RSI Trading Strategies

- RSI Levels Indicating Over-bought and Over-sold Conditions

- Setups for Trading RSI Divergence

- Spotting RSI Bullish and Bearish Classic Divergence Patterns

- Spotting Hidden Bullish and Bearish Divergence with RSI

- Swing Failure Trading Method

- Trend Line Setups for RSI

- RSI Summary Overview

Relative Strength Index Strategy

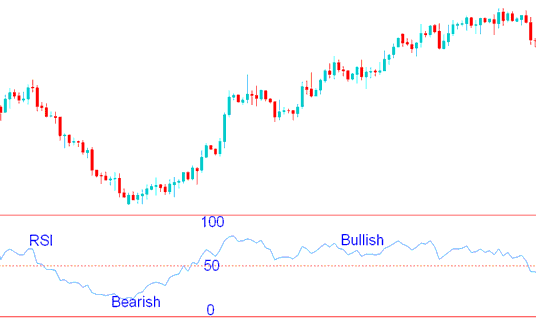

RSI ranks high among XAUUSD tools. This oscillator runs from 0 to 100. It tracks trend speed. Over 50 means up trend: under shows down for gold.

RSI Calculates Momentum of a Market Trend.

The middle line for the RSI is the 50 mark: when it crosses over, it shows a shift from an upward trend to a downward trend and back.

Above 50, buyers outpace sellers. The chart price rises as long as the RSI stays over 50.

Readings below the 50 mark indicate that sellers possess greater downside momentum than buyers, and the chart price is expected to continue declining as long as the RSI remains under 50.

RSI - How to Trade with RSI Indicator

In the example above, when the RSI sat below 50, the price just kept trending down. As long as the RSI stayed under 50, the downtrend continued. But when the RSI crossed above 50, that was the signal momentum flipped from selling to buying, and the downtrend ended.

When the RSI indicator moved to above 50 the price started to move upwards & the market trend changed from bearish to bullish. The chart price continued to move upward and the RSI indicator remained above 50 afterwards.

From the example shown earlier, when the trend was going up sometimes the RSI would go down but it would not go lower than 50, which means that these short moves are just pullbacks because during all this time the price was mostly moving up. As long as the RSI technical indicator does not go below 50 the main trend is still in place. That is why the 50 center-line mark is used to separate the signal between signals that are going up and signals that are going down.

RSI uses 14 days as its standard look-back. J. Welles Wilder set that when he made the tool. Traders also pick 9 or 25 days for moving averages.

The RSI technical indicator period used depends on the trading chart time frame you're using to trade, if you're using day chart time frame the 14 period will represent 14 days, while if you use 1 hour chart time frame the 14 period will represent 14 hours. For our illustration we shall use 14 day moving average, but for your trading you can substitute the day period with the chart time frame you are xauusd with.

To Calculate RSI Indicator:

- The number of the days that the market is up is compared to number of the days that the market is down during a particular given period of time.

- The numerator in the basic formula is an average of all the xauusd sessions that finished with an upward price change.

- The denominator is an average of all the downward xauusd sessions closes for that period.

- The average for the down days is calculated as absolute numbers.

- The Initial RSI is then turned in to an oscillator technical indicator.

Occasionally, a significant surge or drop in price within one trading period can distort the computation of the Relative Strength Index average, thereby generating an erroneous alert - a 'false signal' - manifested as a sharp spike.

RSI Center Line: The center-line for this technical indicator is 50. A value above 50 implies that price trend is in a bullish phase as the average gains are greater than average losses. Values below 50 implies a bearish phase in the market prices are in general closing lower than where it's that they opened.

Wilder set RSI overbought at 70 and oversold at 30. These mark stretched market moves.

Study More Topics and Lessons:

- The Calculation Method for Pip Size in a Nano Account

- How Do I Add FTSE in MetaTrader 4 Android Mobile App?

- Index Trading Money Management Strategy

- Entry Stop FX Orders: Buy Stop FX Order & Sell Stop Order

- How Do You Buy and Sell Shares on MetaTrader 5 Software?

- What's CHFSGD Spreads?

- How to Read and Analyze Trend Line Signals

- Nasdaq Trading Indicator Platform Download

- US100 Signal Trading Strategy