RSI Swing Failure XAUUSD Setup

The RSI swing failure method for XAUUSD is highly effective for trading short-term moves and can also be applied to longer trends, though it is best suited for traders focusing on reversals in shorter time frames.

The RSI swing failure swing xauusd setup shows that the market might change direction soon. This swing failure setup gives an early signal of a breakout, telling us that a support/resistance area in the market will likely be broken. This setup should happen when values are above 70 for an uptrend and below 30 for a downtrend.

Swing Failure In an Upwards Trend

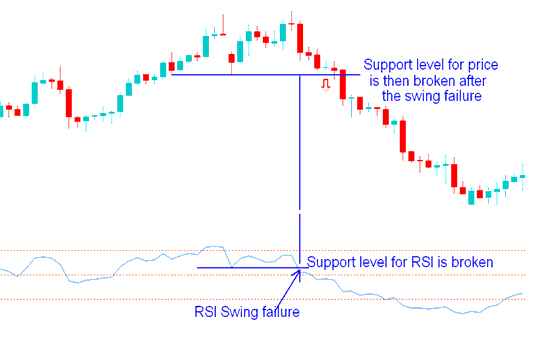

Should the RSI Technical Indicator reach 79, subsequently pull back to 72, then climb to 76 before ultimately descending below 72, this configuration constitutes a failed swing setup for the RSI. Since the 72 mark acts as an RSI support level and has been breached, this signals that the underlying price action is expected to decline and also penetrate its own support level.

In the example here, the RSI indicator gets to 73 and then goes back to 56, which is a level of support. Then, the indicator goes up to 68 and then goes below 56, breaking the support level. The price then goes down as well, breaking its support area. The RSI swing failure shows what might happen next & is confirmed when the price breaks its support area too. Some traders start trades when the swing failure is done, while others wait for the price to show confirmation, so it's up to each gold trader to choose what works for them.

XAUUSD RSI Swing Failure in an Upward Trend

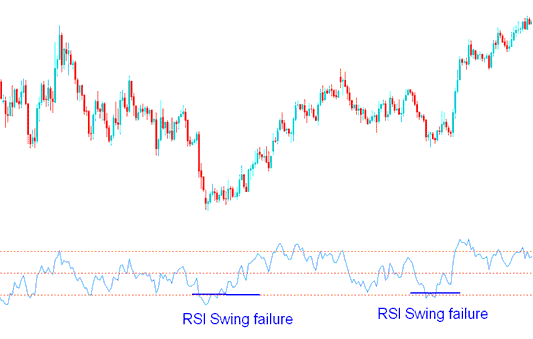

Swing Failure In a Downward Trend

If the RSI Indicator touches 20 then pulls back/retraces to 28, then falls to 24 & finally penetrates above 28, this is considered a failure swing setup. Since the 28 level is an RSI resistance level & it has been penetrated it means that price will and follow and it'll penetrate its resistance zone.

XAUUSD RSI Swing Failure in a Downward Trend

Acquire Additional Themes and Training:

- Combining Stochastics Indicator with Other FX Indicators

- How Do You Use MT5 Balance of Power BOP Indicator?

- MQ5 Bots & EAs

- What Percent Should You Add the Stop Loss Trade Order at?

- How to Create a USD SEK System

- Adding Arrow Indicators on Gold Charts in MetaTrader 4

- Beginner's Guide to Trading Gold Continuation Patterns Successfully

- Time Frame Chart Index Trade Chart Time-frame Indices

- Factors To Consider When Choosing Your Forex Broker

- How Do You Use MT5 RSI Indicator?