Identifying and Setting Up Trade Opportunities Based on RSI Hidden Bullish and Hidden Bearish Divergences

The Hidden Divergence setup functions as a probable indicator for trend persistence. This formation materializes when the price revisits and tests a previous extreme high or low point.

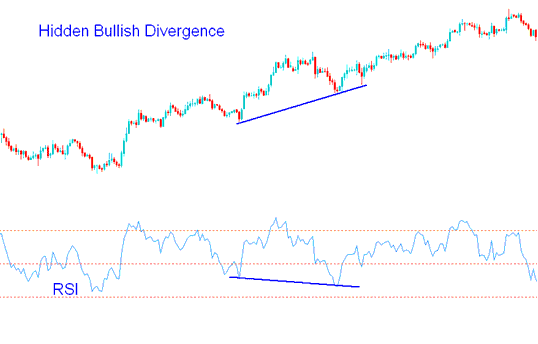

Hidden RSI Bullish Divergence

Hidden RSI bullish divergence setup happens when price makes a higher low, but the oscillator shows a lower low.

A hidden bullish divergence setup occurs when there is a retracement in an upward trend.

RSI Hidden Bullish Divergence - Hidden Divergence Trading Setup

This hidden divergence setup confirms that a market retracement move has concluded. The hidden divergence signifies the underlying strength of an upward trend.

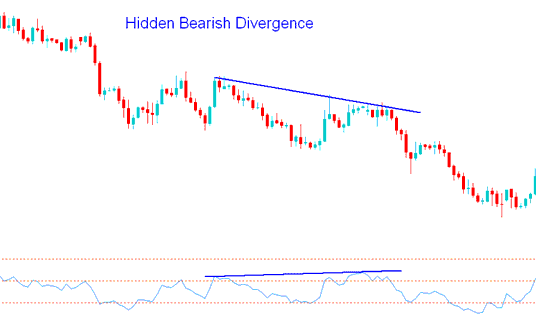

Hidden RSI Bearish Divergence Trade Setup

A hidden RSI bearish divergence happens when price makes a lower high. Yet the indicator shows a higher high.

Hidden bearish divergence occurs when there is a retracement in a downward trend for gold.

Identifying a Hidden Bearish Divergence in Trading - A Setup for Bearish Divergence

This concealed bearish RSI configuration verifies that a retracement move has concluded. This divergence signifies the strength of a downward trend in gold prices.

Learn More Lessons and Topics: