Set ROC Tool on MT4 Charts - Add Rate of Change Indicator

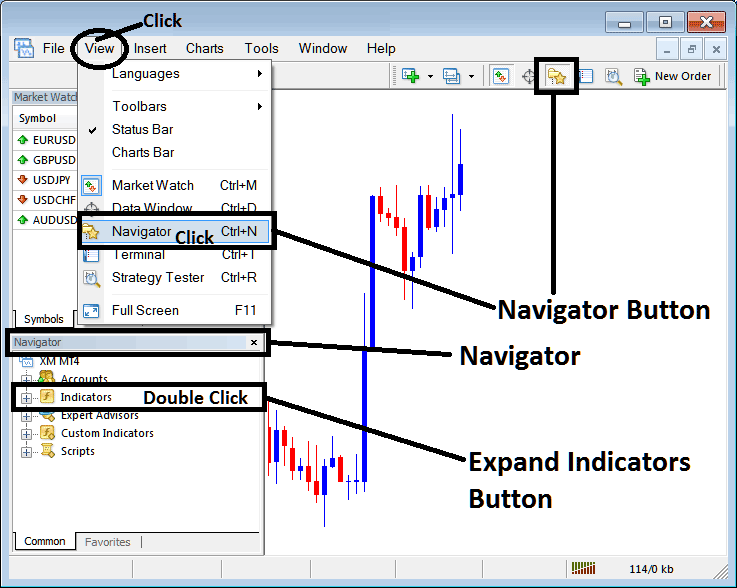

Step 1: Open Navigator Window on Software Platform

Open the Navigator window, as demonstrated below: You can achieve this by navigating to the 'View' menu (click it), subsequently selecting the 'Navigator' window (click), or by clicking the 'Navigator' button on the Standard Toolbar, or by utilizing the keyboard shortcut 'Ctrl+N'.

On Navigator window, choose & select 'Technical Indicators', (Double Click)

Instructions for Incorporating the Rate of Change (ROC) Indicator Within the MT4 Software Environment

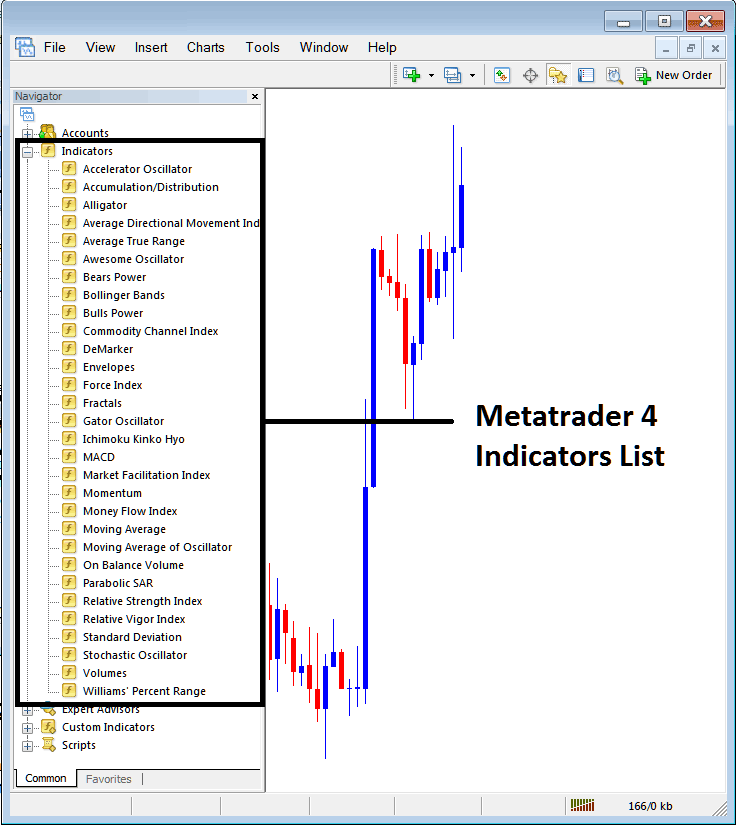

Step 2: Open Indicators in Navigator - Add Rate of Change ROC to MT4

Expand the menu by clicking the expand tool stamp " + " or double-click the 'indicators' menu, after that the button will appear and be shown as (-) & will now display a list just as shown - select the Rate of Change, ROC forex technical indicator from this list of trading technical indicators so as to add the Rate of Change, ROC to the chart.

How Do I Add Rate of Change, ROC - You can then add Rate of Change, ROC, that you, as someone who trades, wants on the chart, from the window above.

How to Set Custom Rate of Change, ROC to MT4

If the indicator you wish to integrate is a custom technical indicator, such as the Rate of Change (ROC), you must first introduce this custom ROC indicator into the MT4 software. Following this, compile the custom Rate of Change, ROC, so that the newly incorporated custom ROC indicator becomes visible within the list of custom indicators available on the MetaTrader 4 Software Platform.

To learn how to install Rate of Change, ROC indicators in the MT4 Platform, how to add Rate of Change, ROC window to MT4 and how to add Rate of Change, ROC custom indicator in MetaTrader 4 Platform - How to add a custom Rate of Change, ROC on MT4.

About Rate of Change, ROC Example Explained

Rate of Change Analysis & Rate of Change Signals

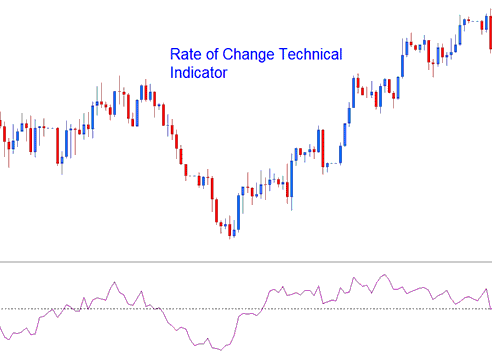

Rate of Change, ROC technical indicator is used to calculate how much price has changed within a specified number of trading price periods. It calculates the difference between the present candle & the price of a specified number of previous candles.

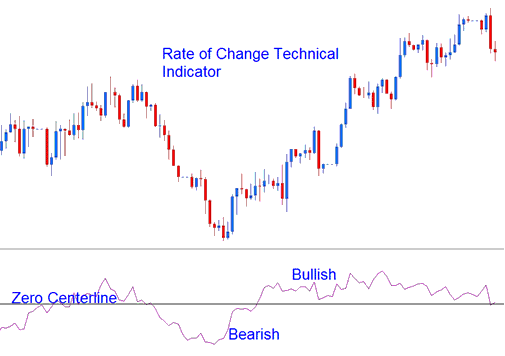

The quantifiable difference can be determined either in Points or Percentages. The Rate of Change indicator oscillates around a central zero line. Readings situated above this zero line indicate bullish sentiment, whereas readings below the zero center line signify bearish conditions.

The greater the changes are in the prices the greater the changes in the ROC Rate of Change.

FX Analysis and Generating Signals

The Rate of Change indicator generates signals using various methods, with some of the most common highlighted here.

Forex Crossover Signals

Bullish Signal - A buy trade signal occurs when the Rate of Change (ROC) crosses above the zero centerline.

Bearish Signal: A sell signal is generated when the Rate of Change crosses below the zero centerline.

Over-bought/Oversold Levels:

Overbought conditions occur when readings are exceptionally high. Values exceeding the overbought threshold suggest that a currency pair may soon face a price correction.

Oversold - A lower reading signifies a greater degree of oversold condition for a given currency pair. Readings falling below the established oversold threshold suggest the currency is oversold, anticipating a subsequent price increase.

Yet, in strong trends, prices stay in overbought or oversold zones for a long time. Instead of reversing, the trend keeps going. Use crossover signals for buy and sell trades.

FX Trend Line Breaks

Trend Lines can be drawn on ROC technical indicator just like trend-lines can be drawn on regular price charts. Since The Rate of Change shows what might happen, the trendlines on it will break before those on the price charts. A trendline break on the ROC means the price might go up or down.

- Bearish reversal- Rate of Change values/readings breaking above a downward trend line warns of a likely bullish reversal.

- Bearish reversal- ROC readings breaking below an upwards trendline warns of a likely bearish reversal.

Divergence Trading

The Rate of Change indicator helps identify divergences and potential trend reversal signals. It spans four types of divergences: classic bullish, classic bearish, hidden bullish, and hidden bearish.

Get More Topics and Tutorials:

- Instructional Tutorial Covering Trading Strategies for the Nikkei Index

- Divergence Gold Trading Setups: How to Trade Divergence Gold Trading Setups

- Best Trading Hours for EURDKK Based on GMT

- A Tool for Calculating Lot Sizes Specifically for Index Trades

- When Are the Optimal Times for Trading?

- Understanding the DJI 30 Index on MT4 Charts

- CHF/SGD Forex Pair

- DAX Stock Index Trading Strategy Training Course Download

- USD vs DKK Exchange Chart

- Bollinger Band Bulge and Bollinger Band Squeeze Stock Indices Strategy