Stochastics Oscillator XAUUSD Divergence - Bullish and Bearish Gold

Divergence in XAUUSD is one of the trading signals that can be produced when employing the stochastic oscillator.

Divergence xauusd is a sign that a rise or fall is weakening and will likely change direction. This means the last buyers or sellers are pushing the price one way while most other traders have stopped trading that way and are wary of a price change or pullback.

There are 4 types of divergence trade setups

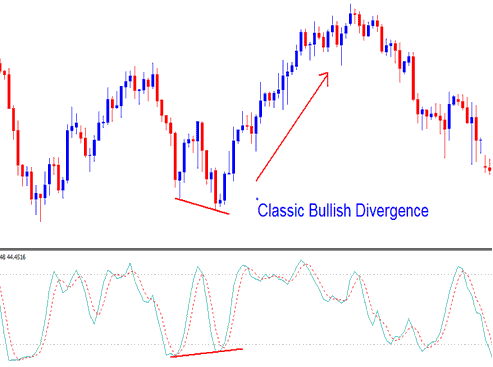

Example 1: Classic Bullish Divergence Trading Setup

A bullish divergence pattern observed between XAUUSD price action and the Stochastic Oscillator indicator suggests a subsequent increase in the price.

Stochastics Oscillator Classic Bullish Divergence

New price lows with stochastic not matching signal a trend shift. An up rally in XAUUSD may follow.

In the above example price set a new low but it was not accompanied with a new low in the measure of the Stochastic oscillator indicator, when the price shaped a new low then the stochastic technical indicator should have followed suit, but the stochastic indicator didn't thenceforth the classic divergence trade setup.

Gold classic divergence trading set-up is even more reliable because it combines a divergence trade setup and a rise past the 20% trading indicator level. This combines the levels for when something is overbought or oversold with this divergence trade setup.

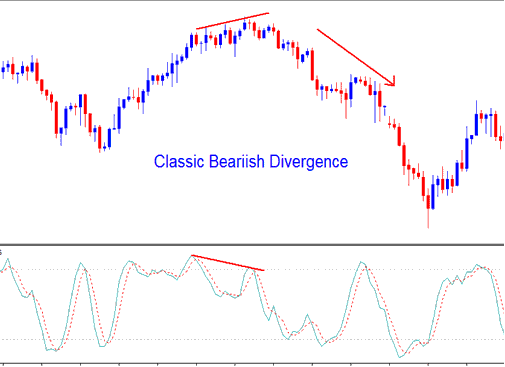

Example 2: Classic Bearish Divergence Trade Setup

A standard Bearish Divergence trading setup happens when the stochastic oscillator and the price are followed by a drop in the price.

Stochastic Indicator Classic Bearish Divergence

When the price goes to new high points, but the Stochastic oscillator tool does not move past its earlier high point, this tells us the upward trend will change direction, and a bearish divergence trade setup will happen next.

This classic bearish divergence setup is even stronger because there is combination of divergence with a dip below the over-bought 80 level.

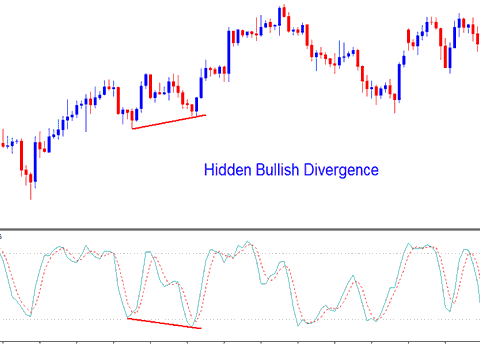

Example 3: Hidden Bullish Divergence Setup

A hidden bullish divergence setup shows a pullback in an uptrend. This is the top divergence pattern to trade. You follow the main trend, not a full reversal.

Stochastic Indicator Hidden Bullish Divergence

Even though the stochastic oscillator showed a lower point, the lowest price was higher than the last low point. This means that even though the sellers tried hard to lower the price, as shown by the stochastic indicator, the price didn't actually drop to a new low. This is a great time to start a buy trade because, since the price is already rising, you don't need to wait for more confirmation to trade: you're buying during a rise.

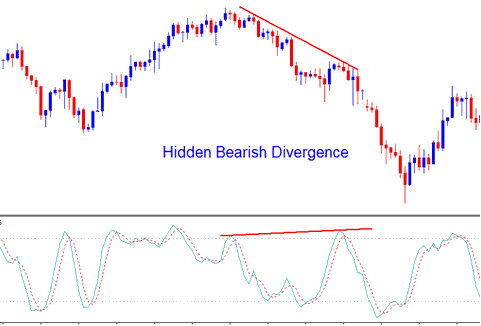

Example 4: Hidden Bearish Divergence

Hidden Bearish Divergence setup signifies a retracement in a downwards trend.

Stochastic Indicator Hidden Bearish Divergence

The hidden bearish divergence setup is arguably the superior divergence pattern for trading, primarily because the action involves trading *with* the existing market price trend, rather than attempting to trade a reversal. This configuration constitutes the ideal moment to initiate a sell transaction, as the market is already in a downward trend, eliminating the need to pause and wait for a subsequent confirmation signal before selling.

Learn More Lessons & Topics: