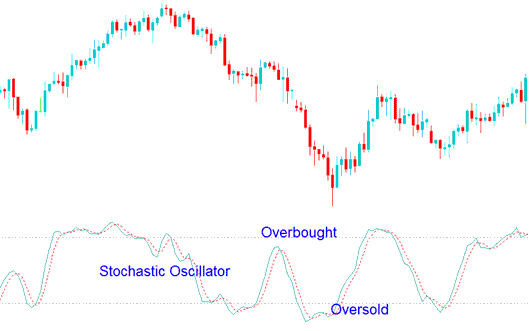

How Stochastics Oscillator Works

The Stochastic oscillator indicator employs time periods to compute the fast and slow lines. The number of time periods utilized to determine the %K and %D lines is contingent upon the specific purpose for which a gold trader is employing the Stochastic oscillator indicator.

- A trader using the Stochastic oscillator indicator in combination with a trend indicator to see overbought & oversold levels, trader can use periods 10 periods.

- The default period used by the stochastic technical indicator is 12.

Traders should not rely only on the stochastic indicator for xauusd decisions. They should combine it with other technical indicators.

In ranging markets this Stochastic oscillator indicator can be used to display oversold/overbought levels as potential profit booking points when trading the markets.

Oversold and overbought levels are typically set at 20 and 80 by default, although some traders prefer 30 and 70.

It is customary to use the 80% mark on the stochastic oscillator as the threshold for identifying the "overbought" zone.

To look for "oversold" region 20% stochastic oscillator mark is use.

Dotted lines show overbought and oversold spots on the stochastic tool. You can set them at 30 and 70.

Over-bought and Over-sold Levels in Stochastic Oscillator

Study More Guides and Courses:

- Developing an Index Trading Plan

- How to Add Demark Projected Range FX Indicator in Chart

- Analyzing indices with the DeMark's Range Expansion indicator on MetaTrader 5

- How Do I Place DJI 30 Index in MetaTrader 5 Platform?

- How to locate the MT4 FTSE MIB 40 charts?

- Where Can You Locate a Learn Online Gold Tutorial Website?