when the price is bouncing around in a limited range.

The Moving Average indicator frequently generates false signals (fake outs) when the market is characterized by sideways consolidation because price action becomes erratic, oscillating closely around the average value. This causes the MA technical indicator to issue signals suggesting an uptrend, only to quickly switch and provide sell signals shortly thereafter, resulting in numerous 'whipsaw' signals.

For this reason, the MA indicator is not suitable for trading XAUUSD in a market that is moving sideways.

Trading in a Ranging Market and Whipsaws with Gold Moving Averages - How to Trade XAUUSD in a Range-Bound Market.

This is why it's best to combine this moving average indicator with other indicators when generating signals to trade with.

Learn More Courses and Lessons:

- How to Add Forex Currency Pairs to MT4

- What Time Does Gold Market Open & What Time Does Gold Market Close Sessions?

- What are XAUUSD Keys Concepts?

- Here's how to register for a live forex account.

- Awesome Oscillator: Buy and Sell Forex Signals Explained

- How to Miss Indices Quick Turns when Using MACD Indices Tool

- A Good Way to Learn XAUUSD

- GBPNOK Currency Pair

- Steps to Display the Choppiness Index Indicator within a Trading Chart using the Trading Software

- How Do You Trade Charts Technical Analysis using Trading Systems?