Stochastic Trading Strategies

- Overview of Three Varieties of Stochastic Oscillator Trading Tools

- Understanding the Stochastic Indicator

- Identifying Oscillator Over-bought and Over-sold Thresholds

- How to Analyze the Stochastic Indicator

- Understanding Stochastic Cross Over Signals

- Stochastic Divergence Setups for Trading Signals

- Stochastics XAUUSD System

Stochastic XAU USD Strategy

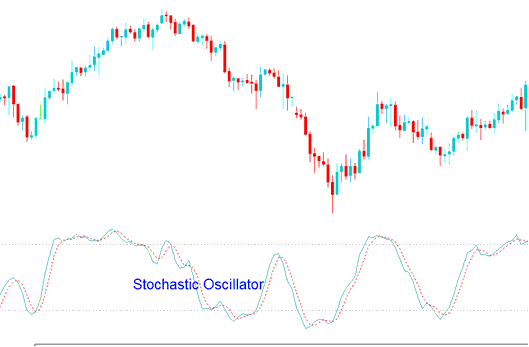

The Stochastic Oscillator functions as an oscillating technical tool designed to quantify the underlying force driving XAUUSD movement.

The Stochastic Oscillator uses a key idea. In up trends, prices close near the high of the candle. In down trends, they close near the low.

The Stochastic Oscillator reveals the strength of current trends and indicates regions of oversold and overbought levels.

Stochastic Oscillator technical indicator is one of the most often used indicator, a lot of traders act on stochastic signals hence the signals of this indicator become self predicting.

The Stochastic Oscillator is employed to recognize specific chart patterns, including divergences.

The Stochastic Oscillator technical indicator can predict market prices early, so it is a leading indicator of where the market is headed.

The Stochastic Oscillator produces more trading signals compared to other momentum indicators. To enhance accuracy, it should be used in combination with additional technical indicators.

The Stochastic Oscillator technical indicator has two lines, one called the fast line and the other called the slow line. These two lines move like the direction of the market trend.

Stochastic Indicator - Stochastics Oscillator Strategy

Study More Topics and Guides:

- MQ5 Robots & Expert Advisors

- MT5 linear regression slope analysis with real examples

- How to Trade with Trade FX Indicators

- Tips for FX Strategies

- How to Utilize the McGinley Dynamic on the MT5 Platform

- Learn XAU USD Guides

- Forex Ehlers Laguerre RSI EA Setup

- Learning Techniques for Forex Trading

- Utilizing Momentum in FX Trading

- MT4 System Setup System Learning Program