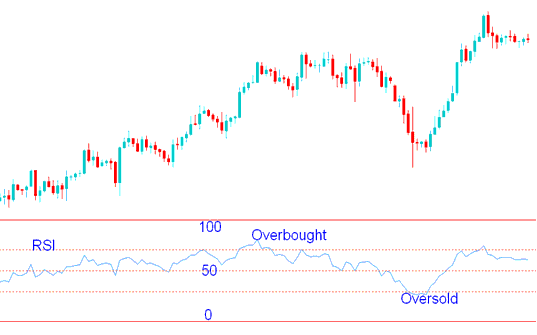

RSI Indicator Over-bought and Oversold Levels

RSI readings over 70 mean overbought conditions. Traders see levels above 70 as peaks to sell and take gains.

When the RSI drops below 30, traders see that as oversold. Points under 30 are considered market bottoms and good spots to take profit.

Check overbought and oversold spots with RSI centerline crosses. These zones might mark tops or bottoms, but confirm with the crossover. Alone, they often lead to fake moves in the market.

In the example shown below, when the RSI reached 70, it indicated that the xauusd was overbought, which could be interpreted as a sign that a trend reversal may occur.

After a short time, the chart changed direction and started to go down until it reached the over-sold levels. People thought this was the lowest point, and then the trading chart started to move up again.

Overbought and Oversold Levels - RSI XAUUSD Methods

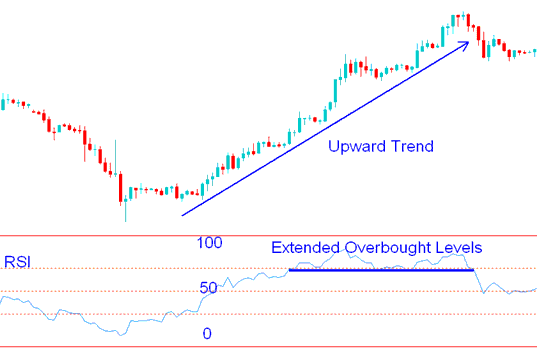

Over Extended Overbought & Oversold Levels

Should the market exhibit persistent, strong movement either upwards or downwards, the RSI indicator can remain fixed in those over-bought and over-sold territories for extended timeframes. When this occurs, these overbought and oversold boundaries cannot be reliably used as markers for market tops or bottoms, as the RSI indicator will hold these technical positions for an extended duration. This circumstance underlies why overbought and over-sold areas are prone to XAUUSD whipsaw signals, emphasizing the benefit of confirming such signals using the RSI center-line crossover methodology.

Over Extended Overbought and Oversold Levels - RSI Indicator Strategy

Courses and tutorials for learning more:

- DJ30 Signals System

- Placing Forex Orders in MetaTrader 4

- XAU/USD Web Gold on MT5 Webtrader

- Identifying Divergence Setup on Charts

- How Do You Set DowJones 30 in MetaTrader 4 Phone Trading App?

- How to Set the NZD CHF Symbol/Quote in the MT4 Terminal

- SMI Course Lesson Index SMI Stock Indices Trading Strategy Lesson Tutorial

- Average Directional Movement Stock Indices MetaTrader 4

- Forex Desktop Apps, Web Traders, and Mobile FX Tools

- How is CAC40 Index Traded on the MT4 & MT5 Trade Software?