RSI Divergence Trading Setups

The XAU/USD divergence setup is a trading pattern a lot of traders use. You'll need to look at the chart plus at least one technical indicator - let's use RSI as an example.

To identify this divergence setup, locate two points on the chart where the price achieves a new swing high or swing low, while the RSI indicator does not reflect the same, indicating a divergence between price and momentum.

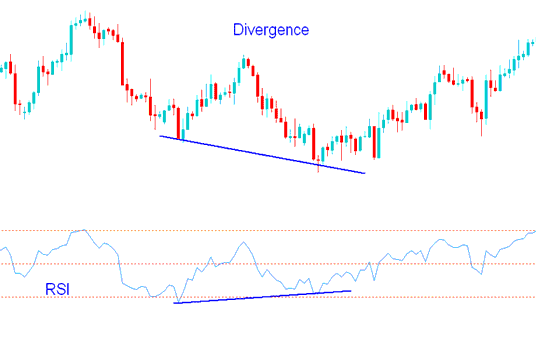

RSI Divergence Example:

In the trading chart below we identify 2 chart points, point A & point B (swing highs)

Then, using the RSI tool, we look at the highs made by it: these highs are right below chart points A and B.

We then draw one line on the trading chart & another line on the RSI indicator.

RSI Divergence Trading Setup – XAU/USD Divergence Analysis using the RSI technical indicator.

How to spot divergence

In order to spot & identify this divergence setup we look for the following:

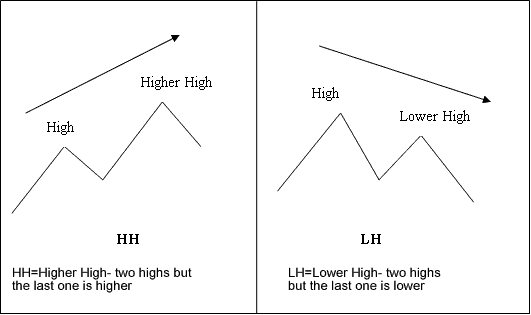

HH = Higher High : two highs but last is higher

LH = Lower High : 2 highs but last is lower

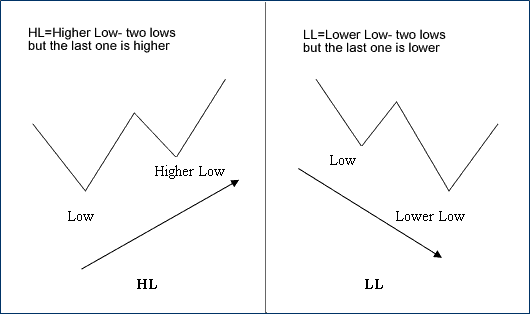

HL = Higher Low : 2 lows but last is higher

LL = Lower Low - 2 lows but last is lower

First let us look at the illustrations of these trading terms

Divergence Terms Meaning

XAU/USD Divergence Terms Definition Example

There are 2 types of divergence setups:

- Classic Divergence Setup

- Hidden Divergence

Study More Tutorials and Lessons:

- How to Analyze XAU/USD Margin Trading Levels

- Continuation Chart Patterns: Ascending Triangle & Descending Triangles Examples

- How to Place MA Moving Average Oscillator in MT4 Forex Chart

- SPX500 System

- DJ30 Trading System Courses

- Equity Management Index Trading System

- Forex NZDCHF Pip Calculator

- Regulated Broker Info

- Buy Stop Order & Sell Stop Order

- MetaTrader Dow Jones Index DowJones30 MT4 Forex Software