Best MetaTrader 4 Templates Example Trading Systems

When building your trading system, remember key points. It must spot new gold trends without falling for false moves. The key is to stick with a system that fits you. Discipline aids success in XAUUSD trading.

Before engaging with XAUUSD on a real account, it is crucial to determine which strategy is effective for you. Understanding the chart timeframe you will be working with and the amount you are willing to risk when trading XAUUSD online is important. All these factors should be considered and documented in your XAUUSD trading plan. A suitable environment to test this trading plan would be a free practice account, where you can evaluate your trading strategies without financial risk to identify the most appropriate strategy for your needs.

Consequently, traders may question how to formulate an effective trading system or identify optimal trading systems.

To formulate an effective xauusd trading plan, the foundational step involves clearly defining your ultimate business objective or target:

The following example demonstrates a goal and outlines the XAUUSD guidelines for achieving that target.

XAUUSD System Goals

1.Identify a new trend

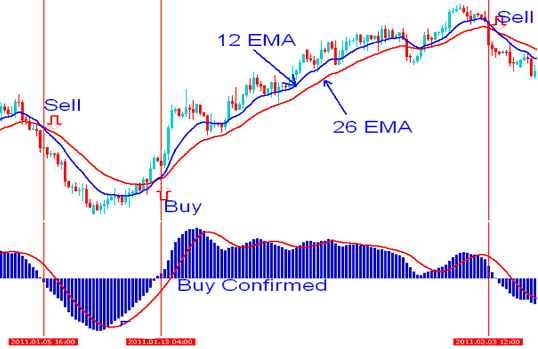

The moving average crossover strategy spots new gold trends most often. Open a long or short trade when two MAs cross each other.

2.Confirm the new trend

The Relative Strength Index (RSI) and Stochastics are two of the most popular indicators for confirming a trend.

Indicator based System

The superior trading technique is one that relies on technical indicators. These methods simplify signal generation, consequently minimizing the likelihood of personal error and aiding the trader in avoiding deceptive market fluctuations (whipsaws).

There are several things we want to achieve when creating/developing a trading system:

- Find entry points as early as possible.

- Find exit points securing max gains.

- Avoid fake entry & exit trade signals.

- Proper XAUUSD Equity Management Rules

Achieving these four objectives will lead to a profitable strategy that is effective.

The last piece of info needed, is making a decision how aggressive you're going to be when entering and exiting a trade. Those traders who are more aggressive wouldn't wait until chart candle closes and would enter as soon as their indicators match up. But a lot of traders would wait until the chart candle of the trading chart timeframe they are using has closed, to have more stable trading signal when entering the market.

To earn from the market, build your own winning system that creates good signals. Craft a strategy to meet your goals. Often, home-made plans work best. Stop hunting online for perfect setups. This site gives tools and steps to make your own trading system.

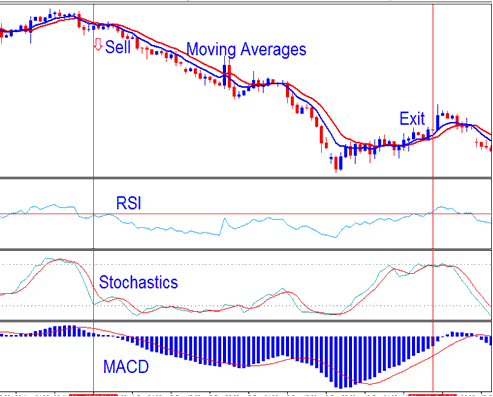

Below is an example of a trading system depending on RSI, MACD and Stochastic.

XAUUSD System - Best MT4 Templates Example Systems

The system example above is composed of four indicators in total, all of these generate trade signals using various different strategies, the Moving Average will generate trading signals using the moving average crossover method shown, the RSI indicator, Stochastic indicator and MACD use different trading analysis to generate the long and short sell signals like as shown in the above exemplification. How to generate these signals is discussed in the next lesson (on the sidebar navigation learn tutorials menu under key concepts).

As they lack sufficient market knowledge and comprehension, novice traders struggle to develop their own xauusd gold trading strategies. This learning site will demonstrate, though, that anyone may build their own free system in only seven simple instructions. With it, you can train yourself to trade the online market by using the best plan you come up with on your own.

The best thing about creating your own free trading methods is knowing how to profit on your own, instead of depending on others.

Check the next tutorial in the sidebar under learn tutorials menu. It covers XAUUSD key ideas. You'll see how to build a system like the one above. Learn its gold rules. Backtest the strategy on a practice account first. Use it on a real account later.

Best MT4 Templates Systems

XAUUSD Strategy

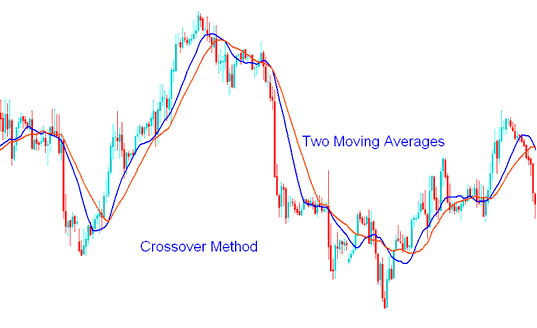

Moving average indicator cross-over trading strategy uses two MAs to generate signals. First Moving Average(MA) uses a shorter period and the second is a longer period.

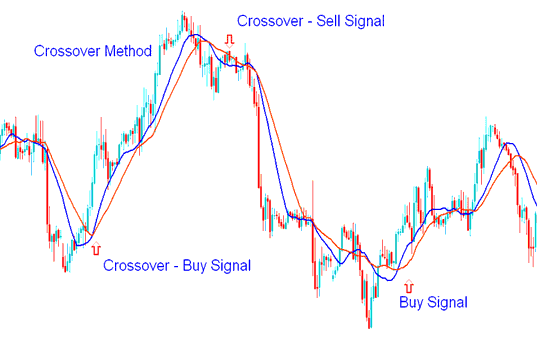

MA Crossover Technique/Method - MA Cross-over Strategy

The xauusd strategy described is known as the moving average crossover approach. It produces signals when the two averages cross over or under each other.

XAUUSD System Example - Short & Long signal Generated by System

A buy trade signal or going long trade is generated when shorter MA indicator crosses above longer moving average indicator (Both MAs Moving Up).

A sell signal or a going short trade is derived & generated when shorter average technical indicator crosses below longer MA technical indicator (Both MAs Moving Down).

Best MT4 Templates Example Systems

Stochastic Oscillator Indicator technical indicator can be combined together with other indicators to make a trade system.

- RSI indicator

- MACD

- MAs Moving Averages technical indicators

Trading Strategies Example - Best MT4 Templates Example Trading Systems

Short trade alert or sell order

How the short sell Gold signal was generated

From our xauusd guide-lines the short sell signal gets generated when:

- Both MAs Moving Averages are heading down

- RSI indicator is below 50

- Stochastic moving downwards

- MACD moving downwards below centerline

To buy at the current bitcoin price, open a new BTCUSD order. Select the Buy by Market button for bitcoin crypto.

The great thing about using a method like this is that we're using different kinds of technical indicators to be sure about the trade signals and to avoid as many false signals as we can along the way.

- Stochastic - xauusd momentum oscillator technical indicator

- RSI - gold momentum oscillator

- Moving Averages Gold TradingIndicator - trend following trading indicator

- MACD - trend following oscillator

Based on the chart timeframe used - this strategy can be used as scalping trading system when the minute trading charts are used or as a XAUUSD day system when hourly trading charts are used.

Example 3: System Example

The Trading key concepts section of the trade plan lesson on this learning website, which is found in the right navigation menu, thoroughly explains this trade system.

Chart Time-Frame

1 H chart

Tools that find a developing pattern

How Moving Averages Intersect Works

Indicators which confirm the trend

RSI

The STOCHASTIC OSCILLATOR indicator

Long Entry - Buy Signal

1. Both Moving Average(moving averages) heading upwards

2. RSI value above 50

3. Both stochastics oscillators heading up

Short Entry - Sell Signal

1. Both Moving Average pointing down,

2. RSI is below 50

3. Both stochastic oscillators heading down

Exit Trade Signal

1. Moving Average gives in the opposite market trend signal

2. RSI Often Signals Against the Trend

Funds Management in Gold Trading

Stop Loss - 35 pips

Take Profit Order - 70 pips

Reward to Risk 2:1

Best MT4 Templates Systems

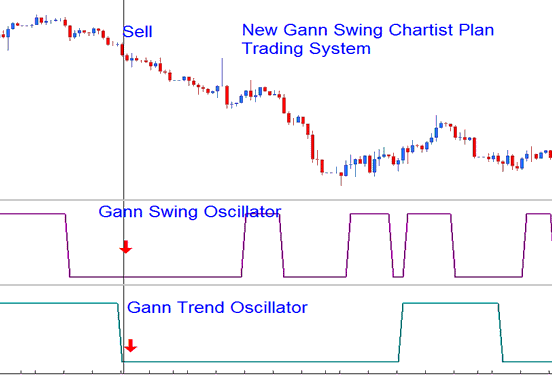

The Gann Swing Oscillator is supposed to be used with the Gann HiLo Activator and Gann Trend to create a whole trade plan usually referred to as the - 'New Gann Swing Chartist Trade Plan'. Within this approach/methodology, Gann Trend uses the Gann Swing Oscillator to assist identify trading only within ruling market trend is displayed by market swings.

Below is the examples of New Gann Swing Chartist Plan

The Gann Chartist Plan - Systems - MT4 Template System

Explore Further Instruction Sets & Programs:

- A Pip Calculator Tool for Trading the FX EUR PLN Pair

- How Do You Set Symbol in MetaTrader 4 Platform?

- What's Ultimate Oscillator Indicator?

- Candlesticks Charts, Line Charts and Bar Charts

- Strategies for Trading FX News Breakouts on Price Charts

- Example Explanation of 1:400 Trading Leverage

- Analysis of Crossover Signals Generated by Moving Averages

- Index Trading Indicators for Stock Indices