RSI XAUUSD Classic Bullish and Bearish Divergence Trading Setups

When the XAUUSD shows a typical difference, it might mean the trend is going to change. A classic difference in trading helps find spots where the price might change direction and start moving the other way. Because of this, using the xauusd gold classic difference is a safe way to start and a good way to end a trade.

- Classic divergence is a low risk method to sell near the top or buy near the bottom of a trend, this makes the risk on your trades are minimum in relation to potential reward.

- Classic divergence is used to predict the optimum ideal level at which to exit a trade position position

There are 2 kinds of common RSI divergence trading setups:

- XAUUSD Classic Bullish Divergence Trading Setup

- XAUUSD Classic Bearish Divergence Trade Setup

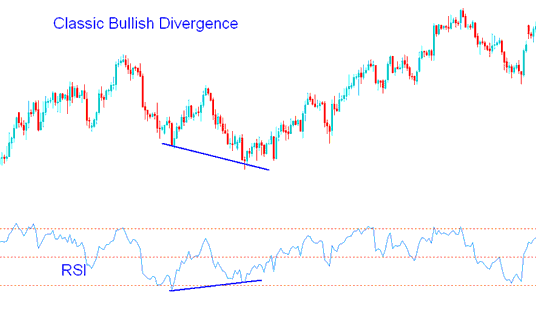

Classic Trade Bullish Divergence

A classic xauusd bullish divergence occurs when the price is forming lower lows (LL), while the oscillator is forming higher lows (HL).

Classic XAU/USD Bullish Divergence - RSI XAUUSD Strategies

Bullish divergence points to a trend flip from down to up. Prices dip, but RSI shows weaker selling. This exposes flaws in the bear move.

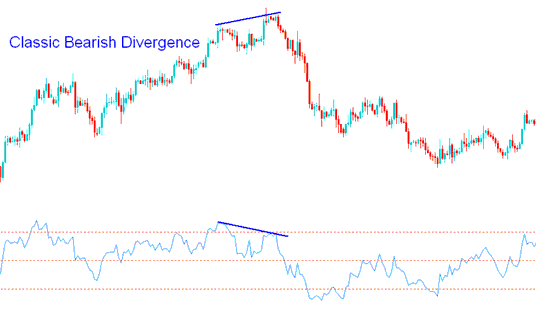

Classic XAU/USD Trade bearish divergence

A classic bearish divergence in XAUUSD materializes when the price action shows a higher high (HH), but the associated oscillator technical indicator registers a lower high (LH).

XAUUSD Classic Bearish Divergence with RSI Indicator Strategies

Classic bearish divergence observed in XAUUSD serves as a warning sign indicating a potential shift in the trend from an upward trajectory toward a downward one. This is due to the observation that, even as price moved higher, the momentum generated by the buying force (bulls) pushing the price up was comparatively diminished, as reflected, for example, by the RSI indicator. This disparity suggests an underlying fragility in the prevailing uptrend.

Obtain Further Programs & Instructional Material: